Gold ring price skyrockets, huge profit after 1 month of investment

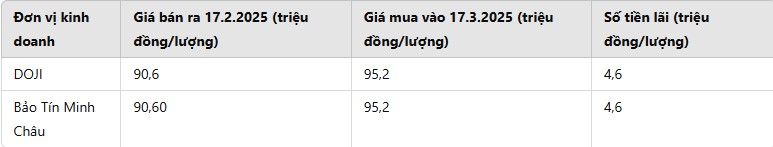

A month ago, on February 17, 2025, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 88.9 million VND/tael for buying and 90.6 million VND/tael for selling. Bao Tin Minh Chau listed the price of gold rings at 88.95 million VND/tael for buying and 90.60 million VND/tael for selling.

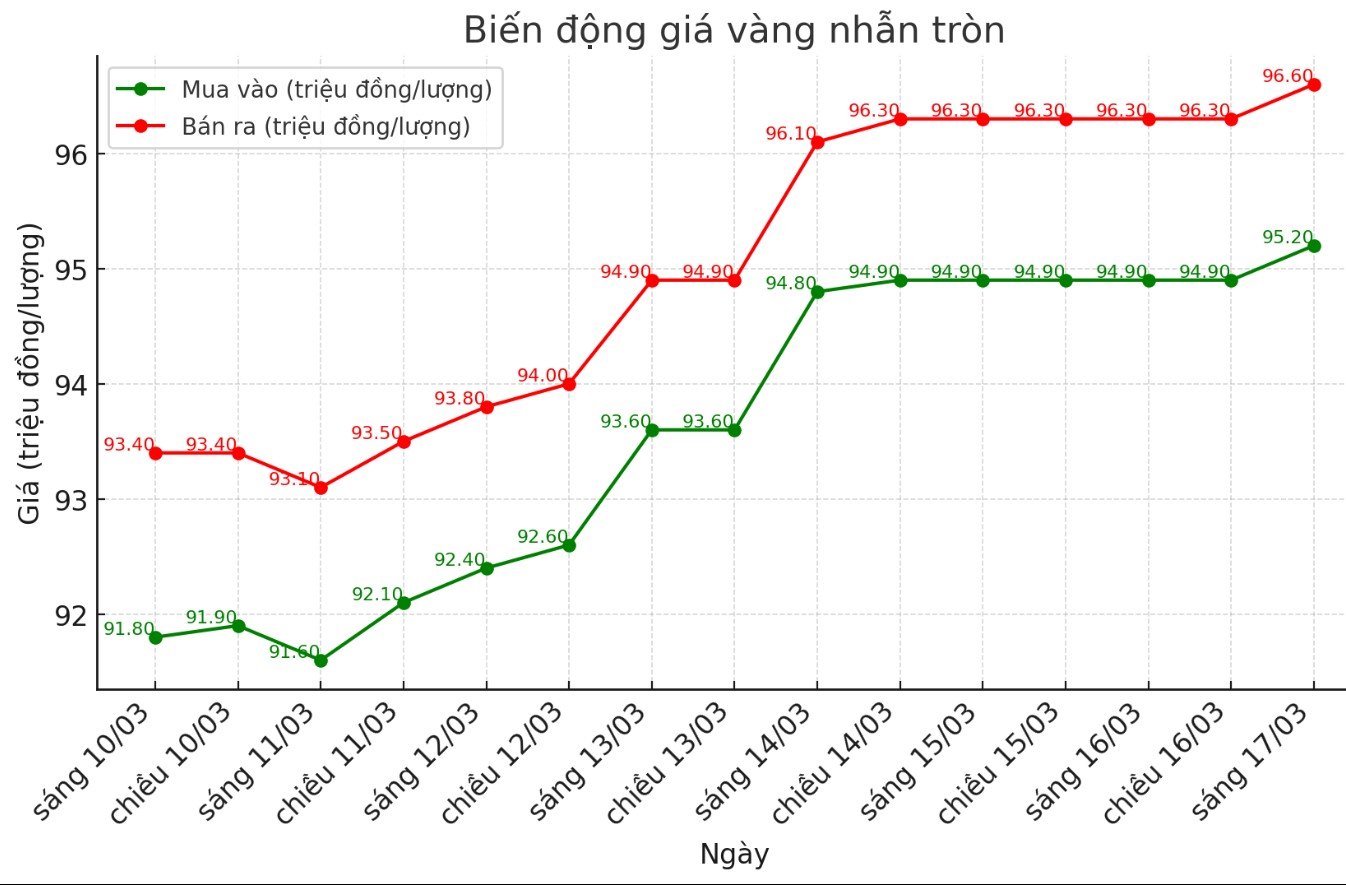

Today, March 17, 2025, the price of Hung Thinh Vuong 9999 round gold rings at DOJI increased to VND95.2 million/tael for buying and VND96.6 million/tael for selling, recording an increase of VND6.3 million/tael for buying and VND6 million/tael for selling.

Bao Tin Minh Chau listed the price of gold rings at 95.2 million VND/tael for buying and 96.8 million VND/tael for selling, corresponding to an increase of 6.25 million VND/tael for buying and 6.2 million VND/tael for selling.

For those who bought gold rings a month ago, the profit is very significant. If buying gold rings a month ago and selling them in today's trading session, the recorded profit was VND4.6 million/tael at both DOJI and Bao Tin Minh Chau.

The above interest rate shows that investing in gold rings in the recent past is an option that brings significant profits. However, in the coming time, investors need to closely monitor market fluctuations to make reasonable decisions.

Experts make surprising predictions about gold ring prices

Talking to PV of Lao Dong Newspaper, Dr. Nguyen Tri Hieu - economic expert commented: "In Vietnam, the price of gold rings has exceeded the price of gold bars. The State Bank still controls the gold bar market to avoid a recurrence of the "gold fever". However, gold rings are traded freely, causing prices of this commodity to fluctuate strongly".

Mr. Hieu said that the price of gold rings will likely reach 100 million VND/tael in the near future. "In my opinion, the probability of reaching 100 million VND/tael is about 60%" - Mr. Hieu shared.

In recent trading sessions, domestic gold prices have often fluctuated in the same direction as the world gold market. Factors such as the interest rate policy of the US Federal Reserve (FED), fluctuations in the USD and gold demand of major countries all affect gold prices.

Before putting money down, investors can refer to the direction of world gold to assess domestic trends.

See more news related to gold prices HERE...