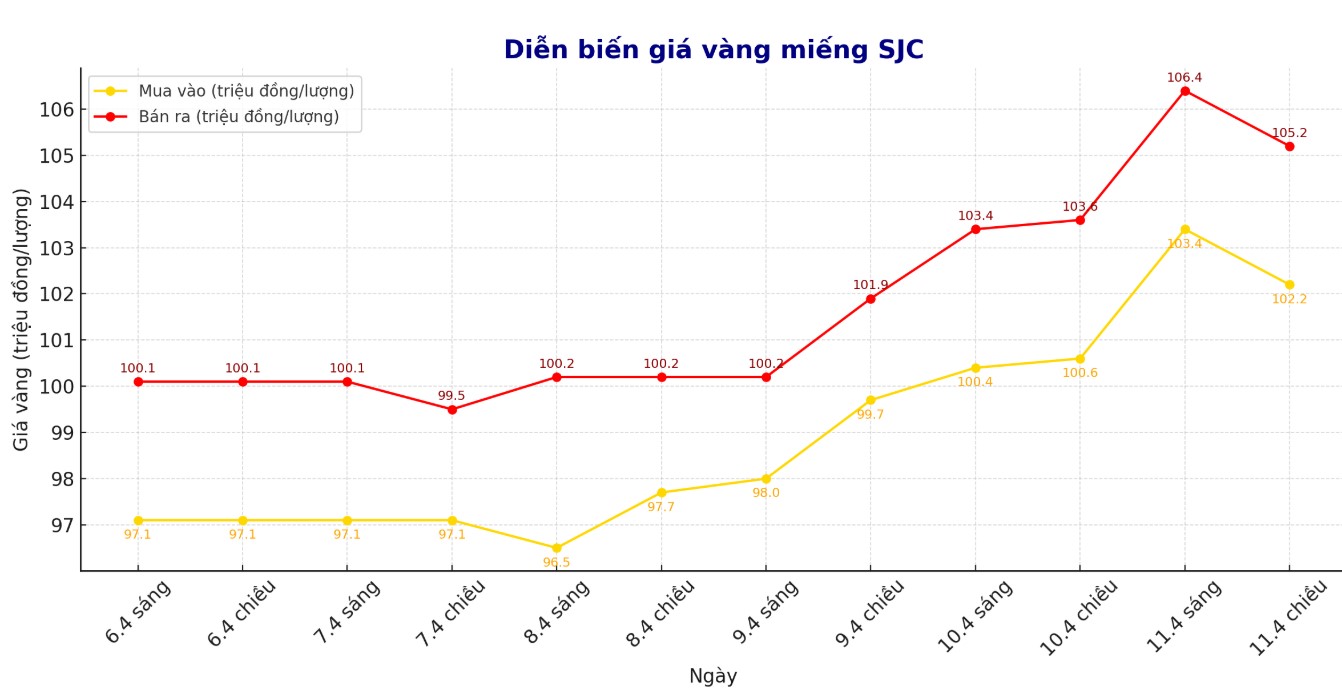

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND102.2-105.2 million/tael (buy in - sell out); an increase of VND1.6 million/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 102.2-105.2 million VND/tael (buy - sell); an increase of 1.6 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 102.2-105.2 million VND/tael (buy - sell); increased by 1.6 million VND/tael for both buying and selling. The difference between buying and selling prices is at 3 million VND/tael.

