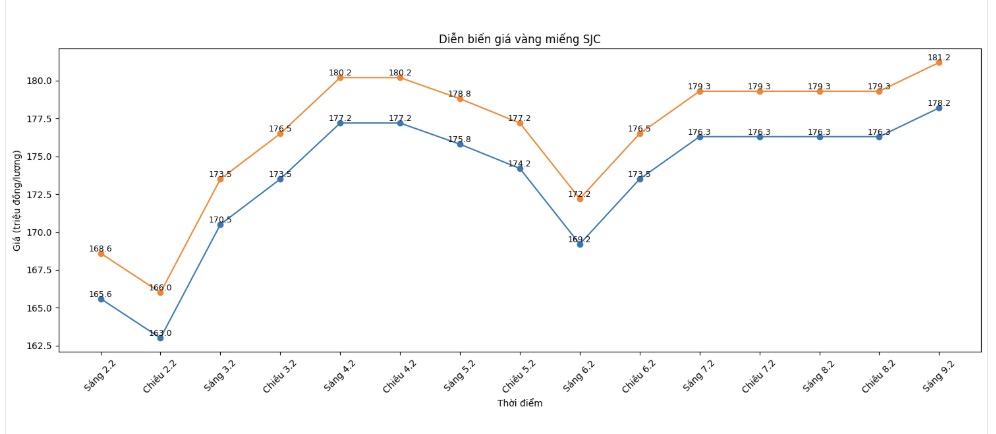

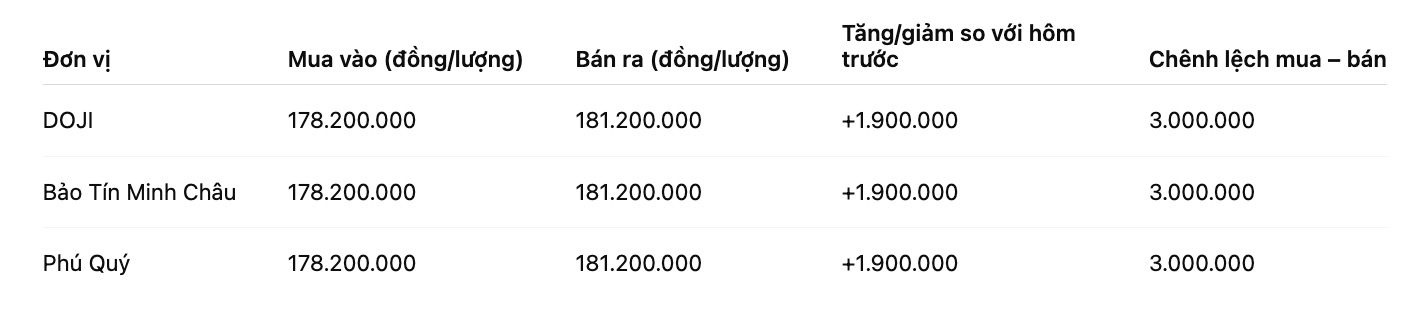

SJC gold bar price

As of 9:15 am, SJC gold bar prices were listed by DOJI Group at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

