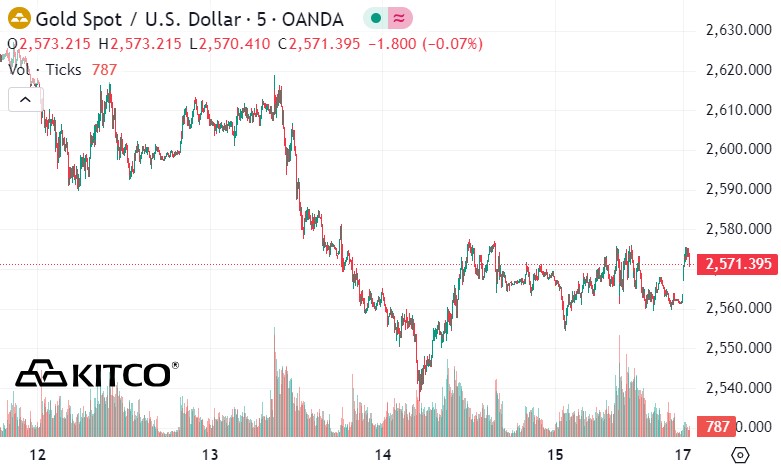

According to Kitco, world gold prices have dropped from a high of $2,800/ounce to more than $2,500/ounce after 2 weeks.

Gold prices have fallen nearly 5% this week alone, marking their biggest weekly decline in nearly three years, said Alex Kuptsikevich, senior market analyst at FxPro.

From its peak, the precious metal has now lost more than $250 an ounce (about 9%), making it the longest losing streak since the beginning of the month.”

Despite the decline, Alex Kuptsikevich said that if gold prices fall to $2,400 an ounce, it will only be a correction, bringing prices back to the 200-day moving average. At the current rate of decline, gold could reach that level before the end of the year.

Technically, Kuptsikevich said, a significant bearish signal has emerged on the weekly chart. "A sharp decline after gold exited overbought territory, accompanied by a decline in the relative strength index (RSI) from above 80. A reversal at this extreme level usually signals a change in momentum," Kuptsikevich noted.

He gives specific examples of the two most recent strong bearish reversals from overbought conditions at all-time highs that occurred in 2009 and 2011.

Accordingly, in 2009, gold saw a 15% drop from peak to trough before new buying activity pushed prices to a new record high. This bull market lasted nearly two years, with only a few brief pauses.

Then, in 2011, gold initially fell nearly 20%. “Although gold recovered 17% thereafter, the bull market fundamentals were broken. Over the next four years, gold lost 45% of its peak value,” he said.

In both cases, the 50-week moving average acted as medium-term support throughout the sell-off, Kuptsikevich said.

“Currently, this moving average is at $2,330/ounce and is trending up, possibly reaching $2,400/ounce by the end of the year. However, a decisive break below this level could trigger a further decline,” Kuptsikevich said.

Naeem Aslam - Chief Investment Officer at Zaye Capital Markets - said that the recent weakness in the precious metal and a number of factors will create a correction in price movements.

“Gold prices have been under significant downward pressure over the past few days due to a rising US dollar and expectations of a change in the US Federal Reserve’s monetary policy. In addition, gold could record its biggest weekly decline in months,” Aslam said.

According to Mr. Aslam, traders and investors are concerned that the yellow metal may face more challenges, as the Fed is in no hurry to change monetary policy in the near future when new economic data is available.

He pointed out that while a stronger US dollar and expectations of fewer rate cuts are weighing on gold prices, a number of factors could change the trajectory of gold prices in the coming months.

“Gold’s appeal as a safe haven asset could be reinforced by global economic uncertainties. Investors may seek refuge in gold in case of increased uncertainty,” Aslam said.

According to Mr. Aslam, the Fed may come under increased pressure to adjust policy if inflation continues to exceed expectations. “Gold may eventually benefit from inflation if it exceeds interest rate increases. In addition, demand for gold may increase if the US dollar starts to weaken due to domestic or international factors,” Naeem Aslam added.