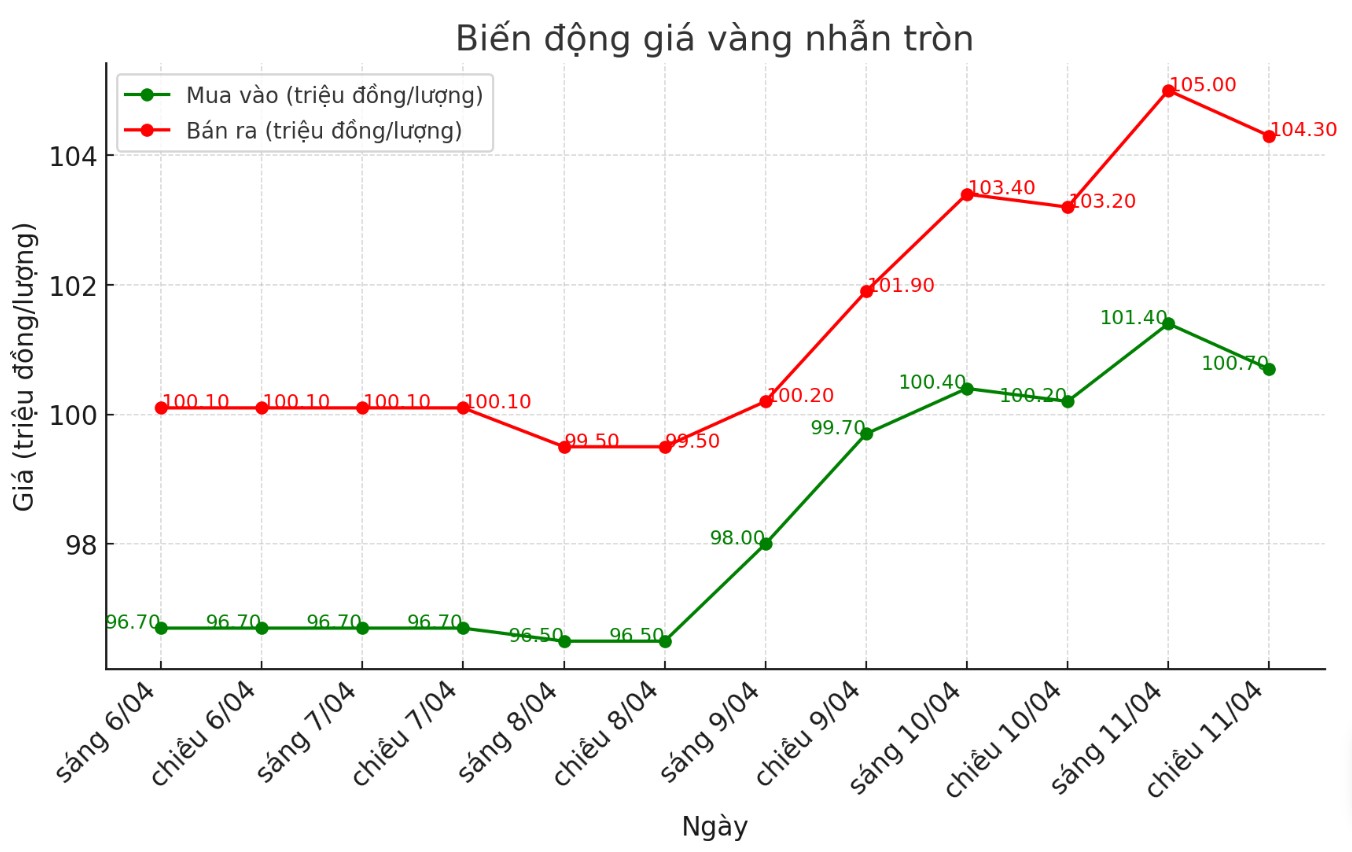

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 100.7-104.3 million VND/tael (buy - sell); an increase of 500,000 VND/tael for buying and an increase of 1.1 million VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3.6 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 100.9-104.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael for buying and an increase of 800,000 VND/tael for selling compared to early in the morning. The difference between buying and selling prices is at 3.6 million VND/tael.

As world gold prices fluctuate strongly, the gap between domestic and domestic prices is widening, showing very clear risks. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

