The domestic gold market has witnessed strong fluctuations over the past year, many times setting records in both SJC gold bars and 9999 gold rings.

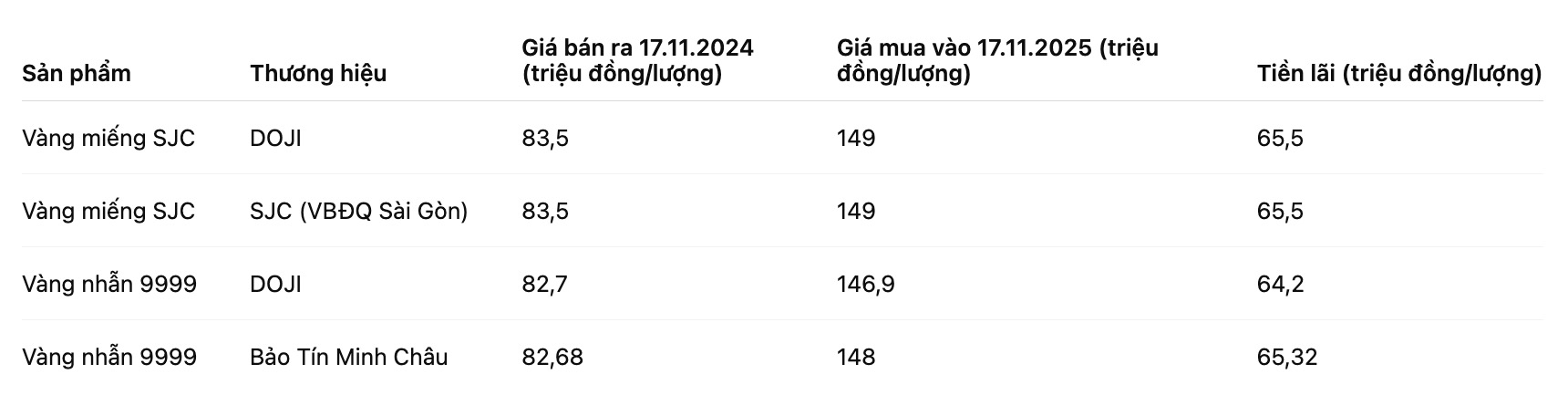

Comparing prices at the two times of November 17, 2024 and November 17, 2025, it shows a steady price increase range, far exceeding the forecast of most analysts.

A year ago, SJC gold bars were listed by DOJI Group and Saigon Jewelry Company at 80 - 83.5 million VND/tael. By the morning of November 17, 2025, the price had increased sharply to 149 - 151 million VND/tael.

Thus, after only 12 months, SJC's purchase price has increased by VND69 million/tael, equivalent to about 86.25% compared to VND80 million/tael last year. In the selling direction, the price increased by 67.5 million VND/tael, equivalent to about 80.84% compared to 83.5 million VND/tael at November 17, 2024. This is a huge percentage increase in the gold market, reflecting the unprecedented hot performance in the past year.

Not only gold bars, 9999 gold rings also recorded a steady increase trend. At DOJI, the price of 9999 rings has increased from 81 - 82.7 million VND/tael in November last year to 146.9 - 149.9 million VND/tael today. This corresponds to an increase of 65.9 million VND for buying and 67.2 million VND for selling.

At Bao Tin Minh Chau, 9999 gold rings also increased sharply, from 81.03 - 82.68 million VND/tael to 148 - 151 million VND/tael, an increase of about 66.97 million VND for buying and 68.32 million VND for selling.

The strong increase in the domestic market occurred in the context of world gold prices also escalating rapidly. From 2,563.2 USD/ounce on November 17, 2024, international gold prices have increased to 4,087 USD/ounce after one year, equivalent to an increase of 59.5%.

If investors buy gold on November 17, 2024 and sell it on November 17, 2025, the profit will be huge. For SJC gold bars, the profit reached about 65.5 million VND/tael. DOJI gold rings brought in a profit of about 64.2 million VND, while BTMC gold rings brought in a profit of about 65.32 million VND/tael.

In general, investors are earning from 64 to more than 66 million VND/tael after a year of holding - a profit that far exceeded many other financial channels.

However, behind this "huge" interest rate are increasingly clear signs of risk. Gold prices are anchored at a record high, the gap between buying and selling prices is widened to VND23 million/tael, making it easy for investors to lose profits if the market turns around. FOMO psychology continues to spread as prices continue to peak, causing many people to rush to buy gold in the context of disruptive information.

Meanwhile, the outlook for world gold prices is still unpredictable due to many factors such as geopolitical tensions, US interest rates and the safe-haven trend of international capital flows. Although domestic gold buying interest rates are at unprecedented highs, investors should be cautious and consider carefully before participating, especially during times of strong market fluctuations and high speculative psychology.