With gold and silver having had a double rally for most of 2025, both precious metals continue to move sideways at high levels. Although most market analysts expect the rally to continue for the precious metal and the S&P 500, the Bank for International Investment (BIS) warned that these two assets may have fallen into the bubble zone.

According to the reports authors Giulio Cornelli, Marco Jacopo Lombardi and Andreas Schrimpf, although gold and the S&P 500 have overcome the threshold of explosive price increase in the past several times, this is the first time in 50 years that both have reached extreme valuations at the same time.

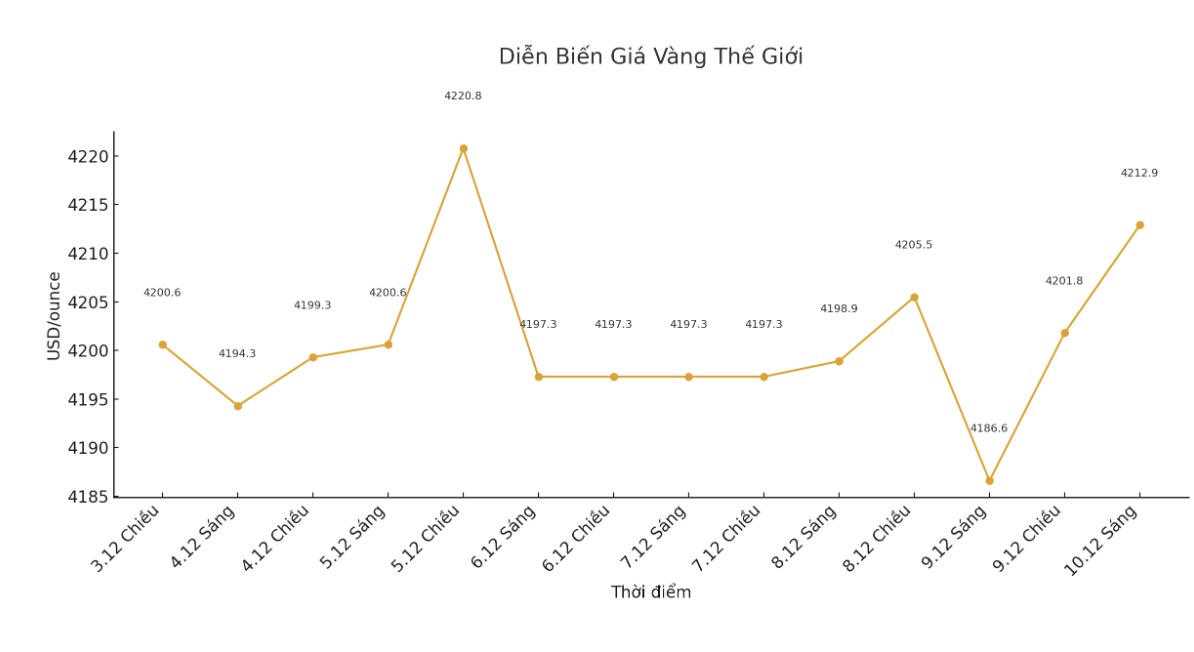

The bubble warning comes as the S&P 500 has gained more than 16% since the start of the year, trading around 6,850 points; Meanwhile, gold is recording its best increase since 1979, up more than 50% since the beginning of the year and trading around $4,200/ounce.

This year, the S&P 500 has set more than 20 new peaks; while gold has set nearly 50 records when prices exceeded the 4,000 USD/ounce mark.

Not only standing at record valuations, but the drivers of this year's price increase are similar, and according to analysts, these are typical signs of a bubble market. Based on capital flow data, the majority of cash flow into US stocks and gold funds comes from individual investors.

A typical symptom of a burlap is the growing influence of individual investors - who are trying to chase the price trend. With media coverage and skyrocketing prices, retail investors could be caught up in risky assets they would normally avoid, driven by herd behavior, social interaction and fear of missing out (FOMO).

This time, there is evidence that the excitement and expectation of easy profits of individual investors has spread to gold - which is considered a traditional safe-haven asset. Since the beginning of 2025, gold ETFs have continuously traded at higher levels than their net asset value (NAV), showing strong interest from individual investors" - the report wrote.

The authors also note that demand from retail investors going against institutional capital trends could cause stronger market fluctuations in the future.

individuals are increasingly holding positions in contrast to institutional investors: holding US stock divestment or maintaining a neutral position on gold, while retail investors are pouring in, the report said. Although capital flows from individual investors have partly compensated for the withdrawal flows of institutions, the growing dominance of this group could threaten market stability, as they tend to act like a flock and easily amplify fluctuations if a sell-off occurs.

Although many analysts believe that the record increase of over 4,360 USD/ounce in October caused gold to fall into overbought territory, not many see it as a sign of a bubble.

Gold prices are currently solidly supported above $4,000/ounce, and according to analysts, strong fundamentals still support higher prices - including demand from central banks as the bloc continues to diversify reserves, reducing dependence on the USD.

This year, central banks are expected to buy about 900 tons of gold, down from the 1,000 tons per year in the previous three years but still significantly above the long-term average.

In addition, the forecast that the Fed will continue to loosen through 2026 is considered a factor that drives investment demand. Lower interest rates are expected to reduce bond yields and weaken the USD - eliminating two major obstacles for gold.

Some analysts also believe that high stock market valuations could continue to support gold, as investors seek to balance risks in their portfolios.

See more news related to gold prices HERE...