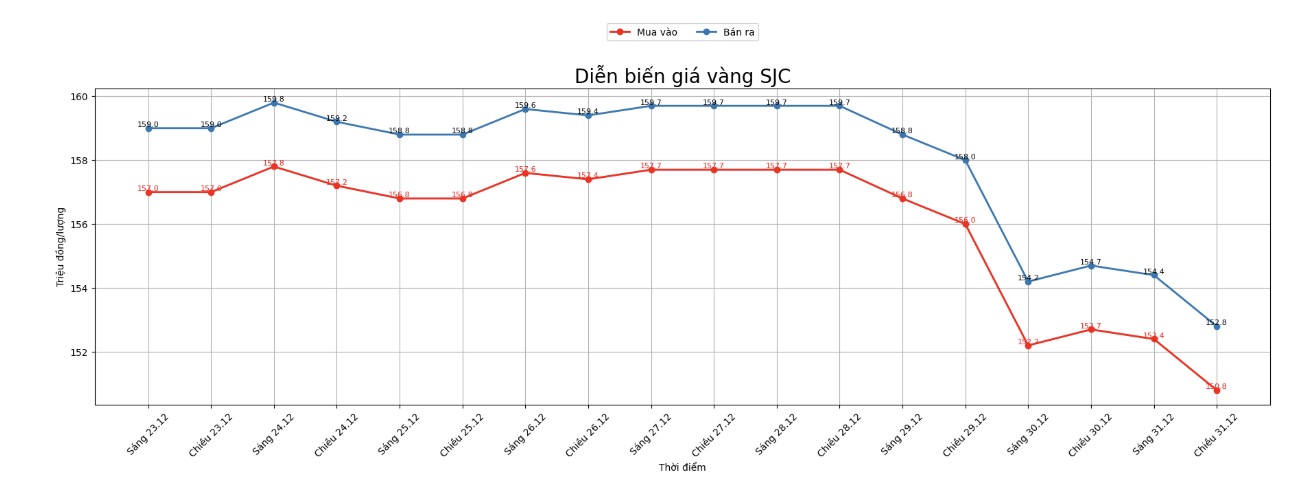

SJC gold bar price

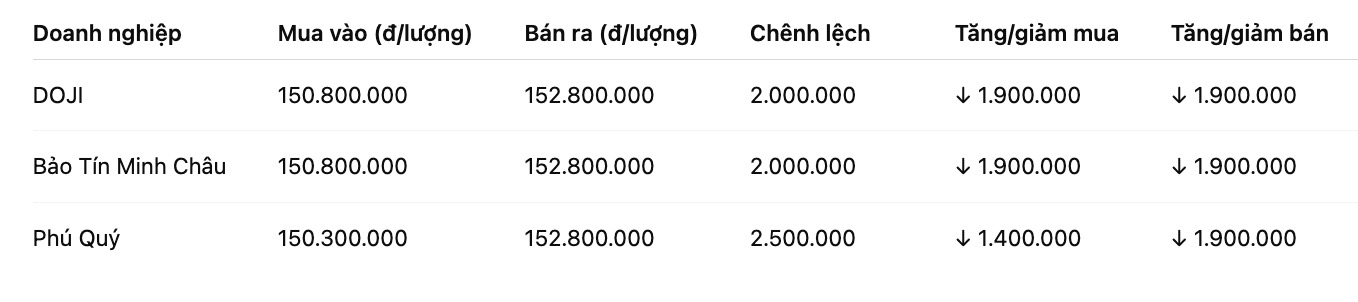

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), down 1.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), down 1.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), down 1.4 million VND/tael on the buying side and down 1.9 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

