Updated SJC gold price

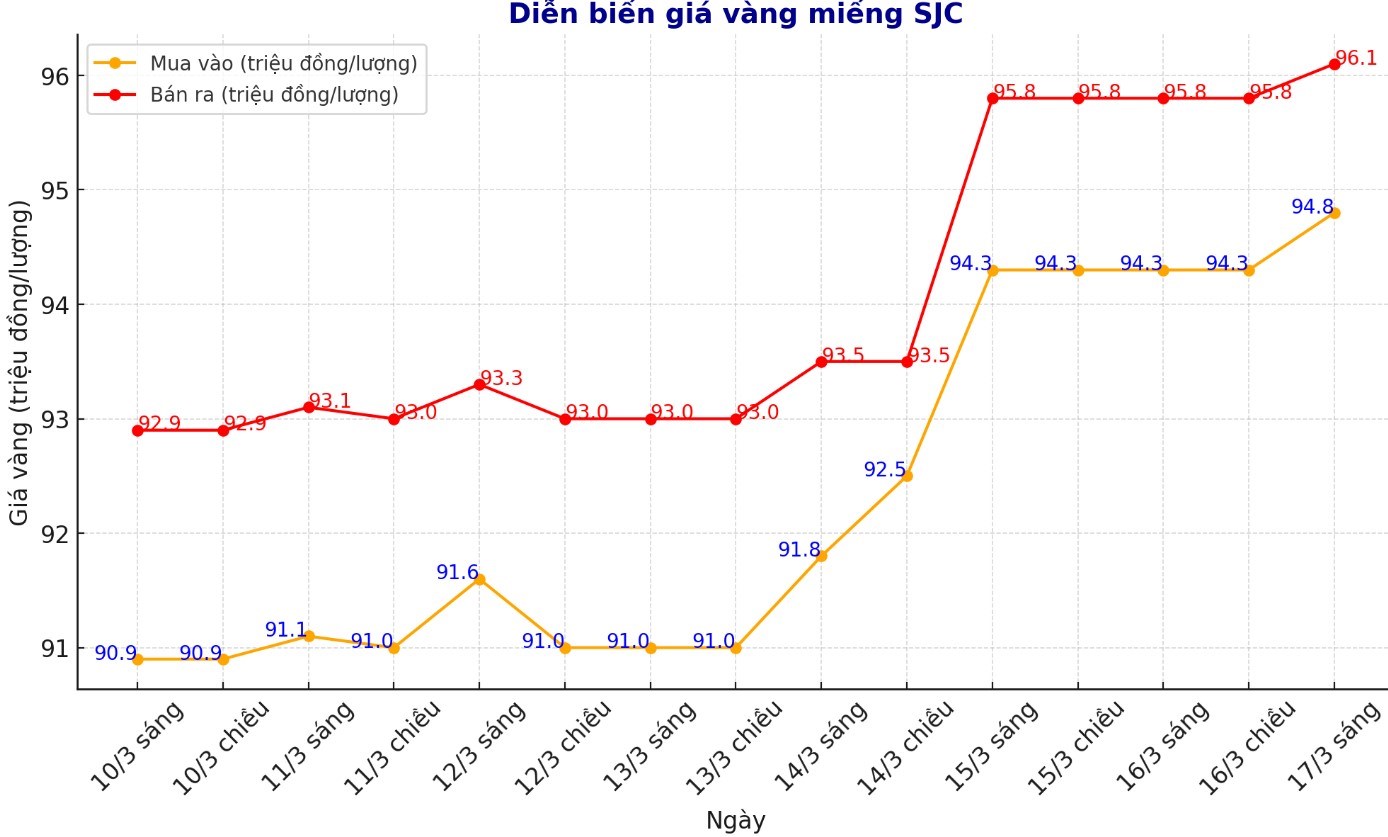

As of 9:20 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at VND94.8-96.1 million/tael (buy - sell), an increase of VND500,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND94.8-96.1 million/tael (buy - sell), an increase of VND400,000/tael for buying and an increase of VND300,000/tael for selling. The difference between buying and selling prices is at 1.3 million VND/tael.

