Neils Christensen - analyst of Kitco News said that although the warnings about the dollar weakening the global role and the "American exception" to an end could make many people think that it was exaggerated, but it was clear that the financial market last week was giving a strong instability signal.

When analysts are still discussing the global import tax policy, Mr. Donald Trump can be re -applied, a proposal that attracts attention is mentioned: The US will pursue new trade agreements that are more beneficial, in return for countries that will accept to maintain a weak USD to ensure global economic stability.

Neils Christensen warns that the boundary between "America above all" and "America alone" is very fragile, and that risk is always permanent.

Meanwhile, the stock market continues to plummet. But the most worrying point comes from the US bond market. 10 -year bond yields soared to 4.5%, recorded the strongest increase in many years. This figure is not only technical, because American bonds are the foundation for the entire global financial market, from interest rates to buy houses to corporate bonds are valued on it.

The yield increased by more than 0.5 percentage points in just a few days, leading to a wave of re -valuation in a series of markets, while pushing the loan cost up high. This is like a real shock.

Normally, when the market panicked, investors will rush to buy US and USD bonds to hide. But last week, that did not happen when many countries began to be reserved, no longer considered the US as a reliable trading partner.

The global monetary system will not collapse overnight, but the change in belief has made gold the focus.

The dollar may still play a global reserve role for decades. However, in a new polar world, only gold is assets that do not depend on any country and are not at geopolitical risks.

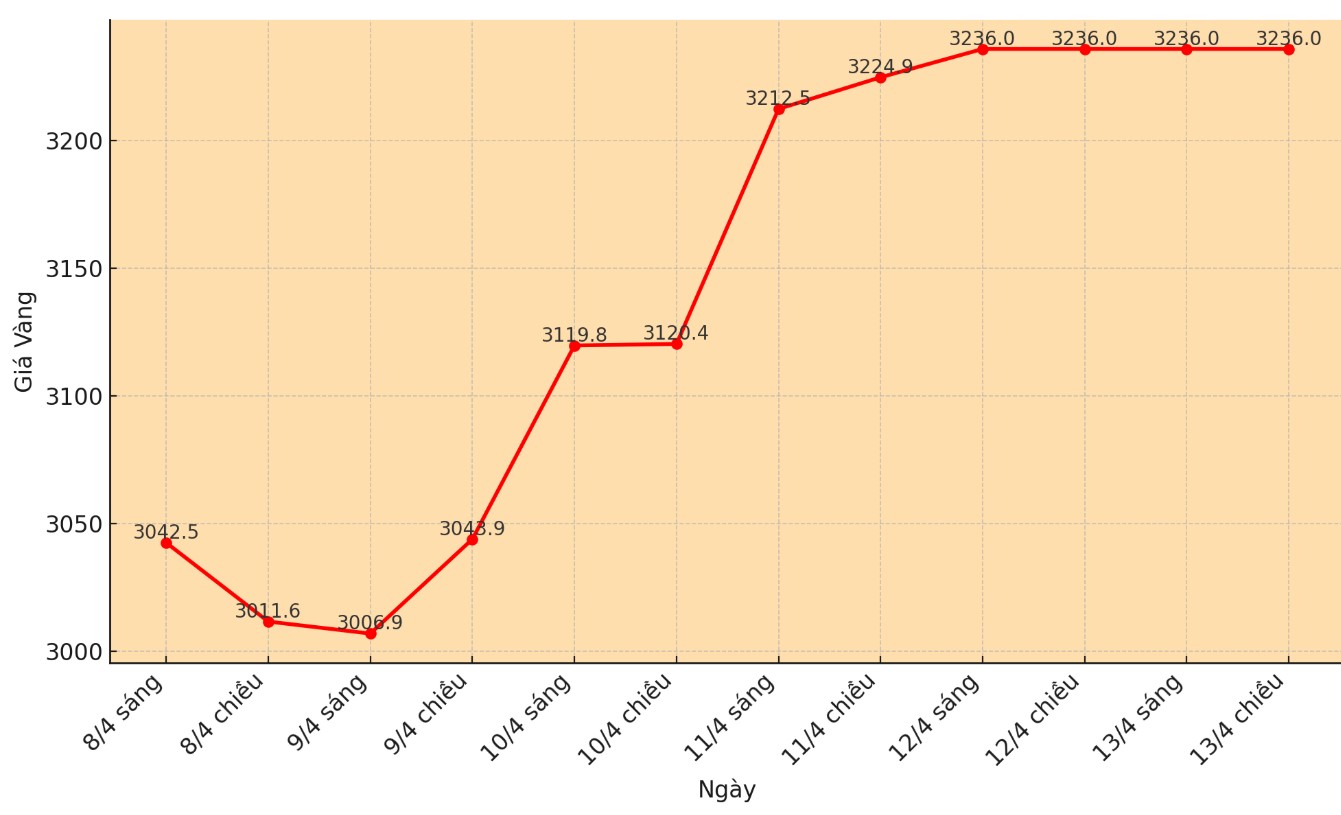

Last week, when USD, stocks and bonds were simultaneously sold, gold prices went against the trend - an increase of more than 6% to over 3,200 USD/ounce.

Although many people think that the gold market is being pushed up too high, almost no one thinks there will be a strong sell -off. In the current instability context, gold is still the top shelter.

For investors, the question now is the rise of gold will last long?

One factor that can push gold price continues to go up is the interest rate of American bonds. If the 10 -year yield close to 5%, the US Federal Reserve (Fed) may have to give up the plan to tighten the monetary and return to the bond pump - which has been called quantitative loosening (QE).

At that time, not just reducing interest rates. The Fed expanding the balance sheet can blow a new wave of price increase of gold.

In this scenario, the highest gold price milestone of all times of inflation, about 3,450 USD/ounce will probably be mentioned soon.