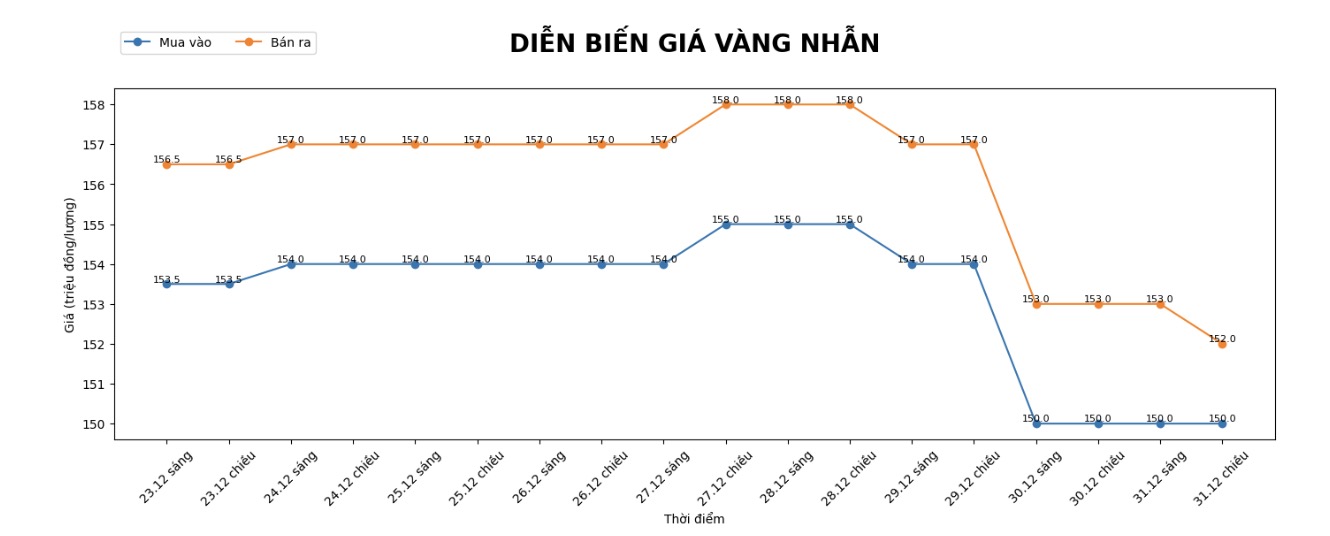

9999 gold ring price

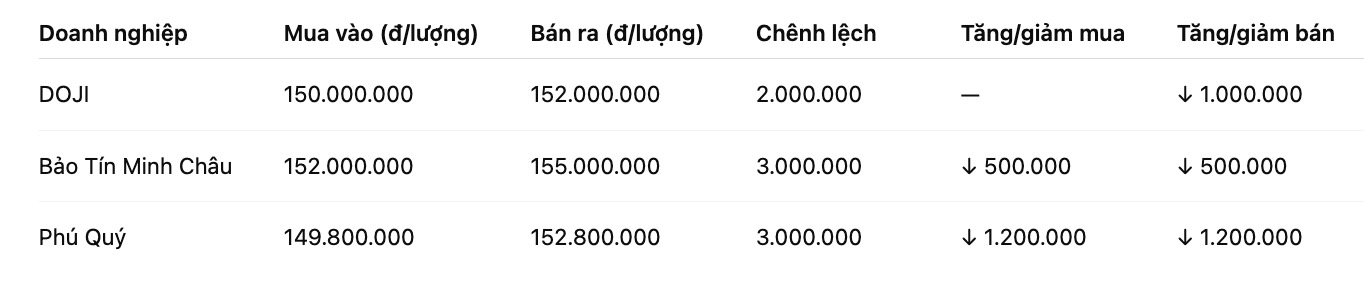

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 150-152 million VND/tael (buying - selling), keeping the buying direction unchanged and decreasing by 1 million VND/tael on the selling side. The buying - selling difference is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 149.8-152.8 million VND/tael (buying - selling), down 1.2 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