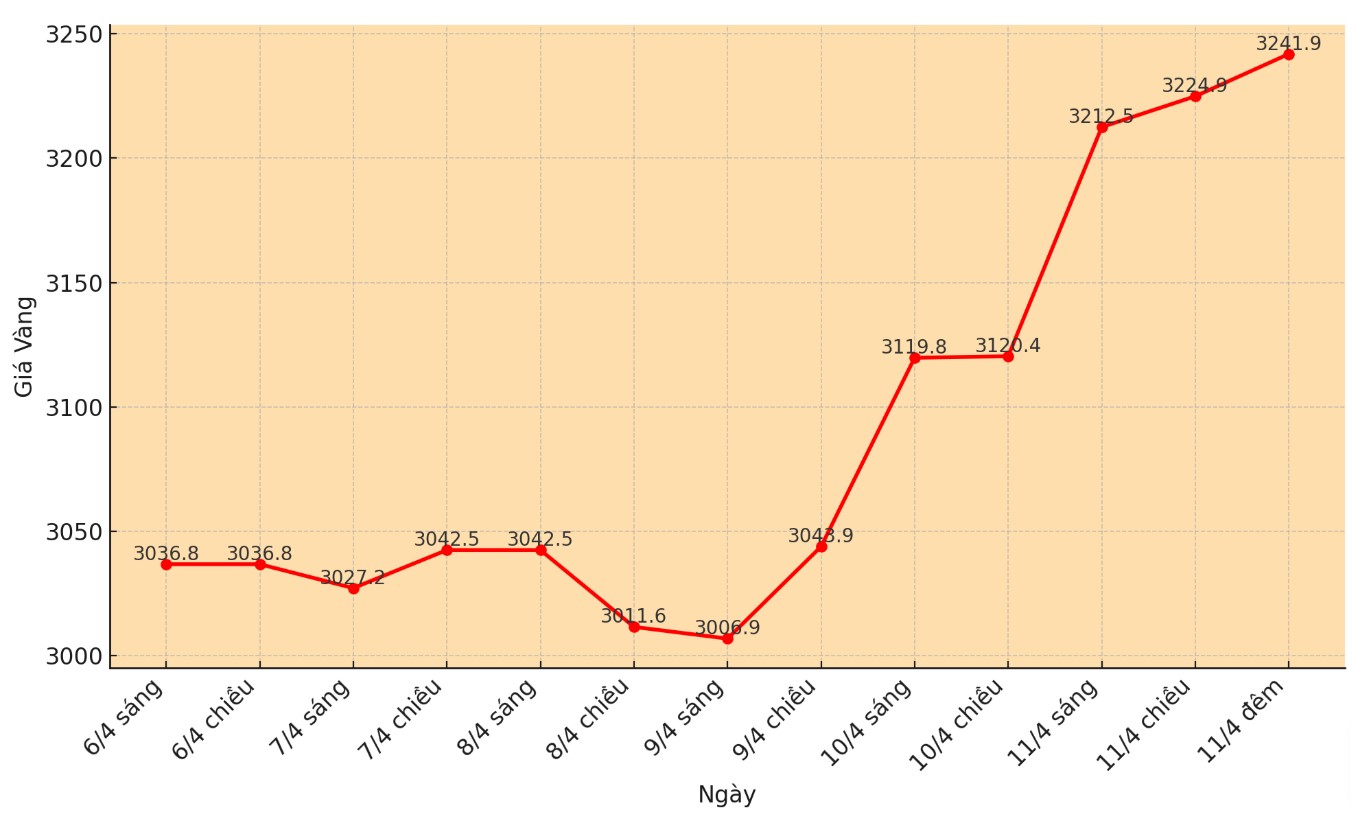

World gold price

As of 6:15 p.m. on April 11, the world gold price was listed at 3,241.9 USD/ounce, up 79.7 USD compared to early in the morning.

Gold price forecast

According to Kitco, gold prices increased sharply and hit a new record high in the US trading session on Friday. Comex gold futures for June delivery at one point peaked at $3,255.90/ounce. Silver prices also increased sharply.

Safety-haven demand continues amid unstable global stock market and signs of a downturn in the US Treasury note market, continuing to support the rally of the two precious metals. Gold prices for June delivery are currently up by 57.70 USD, to 3,235.20 USD/ounce. The price of silver delivered in May increased by 0.691 USD, to 31.45 USD/ounce.

Asian and European stock markets traded in opposite directions overnight. US stock indexes are expected to open for a gain in New York. The US-China trade war has not cooled down yet, and the two sides continue to raise their tariffs on each other. According to a headline from Dow Jones Newswires: The US and China are entering an economic war and everyone will be affected.

This week, a new concern is quietly appearing in the market, which is US Treasury bonds. Greg Ip from the Wall Street Journal wrote: The stock markets decline due to the escalating trade war has been enough to cause concern, but the decline in the US dollar and the increase in new bond yields are really worrying.

Normally, when investors are worried, they seek safe haven usually the US dollar and Treasury bonds. But this time, despite concerns about recession, the safe-haven cash flow has not appeared as usual. If the US bond market is unstable, the global financial system could be affected.

David Morrison from Trade Nation commented: "The market is now focused on the issue of taxes. The risk is that at the end of the week, if there is unexpected news, whether good or bad, the market will react strongly when reopening on Sunday evening. At this time, liquidity is low, fluctuations are often very large".

Gold prices last night hit a new record high of $3,255.9/ounce (June contract), thanks to continued dominance of safe-haven buying.

Technically, gold for June delivery is in a clear technical position in the short term. The next upside target for buyers is to surpass the resistance level of $3,300/ounce.

On the contrary, the sellers will try to pull the price below the important technical support zone at 3,100 USD/ounce. The most recent resistance level was 3,255.9 USD/ounce (last night's peak), followed by 3,275 USD/ounce. First support was at $3,200/ounce, then $3,160/ounce.

In the outside market, the USD index fell sharply, falling to its lowest level in 3 years. Nymex crude oil prices are almost flat, around $60/barrel. The yield on the 10-year US Treasury note is currently at 4.403%.

See more news related to gold prices HERE...