9999 round gold ring price

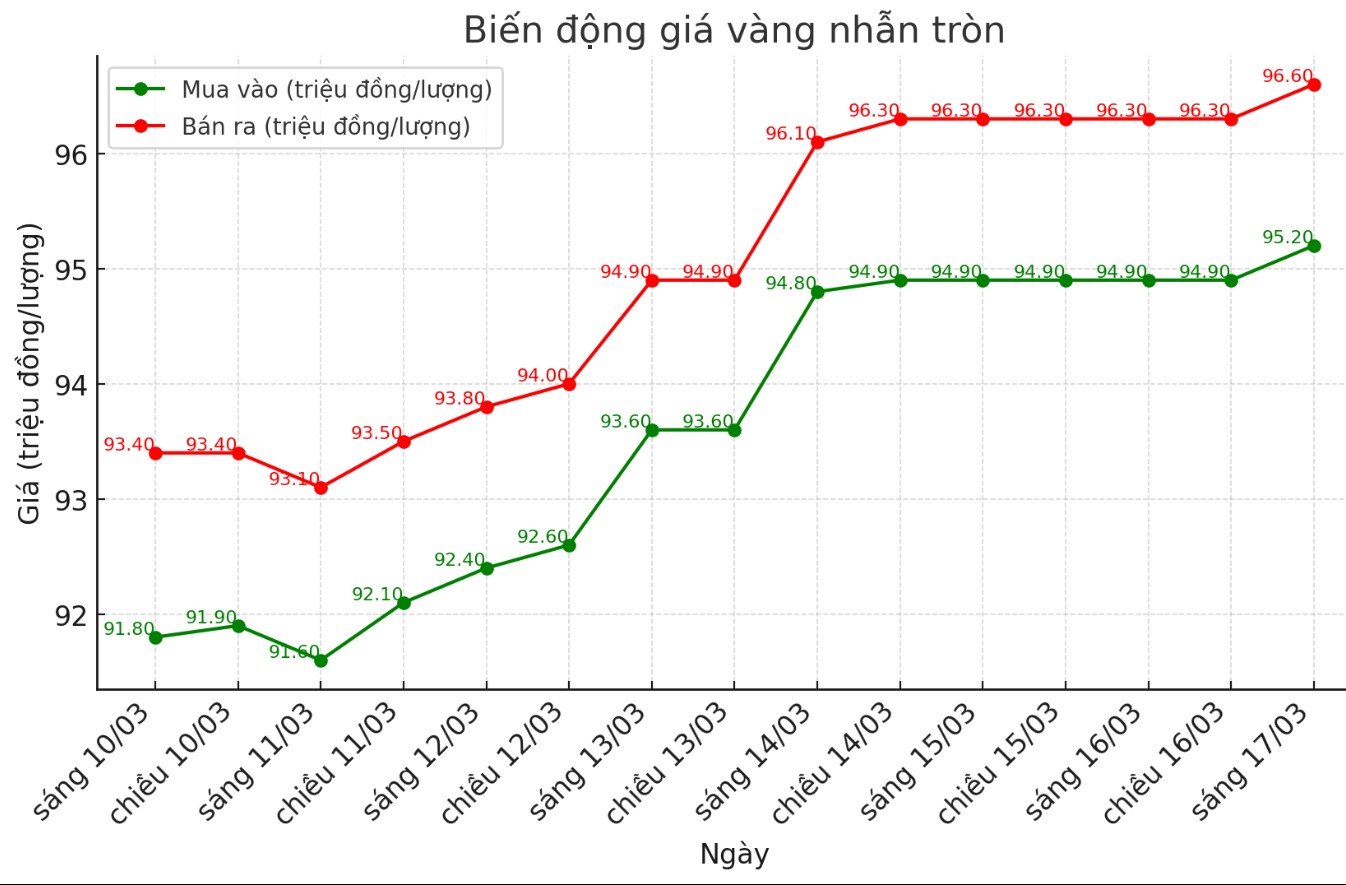

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND95.2-96.6 million/tael (buy in - sell out); increased by VND300,000/tael for both buying and selling. The difference between buying and selling is listed at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95.2-96.8 million VND/tael (buy - sell); increased by 250,000 VND/tael for buying and increased by 300,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

