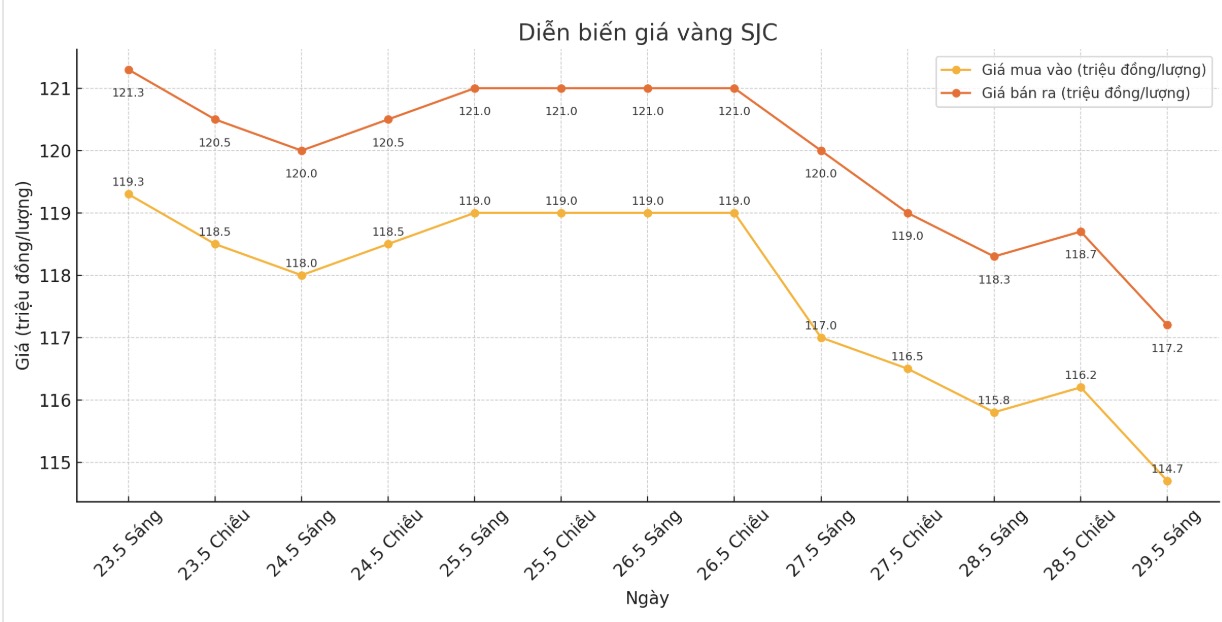

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 114.7/17.2 million/tael (buy - sell), down VND 1.1 million/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 114.7-117.2 million VND/tael (buy - sell), down 1.1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 114.7-117.2 million VND/tael (buy - sell), down 1.1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 113.77.2 million VND/tael (buy - sell), down 1.6 million VND/tael for buying and down 1.1 million VND/tael for selling. The difference between buying and selling prices is at 3.5 million VND/tael.

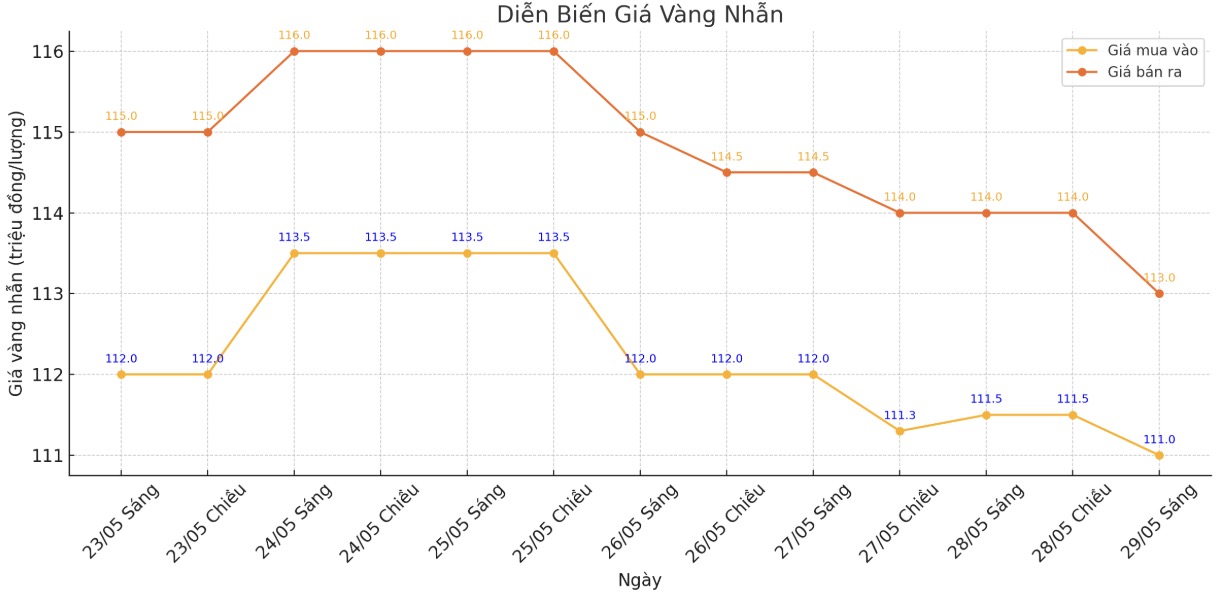

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111-113 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 112.3-115.3 million VND/tael (buy - sell), down 1.2 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 110.5-113.5 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

