Gold price has dropped to the second after reaching a record high at the beginning of the session, due to cooling down when US President Donald Trump exempted taxes on smartphones and computers.

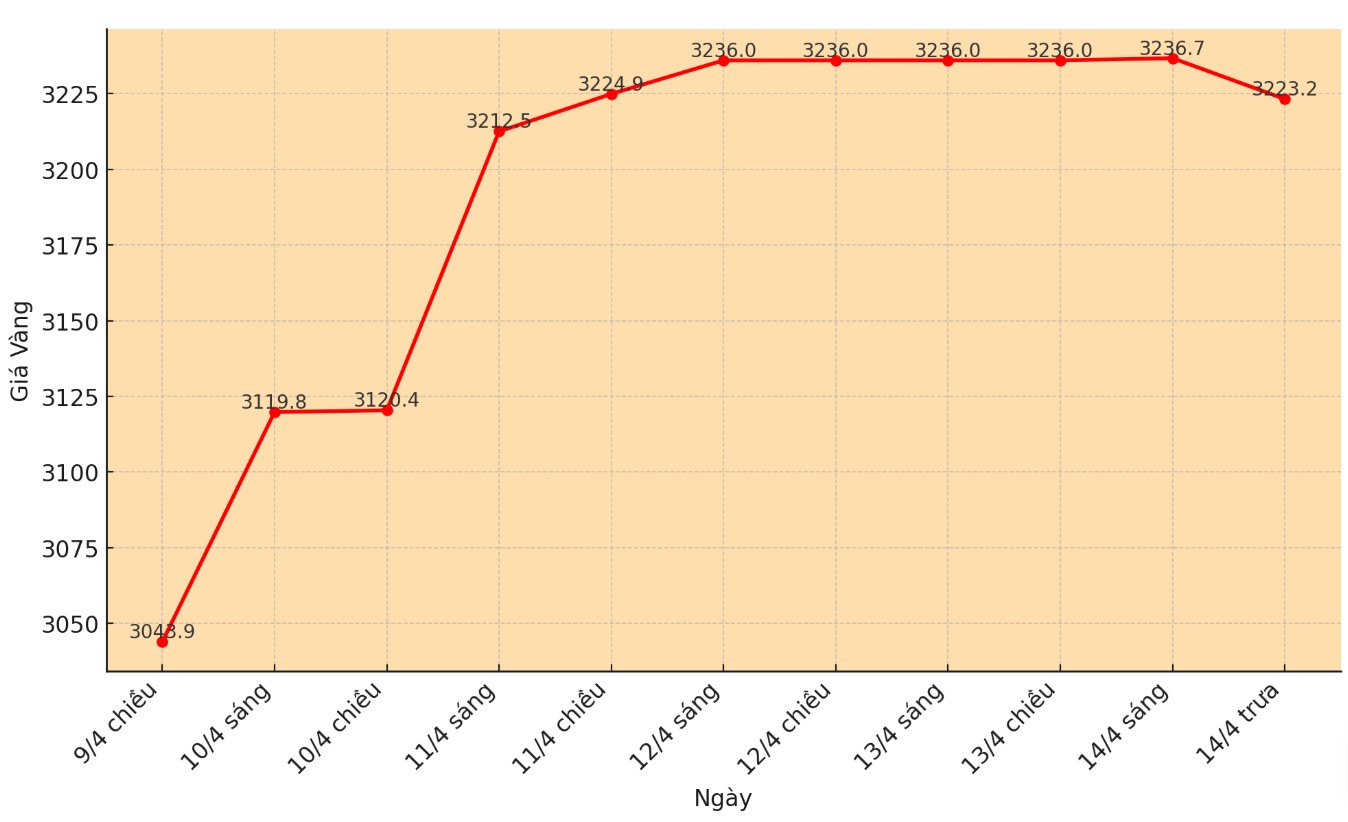

At 3:29 am, spot gold price decreased by 0.1%, to 3,232.45 USD/ounce, after reaching a record high of US $ 3,245.42/ounce of the day.

US future gold contract inched slightly 0.1% to US $ 3,248.2/ounce.

"The weak dollar has supported the price of gold, but the information about tax exemption for technology products has made the psychology of risk increased, reducing the demand for safe shelter, making gold price lack of clear trends," said Tim Waterer, a market analyst at KCM Trade.

The White House announced the high tax exemption on Friday. However, Trump on Sunday said that this exemption for phones and computers from China will only temporarily.

"The continuous trade and tariff disputes have made the financial market more volatile and more unstable. In this context, if the USD continues to be weak, the gold price can be directed to the 3,300 USD/ounce milestones in the short term" - Mr. Waterer added.

Gold is not interested in interest, often considered as a tool to prevent risks in the period of economic instability and inflation.

On Friday, the gold price of gold for the first time surpassed the USD 3,200/ounce due to the US -China trade tensions escalated to wobble the global market.

Goldman Sachs Bank has raised the forecast of gold price at the end of 2025 from US $ 3,300 to US $ 3,700/ounce, thanks to the strong demand from central banks and capital flows into high ETF funds.

Traders now expect the US Federal Reserve (Fed) to cut interest rates about 80 basic points from now until the end of 2025.

In other markets, the price difference in China - the world's leading gold consumer country has increased sharply in the past week, because consumers and investors come to gold to avoid risks from the escalating trade war with the United States.

Silver delivery price decreased by more than 1% to 31.91 USD/ounce. Platinum increased by 0.6% to 948.45 USD, while palladium increased by 0.8% to 922.98 USD/ounce.