Gold prices ended the trading week in a difficult state, when the increase of buyers faced strong technical selling pressure.

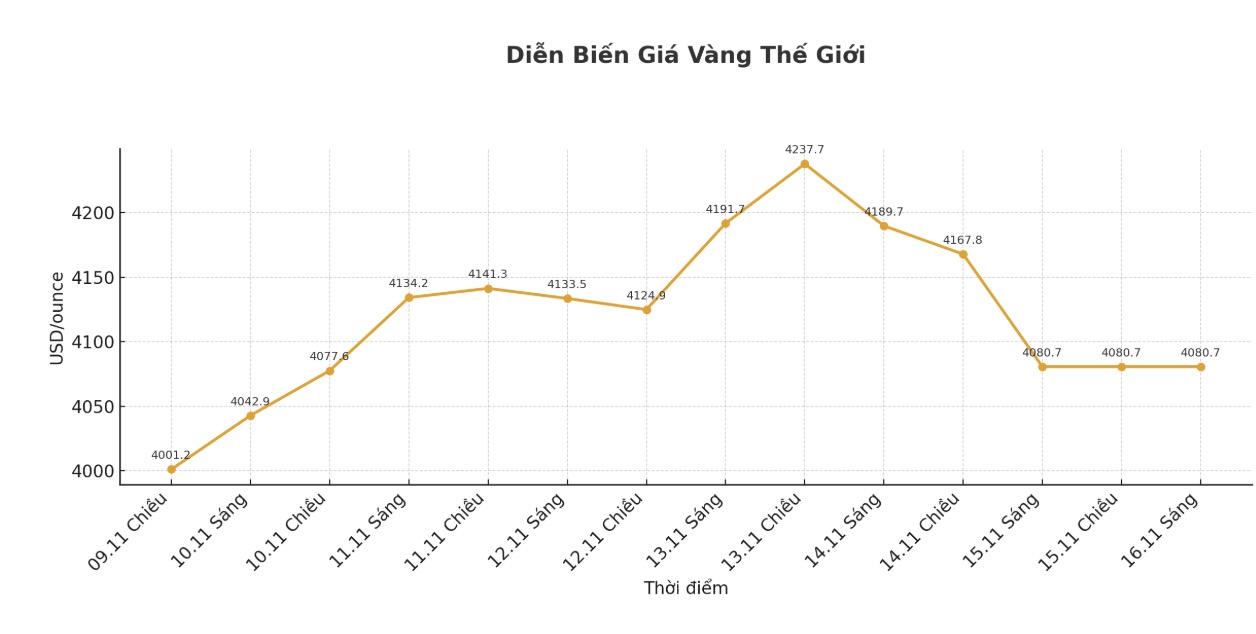

Although in the short term, gold seems to lack direction as investors react to changing economic conditions, it is important not to get caught up in this "activation". Gold prices could not hold above $4,200 this week as the market began to rule out the possibility of the Federal Reserve cutting interest rates next month.

The US government has ended a 43-day closure - the longest in history, but its impacts will continue for the next few weeks. Some economic data, such as the October CPI, will be permanently lost due to manual collection. This could cause big problems for economists, as economic models rely on stable and reliable data.

Meanwhile, the FED is citing the US government's "IT dark" as a reason to maintain the current interest rate at its December meeting. Of course, this is in line with the familiar saying: When you dont know what to do, its best not to do anything.

It is understandable that the Fed's possible "unstable stance" has frightened some investors, leading to them selling everything - including gold. Although gold ended the week with a 2% increase, prices still fell more than 3% compared to the peak on Thursday.

The strong increase in gold at the beginning of the week may be a bit too much, but a decrease of 3% just because the FED wants to "breathe" seems an exaggerated reaction. This is the time to look at the bigger picture.

Even without October economic data, there are still clear signs that the US labor market is gradually losing momentum. At the same time, inflation - although still high, is not accelerating. In the end, inflation is not strong enough to stop the Fed - especially as the agency continues to be pressured by President Donald Trump to cut interest rates.

Even if the Fed misses the December meeting, interest rates will remain lower in 2026. A Fed meeting will not be able to change gold's long-term support platform.

See more news related to gold prices HERE...