Gold prices rose near a two-week high on Wednesday, after a series of US economic data at a soothing level reinforced expectations that the Federal Reserve (Fed) would cut interest rates next month, thereby supporting the precious metal that is not producing this yield.

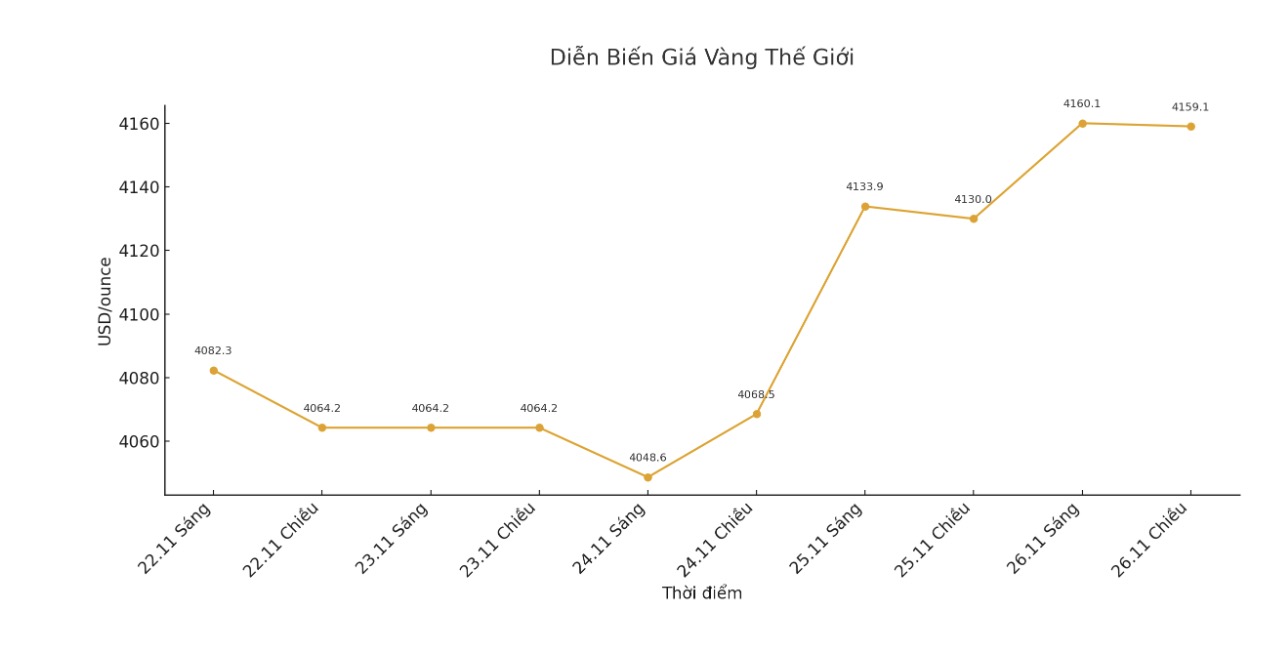

Spot gold prices increased by 0.8% to 4,161.57 USD/ounce at 10:19 GMT (ie 5:19 p.m. Vietnam time), the highest level since November 14. US December gold futures increased 0.4% to $4,157.40/ounce.

Gold, which is an unyielding asset, has often seen a positive performance in a low interest rate environment.

We continue to see room for growth in the short term, with a year-end forecast of $4,200/ounce and $4,500/ounce by mid-year, said Giovanni Staunovo, a commodity analyst at UBS.

Data released on Tuesday showed US retail sales in September increased lower than expected, while the Producer Price Index (PPI) was in line with expectations. US consumer confidence also weakened in November as households became increasingly concerned about jobs and financial prospects.

The data comes after a series of recent dovish comments from Fed officials.

The CME FedWatch tool shows that traders now see the possibility of the Fed cutting interest rates next month at 83%, up from 30% a week ago.

Adding to gold prices is the news that White House economic adviser Kevin Hassett is emerging as the leading candidate for the next Fed Chairman, reinforcing expectations for a dovish policy preferred by President Donald Trump.

Investors are now waiting for the US weekly jobless claims report, due later on Wednesday - an important measure of the health of the labor market and the Fed's policy outlook.

Notably, Deutsche Bank (DBKGn.DE) - Germany's largest bank - raised its gold price forecast for 2026 to 4,450 USD/ounce from 4,000 USD on Wednesday, citing the stabilization of investment capital flows and persistent demand from central banks.

The bank now expects gold prices next year to range between $3,950 and $4,950, with a price ceiling of about 14% higher than the current December 2026 gold contract price on the COMEX.

Note: The world gold market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...