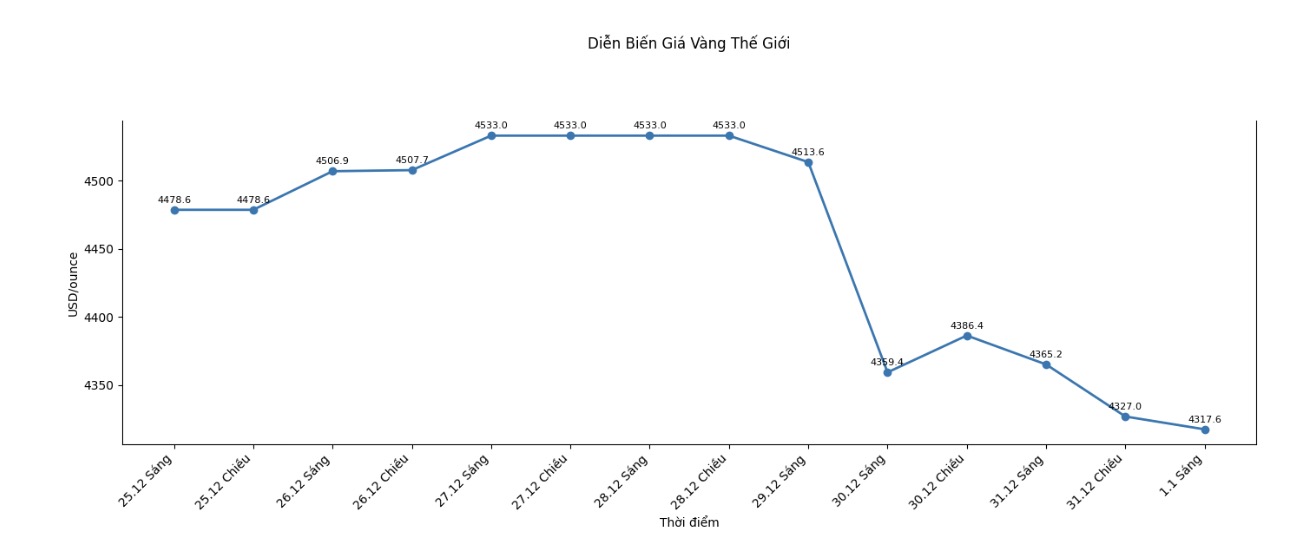

World gold price

World gold price listed at 5:55 am at the threshold of 4,317.6 USD/ounce, down 20.1 USD/ounce.

Gold price forecast

It's a bit of a bit of a bit of a bit of a bit of a bit.

World gold prices today fell sharply, falling to the lowest level in three weeks, while silver prices also plummeted deeply. Both precious metals are experiencing trading sessions with extremely large price fluctuations during the day, causing serious risks for both buyers and sellers, especially short-term futures contract traders, in the context of the market continuously "changing direction" strongly.

At the close of the most recent session, February gold fell $52.9, down to $4,333.2/ounce. March silver fell $6.85, down to $71.09/ounce.

According to analysts, Friday's trading session (January 2nd) is considered a turning point for the prolonged upward trend of gold and silver. Closing price movements during the day - near the week's peak or near the week's bottom - may determine the trading trend as well as the direction of the prices of these two precious metals in the following weeks.

Previously, gold and silver increased sharply on Tuesday after absorbing the deep declines of the first session of the week. However, in today's session, both turned down sharply. Too large price fluctuations in the precious metal market are making many other commodity traders more cautious and lean towards negative scenarios.

Notably, CME Group announced that it will continue to raise margins for precious metal futures contracts, marking the second adjustment in just one week. Accordingly, gold, silver, platinum and palladium contracts will apply higher margins after the market closed today. CME said this decision was made after reviewing the level of strong market volatility to ensure financial safety and sufficient collateral.

Regarding technical analysis, gold buyers for February delivery are aiming to push the closing price beyond the strong resistance zone at a record peak of 4,584 USD/ounce. Conversely, sellers are aiming to pull the price below the important support level of 4,200 USD/ounce.

In the short term, the first resistance level of gold is at 4,384.9 USD/ounce, followed by the 4,400 USD/ounce mark. The nearest support level is 4,284.3 USD/ounce, followed by 4,250 USD/ounce.

In foreign markets, the USD index increased slightly. Crude oil prices decreased and are trading around the 58 USD/barrel mark. The yield of US 10-year government bonds is currently at 4.138%.

It's a bit of a bit of a bit of a bit of a bit of a bit.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...