The latest trading data from the US Securities and Exchange Commission (CSTC) shows that as of the week ended July 18, fund managers have increased their stakes to 7,972 more contracts, bringing the total to 172,657 contracts. At the same time, they also reduced their selling bet to 13,763 contracts, down to 22,625 contracts.

The total number of net purchase contracts is currently 136,726 contracts, equivalent to the sideways trend observed over the past month.

In the latest report on gold, Suki Cooper - Precious metals analysis expert at Standard Chartered Bank noted that the net buying ratio on the total number of open-end contracts has fluctuated around 31% over the past seven weeks.

She pointed out that the number of contracts opened remained stable in early July, when US President Donald Trump made statements about new tariffs in the ongoing trade war. Although strategic trading position is still positive and crowded, it has also become a major factor affecting recent price movements.

However, Cooper said, instead of just looking at speculative trading, she is closely monitoring investment demand in exchange-traded funds (ETPs) with gold guarantees globally. In the first half of 2025, these funds recorded the strongest cash flow in the past 5 years.

She also noted that gold holdings in ETPs are still well below the peak set in 2020.

Cash flow into gold ETPs slowed in July, but overall remained positive, and total holdings were still 300 tons lower than the peak in October 2020. The largest gold ETP counterfeit sold volume fell in the last two weeks of June, showing confidence in the possibility of price increases is increasing. In the period of slowing seasonal gold consumption, ETP funds may still be the main factor to monitor to determine the gold price range, she said.

In addition to the ETP factor, Cooper is also monitoring the USD's movements. She explained that if the greenback continues to weaken, this will support gold prices.

Gold prices may not react as strongly as they did at the beginning of the year with tariff information, but still show the strongest correlation with the USD, with an average three-month correlation rate of -70%, while the correlation with real yields also begins to decline negative at -17%.

Currently, gold is less seen as a safe haven, but is still mainly affected by the USD. Concerns about US public debt continue to fuel interest in gold. Rising US public debt and updated tariffs could keep gold at the center, and now, floor prices appear to be solidly supported, she said.

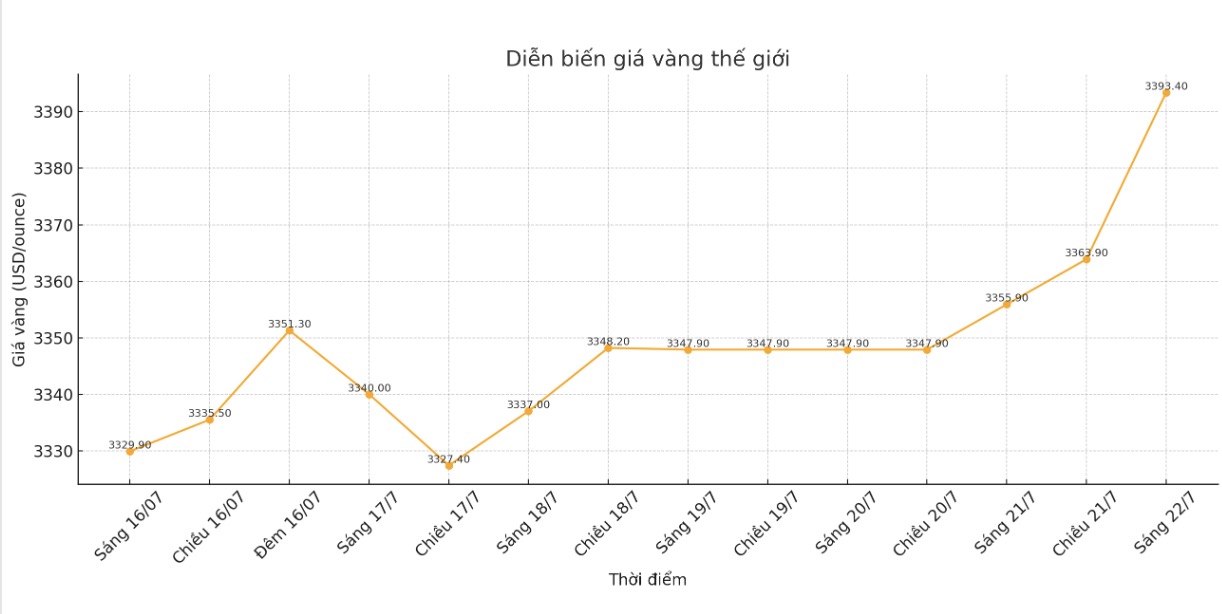

Gold prices are starting a new trading week with a fairly strong increase, as prices approach the resistance level of 3,400 USD/ounce. The latest spot gold price recorded at 3,393.4 USD/ounce. This new momentum appeared when the USD index fell below the 98 point mark.

Cooper also maintains a positive view on gold as central banks continue to increase official reserves, although the buying pace has slowed in recent months.

Input-in activities in the official sector have shown signs of slowing down, but central banks continue to buy despite record high prices and not moving to net selling, she said.