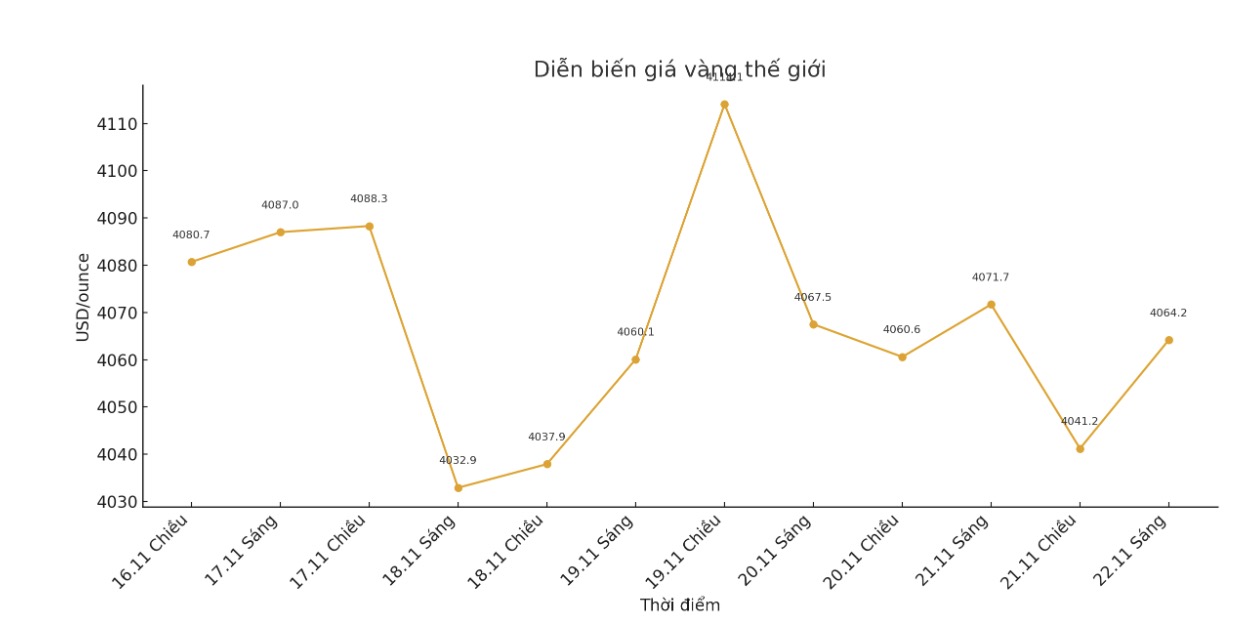

Gold price developments last week

After a week overwhelmed by stories about AI and stocks, traders and investors are turning their attention back to the US Federal Reserve (FED) to find a clear direction, in the context of gold prices continuing to fluctuate strongly and fluctuate erratically.

Spot gold prices started the week at $4,100/ounce, but as repeated many times during the week, the precious metal could not hold any increase above this threshold.

After a second failed attempt shortly after 8:30 p.m. (Eastern time), gold slid to the support zone around $4,058/ounce just after midnight. The European session helped push prices back to nearly 4,090 USD/ounce, but by the time the North American market opened, gold was only around 4,074 USD/ounce.

Many efforts to break through this resistance level failed, leading to the first strong sell-off of the week, causing prices to fall to $4,011/ounce just before 3:00 p.m.

By 6:00 p.m. on Monday, gold had surpassed $4,050 an ounce, but the increase quickly weakened. At 2:15 a.m. (Eastern time), the price set a weekly low, only moving above $4,000/ounce.

At this level, gold became more attractive, and by the North American opening session on Tuesday, prices rebounded to the 4,075 USD/ounce zone. A review of the short-term support zone around $4,060/ounce in the Asia session further strengthened buyers' confidence, and by 4:30 a.m. on Wednesday, spot gold prices surpassed $4,100/ounce.

North American investors quickly took the lead, but after hitting a weekly peak above $430/ounce about 30 minutes after opening time, gold saw a second strong sell-off, falling to $4,065/ounce at noon the same day.

With support and resistance zones clearly formed in market sentiment, the rest of the week saw gold fluctuate in the range of 4,030 - 4,100 USD/ounce. Entering the weekend, prices are still anchored around the support level of 4,065 USD/ounce.

Gold price forecast for next week

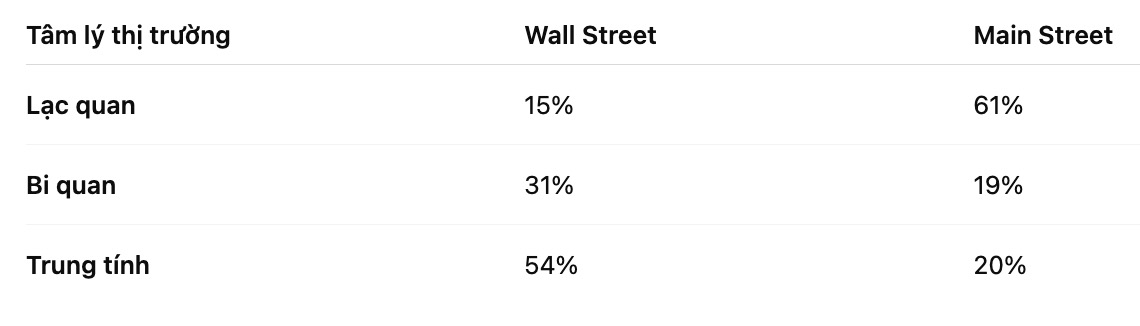

The latest weekly gold survey by an international financial information platform shows that the majority of Wall Street experts are shifting to a bearish or neutral view, while individual investors maintain a majority optimistic ratio.

This week, 13 analysts participated in the gold survey, with only a small group of Wall Street experts holding an upward view. Only two people (equivalent to 15%) predict gold prices will increase next week, while four others (accounting for 31%), predict prices will decrease. The remaining seven analysts (equivalent to 54%) expect the precious metal to move sideways next week.

Meanwhile, the online survey recorded 228 votes, with the optimistic sentiment of investors on Main Street somewhat decreasing compared to last week. 138 individual investors (61%), while 44%, see gold prices rising next week, see prices falling. The remaining 46 people (equivalent to 20%), expect gold prices to enter the accumulation phase next week.

Economic data to watch next week

Next week will see a series of important economic reports piled up in the first three days of the week, as the US government continues to handle the data backlog after the recent closure.

On Tuesday morning, the market will receive the US PPI and Retail Sales reports for September, along with the data for Ho Chi Minh City's pending sales in October.

On Wednesday, traders will monitor a series of published data including long-term commodity orders, preliminary GDP for the third quarter, Personal Consumption Expenditures Index (PCE), New home sales and weekly jobless claims.

The US market will close for the Thanksgiving holiday on Thursday, and although it will resume operations on Friday, there will be no other notable economic reports released.

See more news related to gold prices HERE...