After two strong increases, world gold prices are witnessing remarkable corrections after the US consecutively released optimistic economic reports, from the labor market to long-term orders.

According to the latest report from the US Department of Labor, the number of first-time jobless claims in the week ended November 22 reached 216,000, significantly lower than the forecast of 225,000 from economists. Last week's figure was also adjusted up slightly to 222,000, showing a stable trend for many consecutive weeks.

The 4-week average - an important measure to reduce short-term fluctuations - has decreased to 223,750, from 224,750 in the previous period. This shows that the labor market is maintaining resilience despite global economic instability.

However, the number of people continuing to receive unemployment benefits increased slightly to 1,960 million, higher than the 1.953 million level last week. However, this figure is still lower than the forecast of 1.974 million, continuing to reinforce the view that the US job market remains strong.

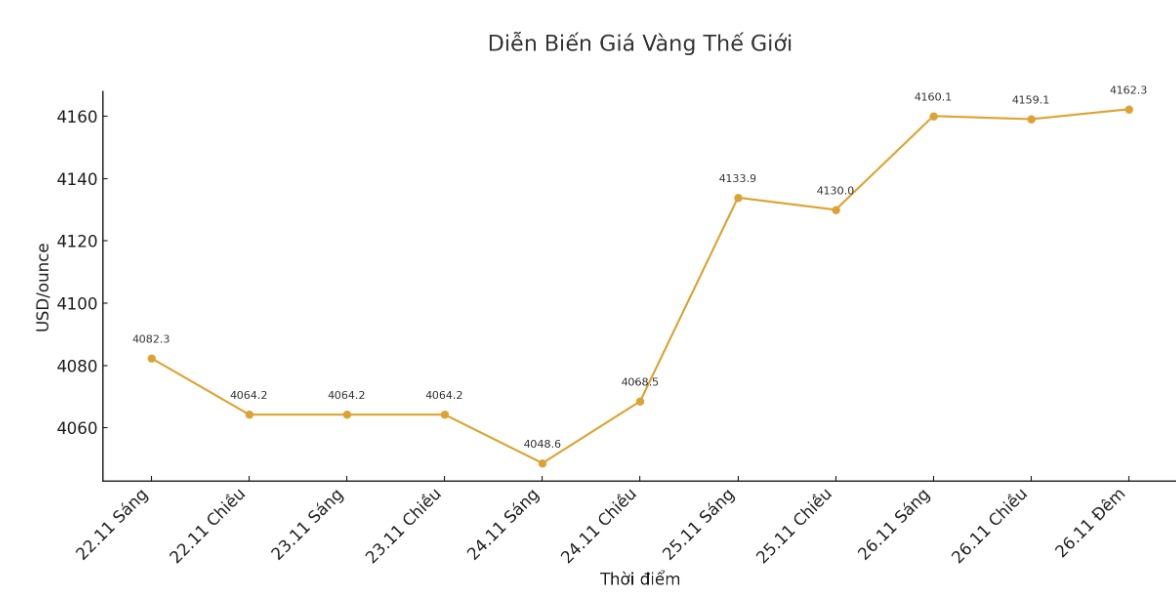

Immediately after the labor market data was released, world gold prices - previously surpassed 4,170 USD/ounce in the session - began to decline slightly.

In addition to signals from the labor market, the US manufacturing sector also recorded important results. The Ministry of Commerce said that long-term goods orders in September increased by 0.5%, in line with market forecasts and followed a strong increase of 3.0% in August (after adjustment).

Notably, core orders - excluding the transport sector with many fluctuations - increased by 0.6%, far exceeding the expectation of 0.2%. Orders for non-defense capital equipment, excluding aircraft - an important indicator of corporate investment, increased by 0.9%, continuing to exceed the forecast of 0.2%, while the August figure was also raised from 0.7% to 0.9%.

These figures reinforce the view that the manufacturing sector is recovering more resiliently than expected, thereby reducing demand for safe-haven assets such as gold.

Gold prices have recently held steady thanks to concerns that the US economy could head towards recession, making it easier for the market to react strongly to better-than-expected reports.

This week's developments clearly show this sensitivity. After the number of initial unemployment claims fell to 216,000 - lower than the forecast of 225,000 - gold left the peaks above $4,170/ounce and traded around $4,154.91/ounce, but still increased by 0.58% in the session.

In another development, the report showed that September long-term commodity orders increased by 0.5%, along with core figures exceeding expectations, also put selling pressure on gold. However, the precious metal price still maintained most of its previous gains and traded above $4,150/ounce.

Technically, the next bullish target for December gold futures is to close above the strong resistance level at the November peak at $4,250/ounce. The closest downside target for the bears is to push prices below the solid technical support level at $4,000/ounce.

The first resistance was seen at $4,175 an ounce, followed by $4,200 an ounce. The first support at the bottom of the night was $4,127.5 an ounce, followed by $4,100 an ounce.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.