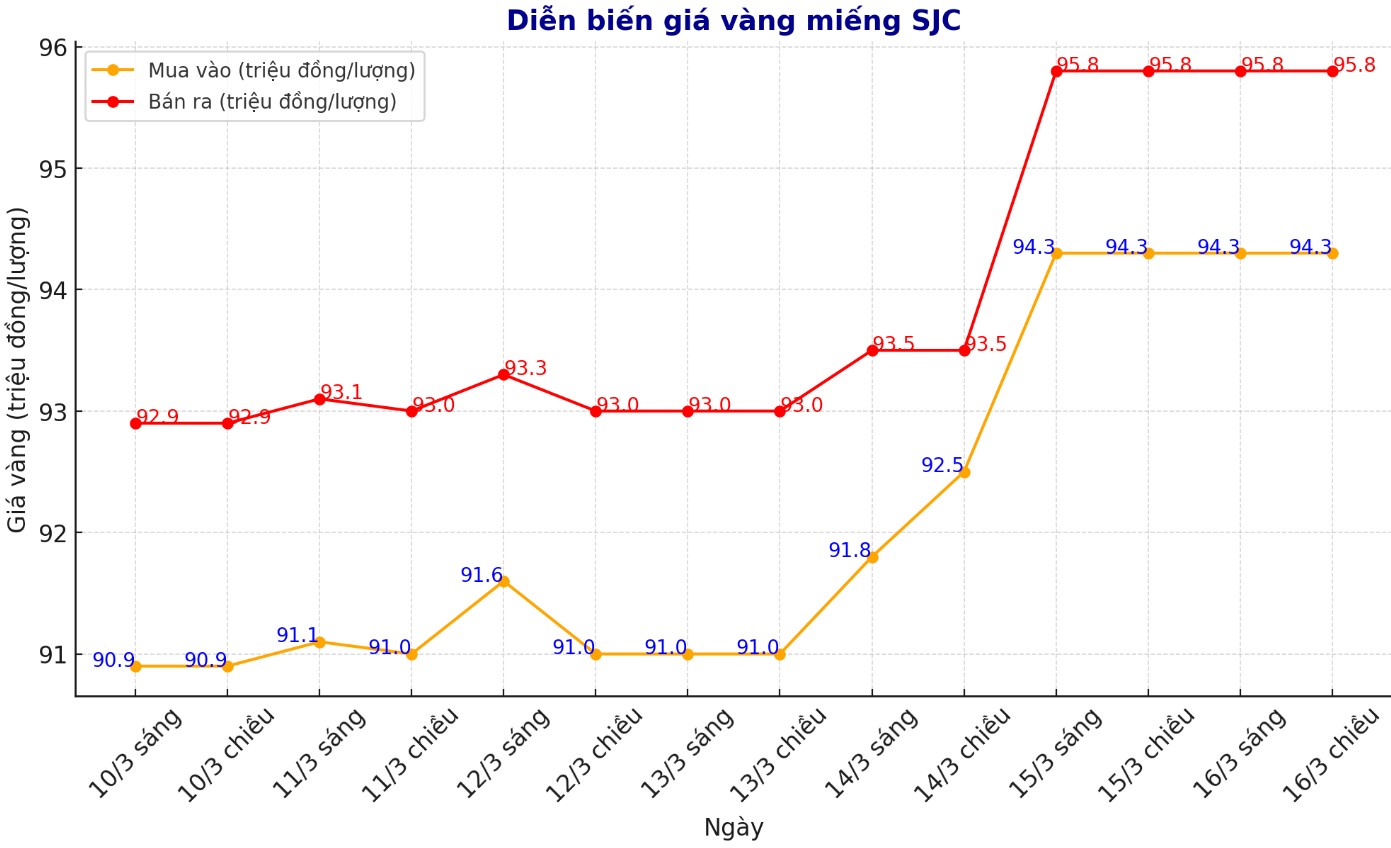

Updated SJC gold price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at VND94.3-95.8 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 9, 2025), the price of SJC gold bars at DOJI increased by VND3.4 million/tael for buying and VND2.9 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at VND94.3-95.8 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 9, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND3.4 million/tael for buying and VND2.9 million/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of March 9 and selling it in today's session (March 16), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of 1.4 million VND/tael.

