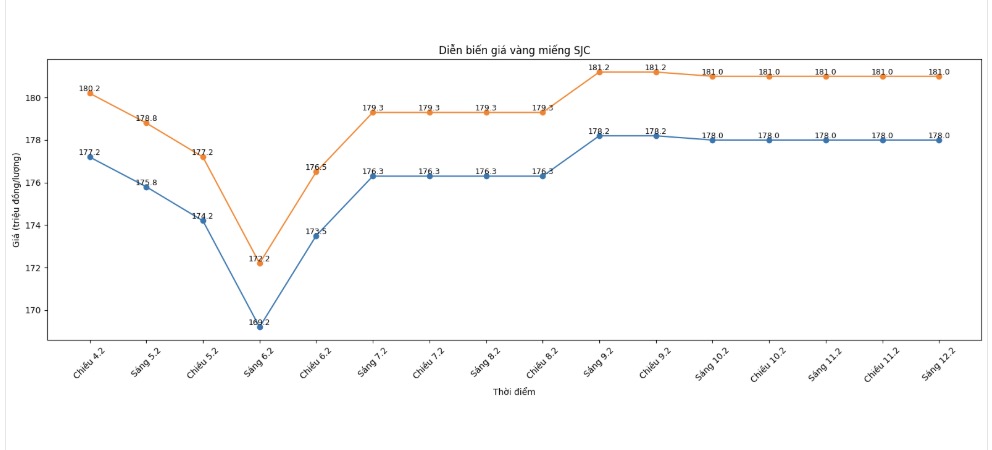

SJC gold bar price

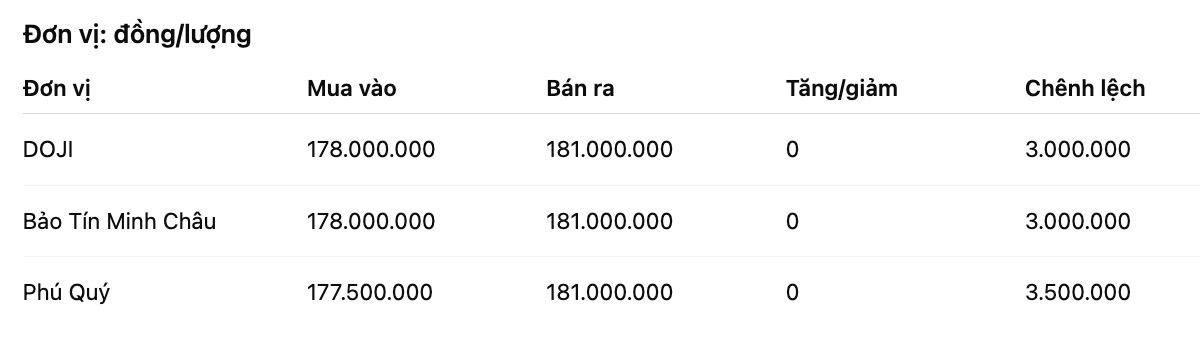

As of 9:05 am, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed SJC gold bar prices at the threshold of 177.5-181 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 3.5 million VND/tael.

