According to Reuters, gold prices fell to a more than a week low on Thursday, after a US federal court blocked "all in and out" tariffs issued by President Donald Trump, weakening the precious metal's safe-haven appeal. The stronger USD also puts more downward pressure on gold.

A US commercial court on Wednesday issued a ruling suspending Trump's implementation of tariffs, saying the president had violated his authority to impose a generally accepted tax rate on imports from countries with trade surpluses with the US.

"The US court's ruling is the main factor driving the US dollar up, thereby pushing gold prices down," said Mr. Nicholas Frappell, global director of organizational markets at ABC Refinery.

Previously, on April 2, Mr. Trump imposed "if you get back" tariffs on many countries, raising concerns about a global economic recession. However, many taxes by country were suspended just a week later.

After the commercial court's ruling, the USD (.DXY) index increased sharply, making gold - priced in USD - more expensive. Wall Street and Asian stock futures also increased simultaneously.

Meanwhile, the Trump administration has filed an appeal and signaled it is ready to take the case to the Supreme Court if necessary.

However, the gold market remains upward in the long term as long-term prospects show a weakening of the US dollar and the possibility of short-term inflationary pressures, Frappell added.

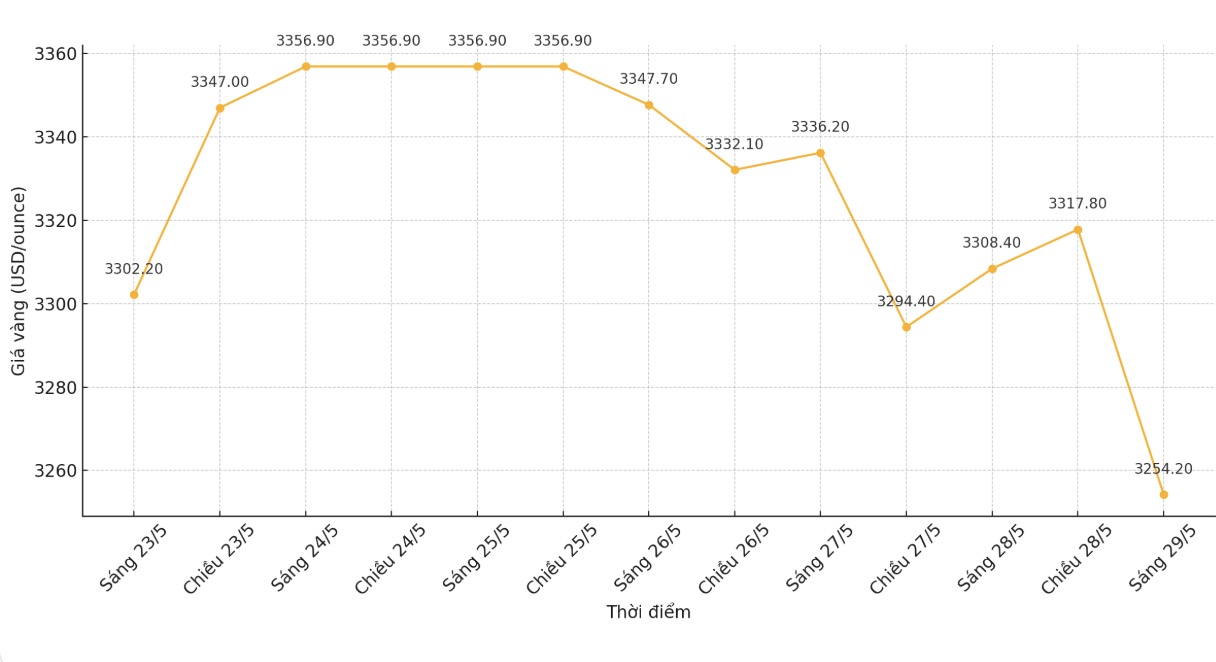

As of 16:31 GMT (11:31 Vietnam time), spot gold prices fell 0.5% to $3,273.37/ounce, after hitting their lowest level since May 20. US gold futures fell 0.7% to $3,270.8/ounce.

In another development, the minutes of the US Federal Reserve's (FED) meeting on May 6-7 showed officials worried about the possibility of inflation and unemployment rising at the same time, forcing them to choose between tightening monetary policy to fight inflation or lowering interest rates to support growth and employment.

The market is now waiting for the US GDP data to be released later in the day, along with the core Personal Consumption Expenditures (PCE) index, to provide further signals on the direction of interest rates.

In other metals markets, spot silver rose 0.6% to $33.19 an ounce, platinum rose 0.6% to $1,080.9/ounce, and gold rose 1.3% to $974.69/ounce.