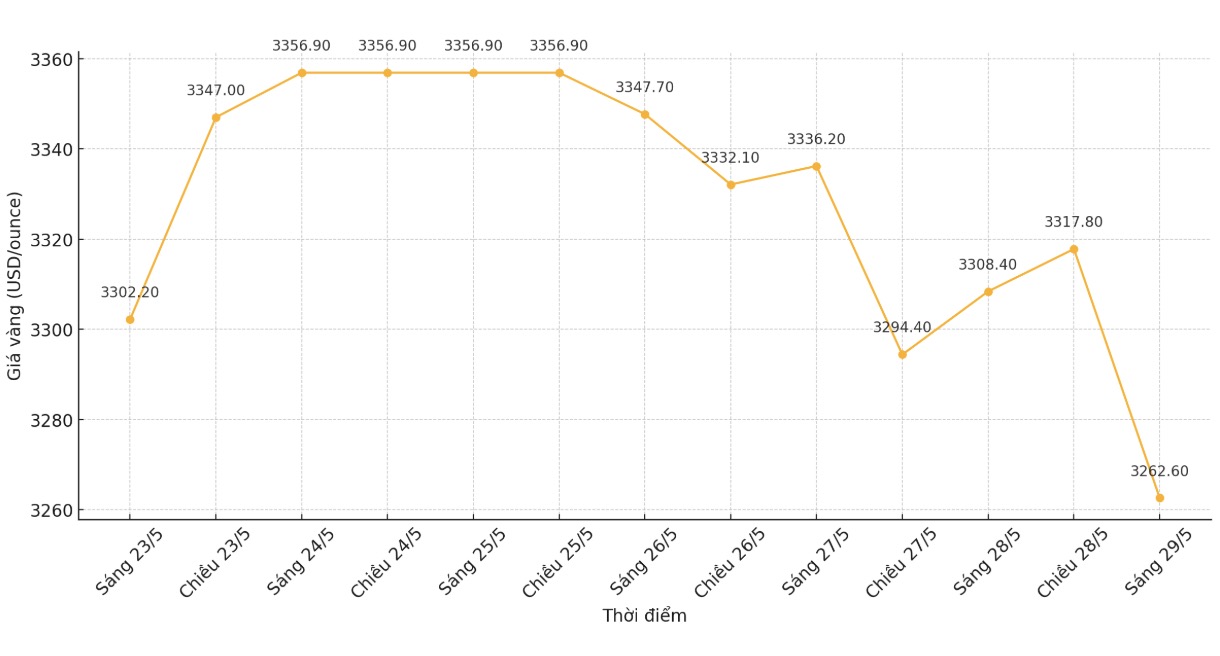

World gold price

At 9:00 a.m., the world gold price listed on Kitco was around 3,262.6 USD/ounce, down 45.8 USD/ounce.

Gold price forecast

World gold prices plummeted in the context of the US Federal Reserve (FED) affirming that economic activities and the labor market continue to remain stable, and there is no need for policy intervention

Minutes from the Federal Open Market Committee (FOMC) meeting have just been released showing that FED officials are in a dilemma as they face rising inflation and unemployment. They also warned of the increasingly obvious risk of economic recession.

Gold - which is seen as a safe haven in times of uncertainty and benefits from a low-interest-rate environment - has risen 26% since the beginning of the year and peaked in April.

Kitco Metals analyst Jim Wyckoff commented that the recent gold market has fluctuated without a clear trend, mainly responding to important economic and political information released daily.

Goldman Sachs recently recommended that investors increase their holdings of gold in their long-term portfolios, in the context of the prestige of US institutions facing risks and the FED under pressure. Meanwhile, central banks around the world continue to maintain a steady gold buying trend.

In another development, China's gold imports through Hong Kong (China) nearly tripled in April as price differences increased

Total gold imports through Hong Kong (China) in April reached 58.61 tons, up 178.17% compared to 21.07 tons recorded in March, also the highest level in more than a year.

ANZ commodity strategist Soni Kumari told Reuters that the amount of gold imported through Hong Kong (China) in the first quarter was still low despite strong overall demand. She said the low price difference compared to international spot gold prices caused import demand to decrease in the first quarter of the year.

That leads to a shortage of supply and increases the difference in spot prices. When the difference increases, it encourages import activities. Central bank demand for gold could also be a driver for increased imports, Kumari said.

Investors are watching the results of US-EU and US-Japan negotiations as well as the trade war between Washington and Beijing. Any tough statement from both sides could push gold up and back.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...