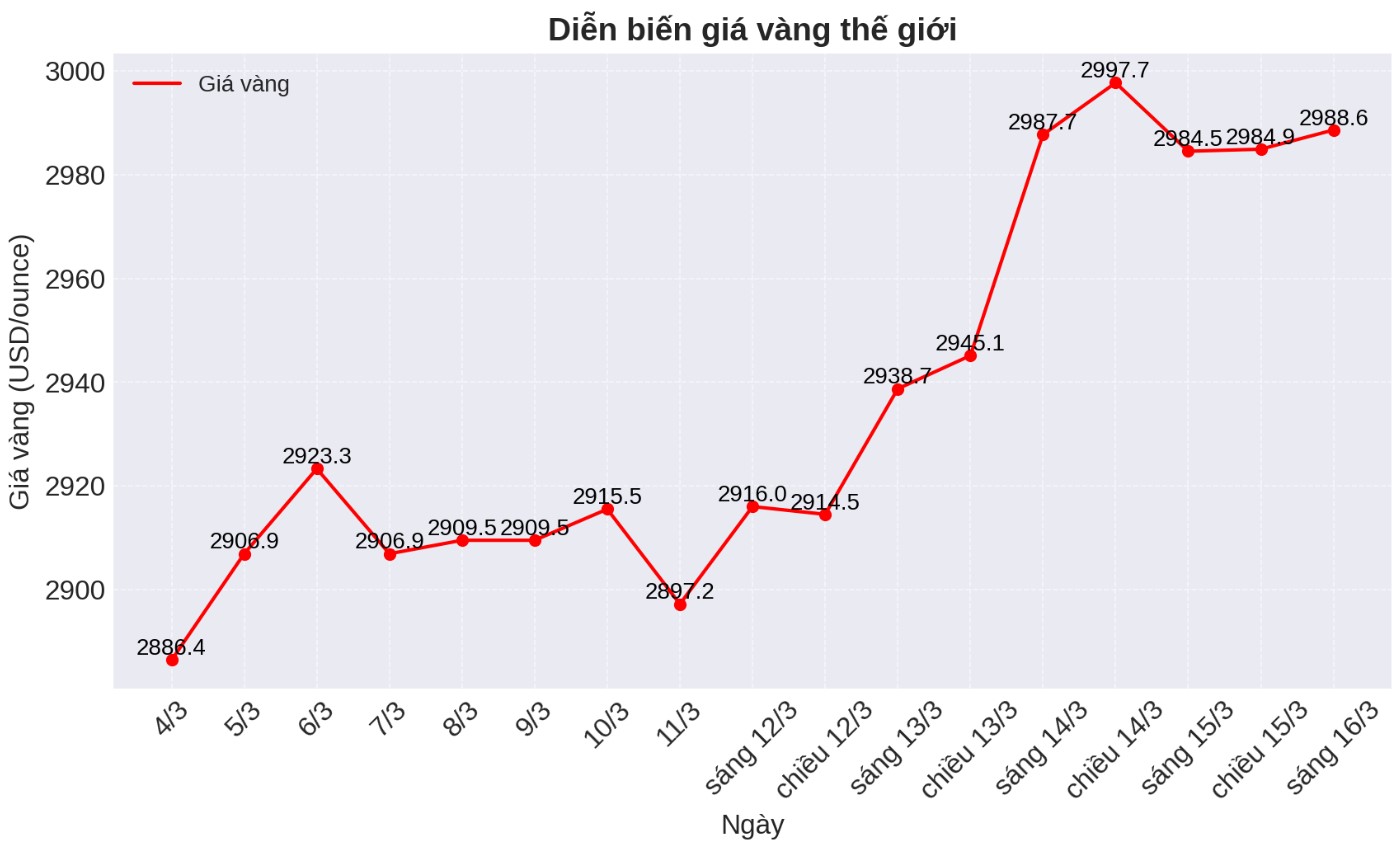

As of 9:25 a.m. on March 17, the world gold price listed on Kitco was at 2,988.6 USD/ounce, up slightly compared to the same time in the previous session.

Gold price forecast

World gold prices increased on a high basis in the context of the USD decreasing. Recorded at 9:30 a.m. on March 17, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 0.02%).