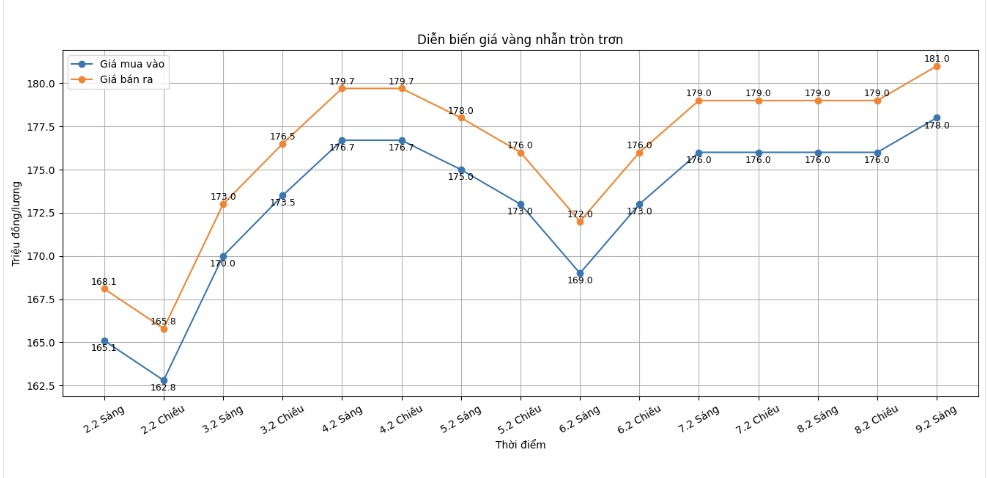

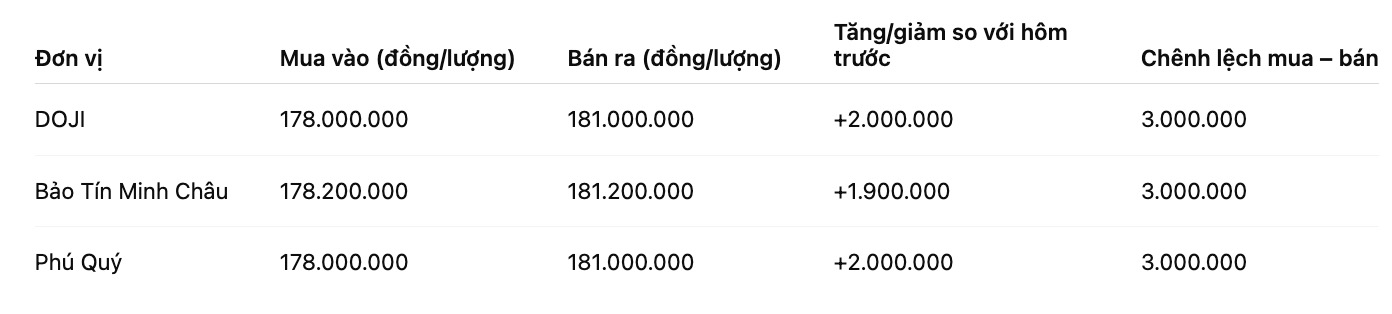

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 178.2-181.2 million VND/tael (buying - selling), an increase of 1.9 million VND/tael in both buying and selling directions. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 2 to 3 million VND/tael, posing a risk of losses for investors.

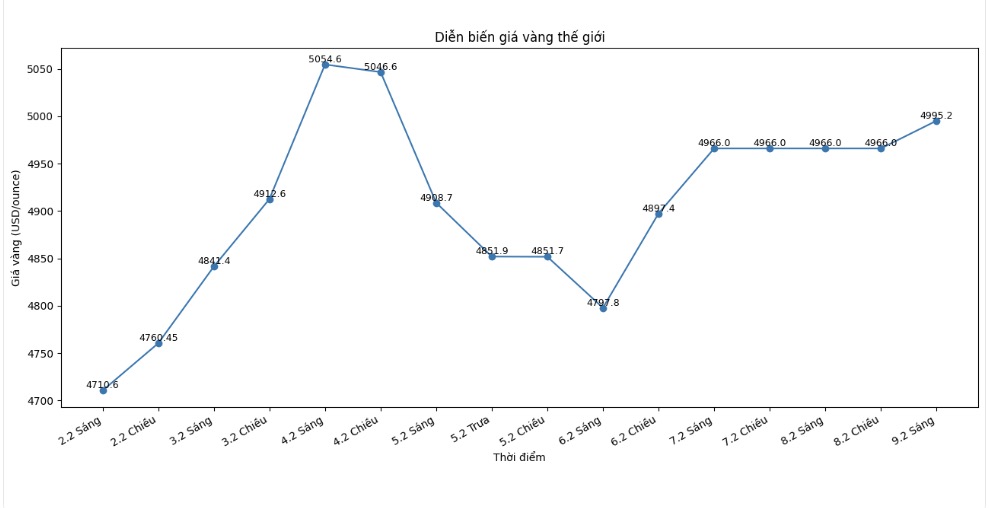

World gold price

At 9:15 am, world gold prices were listed around the threshold of 4,995.2 USD/ounce, up 29.2 USD compared to the previous day.

Gold price forecast

Recent trading sessions have witnessed rare fluctuations in the world gold market, as the intraday fluctuation range has been continuously widened. Sharp ups and downs taking place in quick succession not only make short-term investors feel worried, but also shake the long-standing view that gold is always a "stable" asset in an uncertain context.

According to Neils Christensen - Kitco News analyst, the current level of volatility is very rare if placed in a historical context. Fluctuations that were once considered unusual for precious metals now appear more frequently. However, he believes that the market needs to be viewed more broadly, because behind strong fluctuations are not collapses, but self-adjustments after a period of hot growth.

In fact, gold has just gone through a particularly strong price increase streak, continuously setting new records in a short time. The too-fast upward momentum has pushed the market into a state of over-buying, leading to profit-taking activities and reduced leverage on a large scale. In that context, current adjustments are considered necessary for the market to rebalance. Although it has left its historical peaks, gold prices are still fluctuating stably in the high zone and maintaining a certain increase compared to the previous week.

Notably, the recent sell-off did not weaken the fundamental factors of gold. Long-term demand is still present, especially from central banks and physical demand in large markets. In addition, the proportion of gold in the portfolio of many institutional investors is still modest, showing room to attract more capital if macroeconomic risks persist.

From a short-term perspective, Mr. Rich Checkan – Chairman and CEO of Asset Strategies International – believes that the recent declines are more technical than a change in trend. According to him, the foundation of the gold market shows no signs of deteriorating, while profit-taking activities have taken place quite strongly. Therefore, the current adjustment phase may open up buying opportunities for investors pursuing an upward trend.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...