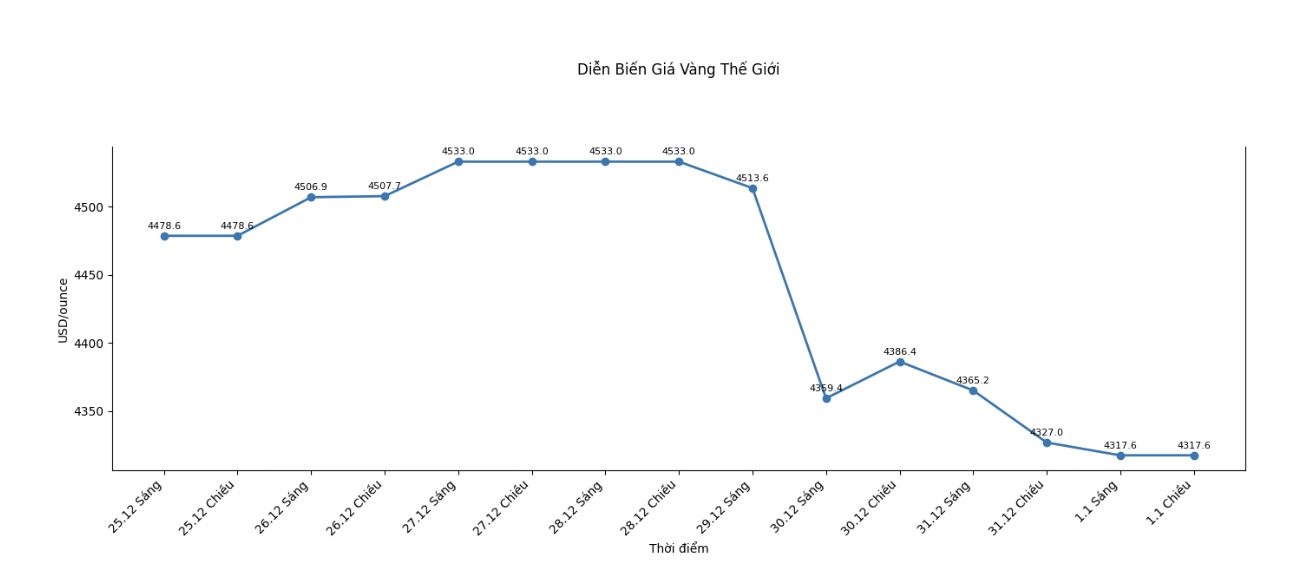

The Chicago Mercantile Exchange (CME)'s surprise announcement of a second margin increase in just three days for precious metal futures contracts has created strong fluctuations in the market on the last trading day of the year.

This move makes many investors worried that the multi-year upward cycle of gold, silver and other precious metals is entering its end. Meanwhile, a part of individual investors expressed frustration, saying that large institutions are continuing to "tighten" their opportunities right at a time when the market is volatile.

However, according to Mr. Kevin Grady – Chairman of Phoenix Futures and Options – such a view is not complete. In an exchange with Kitco News when the market only had a few hours of trading at the end of the year, Mr. Grady said that to understand CME's decision, it is necessary to correctly look at the nature of the futures contract market, as well as clearly identify who is actually participating in buying and selling and for what purpose.

According to Mr. Grady, the market is currently dominated mainly by short-term speculative activities. The holiday makes many experienced traders leave the exchange, so market liquidity becomes thinner than usual.

In that context, just a not too large trading volume can create very strong price fluctuations. CME, according to him, does nothing else but try to maintain the necessary order and stability for the market.

Mr. Grady emphasized that the very large intraday fluctuations of silver, sometimes up to 5-7 USD per ounce, do not reflect the behavior of long-term investors or hedge organizations. These are unusual fluctuations, mainly stemming from the rapid buying and selling activity of speculators.

When prices fluctuate too strongly in a short time, the risk is not only in the trader but also spreads to the entire payment and clearing system.

According to this expert, while public opinion usually only pays attention to the decisions of the exchanges, payment brokerage companies and organizations behind them are the ones who bear the greatest pressure. When the price of precious metals fluctuates strongly, the necessary margin value for each contract increases rapidly.

To protect themselves and customers, brokerage companies often have to proactively raise their internal margin levels, even earlier and higher than required by CME.

Mr. Grady said that this is a risk-preventing response, aimed at avoiding cases of accounts losing money beyond control. Brokerage companies do not want customers to see commodity transactions as a risky game, especially in the last weeks of the year when liquidity is low and price fluctuations can be amplified.

Another noteworthy point, according to Mr. Grady, is that some small-scale precious metal markets are being turned into pure speculative tools. Silver, platinum or palladium have recently seen a sharp increase in trading volume, not commensurate with the scale and actual defensive needs of the physical market.

This makes these markets appear like "trend stocks", where short-term cash flow flows flow in with the goal of quickly making a profit instead of serving the demand for price insurance.

History shows that holiday periods are often times when strong fluctuations are likely to occur. When many large organizations temporarily reduce operations, a small group of speculators can create larger price waves than usual.

This trend becomes even clearer in the context of strong algorithmic and automated trading. Pre-programmed trading programs will react very quickly to technical signals, contributing to pushing prices further without human consideration.

However, Mr. Grady believes that the increase in margin should not be understood as a signal that the long-term upward trend of precious metals has ended. According to him, the fundamental factors supporting the market, especially the long-term storage demand from large institutions and central banks, are still present.

Meanwhile, supply from mining enterprises has not increased sharply, because many companies are currently only protecting at a minimum level to maintain operations, instead of selling strongly as before.

Mr. Grady admitted that the recent price increase has attracted a large number of speculative investors, especially when prices continuously hit new peaks and the media paid much attention.

This makes the market more sensitive to technical corrections. However, according to him, such corrections are necessary to test the sustainability of the trend.