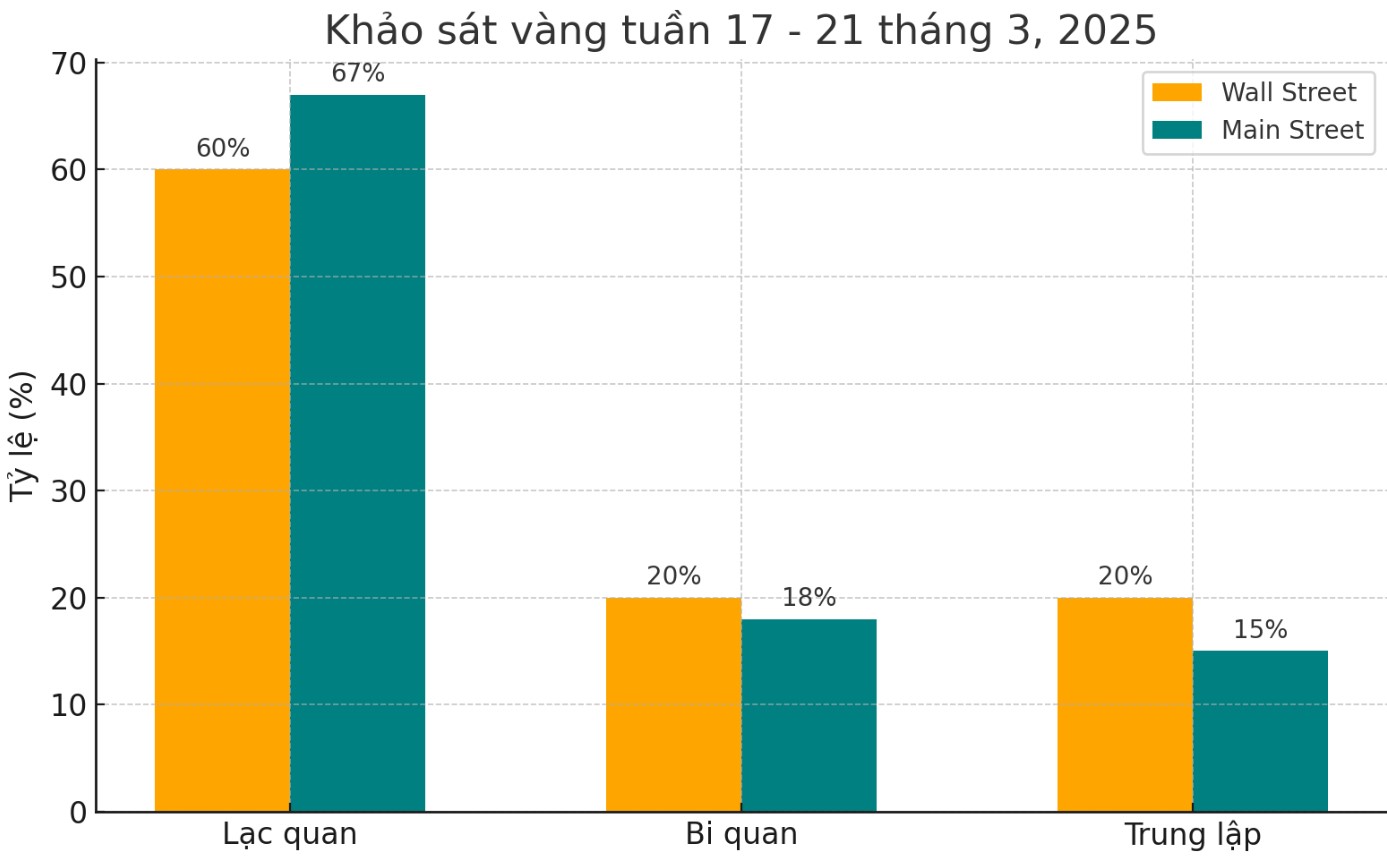

15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise this week. Three analysts, or 20%, predict gold prices will fall. The remaining three experts see gold prices moving sideways.

Meanwhile, 262 people participated in Kitco's online survey, with investor sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 this week. Meanwhile, another 47 people, or 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

Adrian Day - Chairman of Adrian Day Asset Management - predicted that gold prices will continue to increase and surpass the $3,000/ounce mark. He said that central banks continue to buy strongly, especially foreign banks, which are not affected by the price of 3,000 USD/ounce.

North American investors are also returning to the gold market after a two-year absence, creating new demand.

Darin Newsom - senior analyst at Barchart.com - commented that both technical and basic analysis are no longer important at this time. He said that gold is still a safe haven in the context of strong global economic and political fluctuations.

Sharing the same view, Sean Lusk - co-head of commercial risk prevention at Walsh Trading - said that gold prices are being driven by economic and political events. He said that central banks continue to increase their gold holdings whenever prices have a correction.

We have seen a strong rally from 2023 to present, thanks to the prolonged uncertainty that has benefited gold over the past three years, Lusk said.

He also noted that the next potential prices could be $3,036/ounce and $3,168/ounce.

Kevin Grady - President of Phoenix Futures and Options - said that the $3,000/ounce mark is an important psychological threshold, but the most important thing is who is buying and who is selling.

He found that central banks such as Poland, Turkey and China have all increased their gold reserves. I think youll see prices around $3,000 an ounce for a while, but the general trend is still up, Grady said.

On the other hand, Rich Checkan, president and COO at Asset Strategies International, said that after reaching $3,000 an ounce, gold could face a profit-taking before continuing to increase again.

James Stanley - senior strategist at Forex.com - said that the $3,000/ounce mark will create selling pressure, allowing gold prices to adjust slightly instead of completely reversing.

See more news related to gold prices HERE...