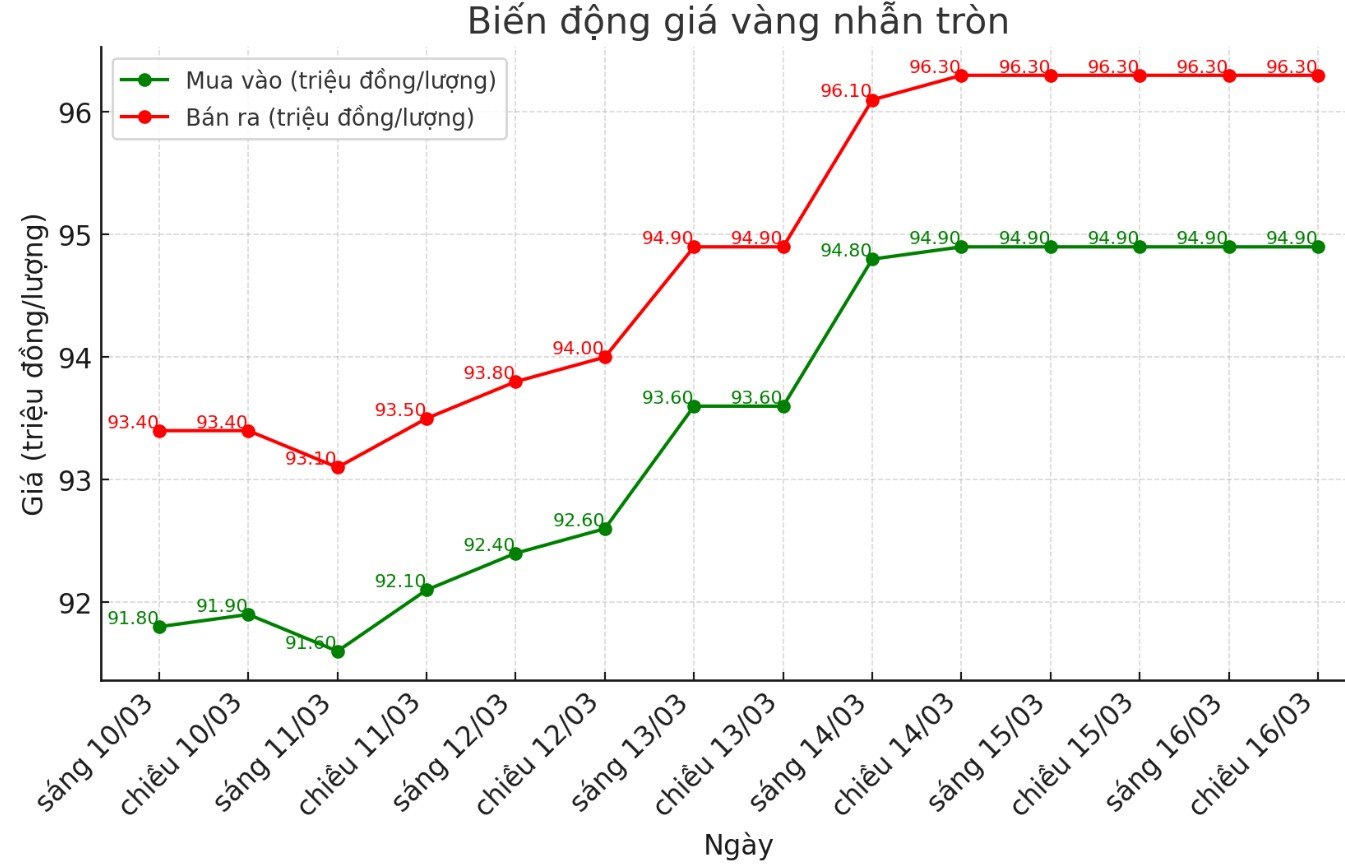

9999 round gold ring price

At the end of the trading session of the week, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND94.9-96.3 million/tael (buy - sell); an increase of VND3.3 million/tael for buying and an increase of VND3.1 million/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95-96.6 million VND/tael (buy - sell); an increase of 3.3 million VND/tael for both buying and selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

If buying gold rings in the session of March 9 and selling in today's session (March 16), buyers at DOJI and Bao Tin Minh Chau will both earn a profit of 1.7 million VND/tael.