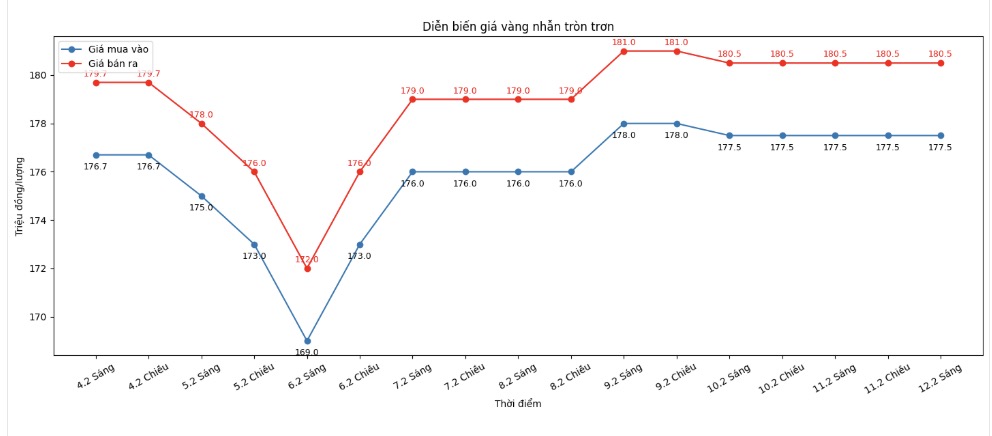

9999 gold ring price

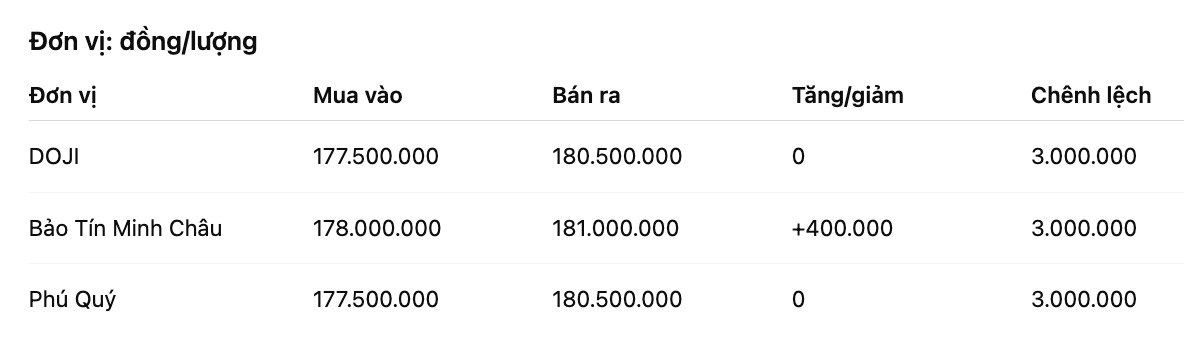

As of 9:00 AM, DOJI Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), an increase of 400,000 VND/tael in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at 177.5-180.5 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 to 3.5 million VND/tael, posing a risk of losses for investors.

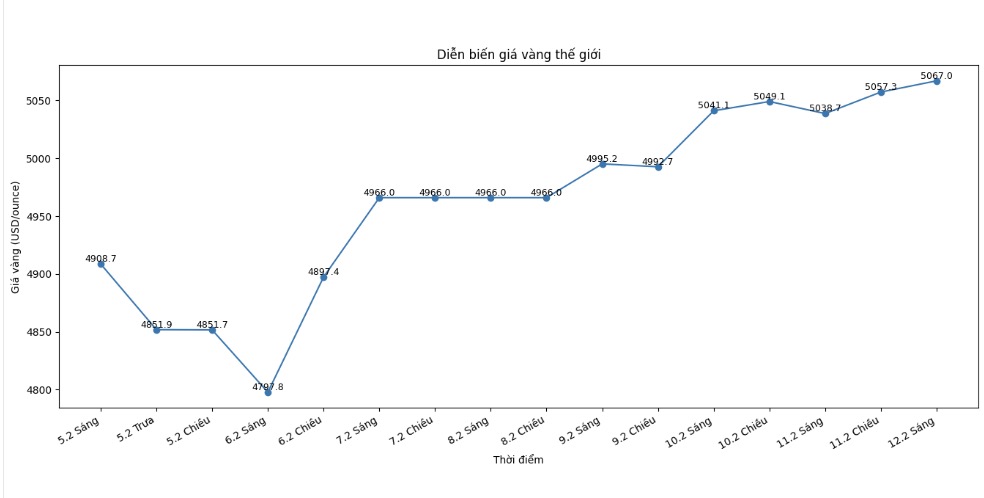

World gold price

At 9:10 am, world gold prices were listed around the threshold of 5.607 USD/ounce, up 28.3 USD compared to the previous day.

Gold price forecast

World gold and silver prices simultaneously went up, maintained even though the US jobs report released earlier showed positive results beyond expectations - a factor that often puts pressure on precious metals due to increasing bond yields and strengthening the USD.

According to the US Department of Labor, the country's economy created 130,000 non-farm jobs in January, much higher than the adjusted increase in December and far exceeding market forecasts.

This information pushed up the USD index and US government bond yields, while stocks also recovered. In that context, the fact that gold and silver still maintained most of the increase shows that the foundational demand is still solid.

Analysts believe that expectations for the US Federal Reserve (Fed) to soon cut interest rates have weakened clearly. The market currently assesses the probability of interest rate cuts in March as very low, instead leaning towards a scenario of only a few adjustments in the second half of the year.

Usually, a high interest rate environment is not favorable for gold, but new developments show that safe-haven cash flow still plays a leading role. One of the notable drivers is the need to hedge against risks in the context of geopolitical instability.

In addition, the accumulation trend and buying activities of central banks continue to support gold prices. This partly "overwhelms" the impact of a strong USD and rising yields.

Technically, the April gold futures contract is heading towards an important resistance zone around the 5,200 – 5,250 USD/ounce mark. If successfully surpassed, the room for increase may expand. Conversely, the 5,000 USD/ounce zone is considered close support, playing a "cushion" role for the current trend.

With the market rating at a positive level, many experts believe that gold prices still have the opportunity to maintain a high level in the short term, but strong fluctuations may appear when new economic data is released.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...