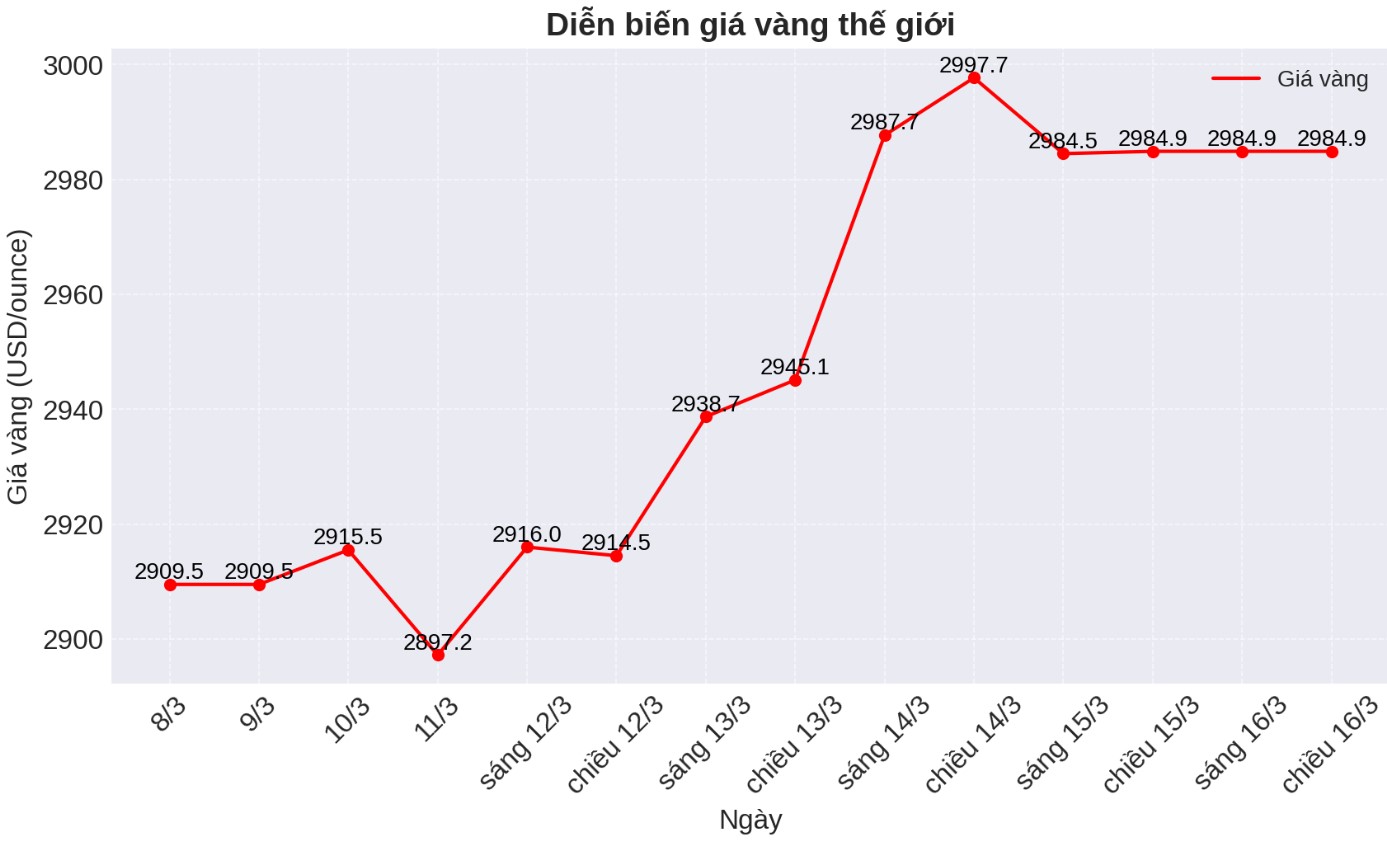

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,984.9 USD/ounce, up 75.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices are anchored high in the context of the USD decreasing. Recorded at 8:30 a.m. on March 16, the USD Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 0.13%).

The latest weekly gold survey from Kitco News shows that optimism is still strong among experts and retail investors, despite record high prices. Most opinions predict that gold prices will continue to increase next week.

15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise next week. Three analysts, or 20%, predict gold prices will fall. The remaining three experts see gold prices moving sideways.

Meanwhile, 262 people participated in Kitco's online survey, with investor sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week. Meanwhile, another 47 people, accounting for 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

On Kitco, Jesse Colombo - independent precious metals analyst and author of The Bubble Bubble Report on Substack - commented that the decline in gold prices at the end of the week was just a temporary stop at an important resistance level and an important psychological level.

"The trend is still strong and I expect gold prices to continue to try to break the $3,000 threshold, maybe next week."

Meanwhile, commodity analysts at TD Securities note that gold's testing at $3,000/ounce will mark the third largest rally in modern history. They said that although risks are increasing in the market, the increase is not over.

Macro funds are still capable of buying more, but their budgets are not endless. However, larger macro factors are still supporting the increase in the medium term, the analysts said in a note.

Important economic data next week

Monday: US retail sales, Empire State Production Index.

Tuesday: Housing under construction and construction permits in the US, monetary policy decision of the Bank of Japan.

Wednesday: Fed monetary policy decision.

Thursday: Swiss National Bank and Bank of England monetary policy decision, weekly jobless claims in the US, Philly FED manufacturing survey, existing home sales in the US.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...