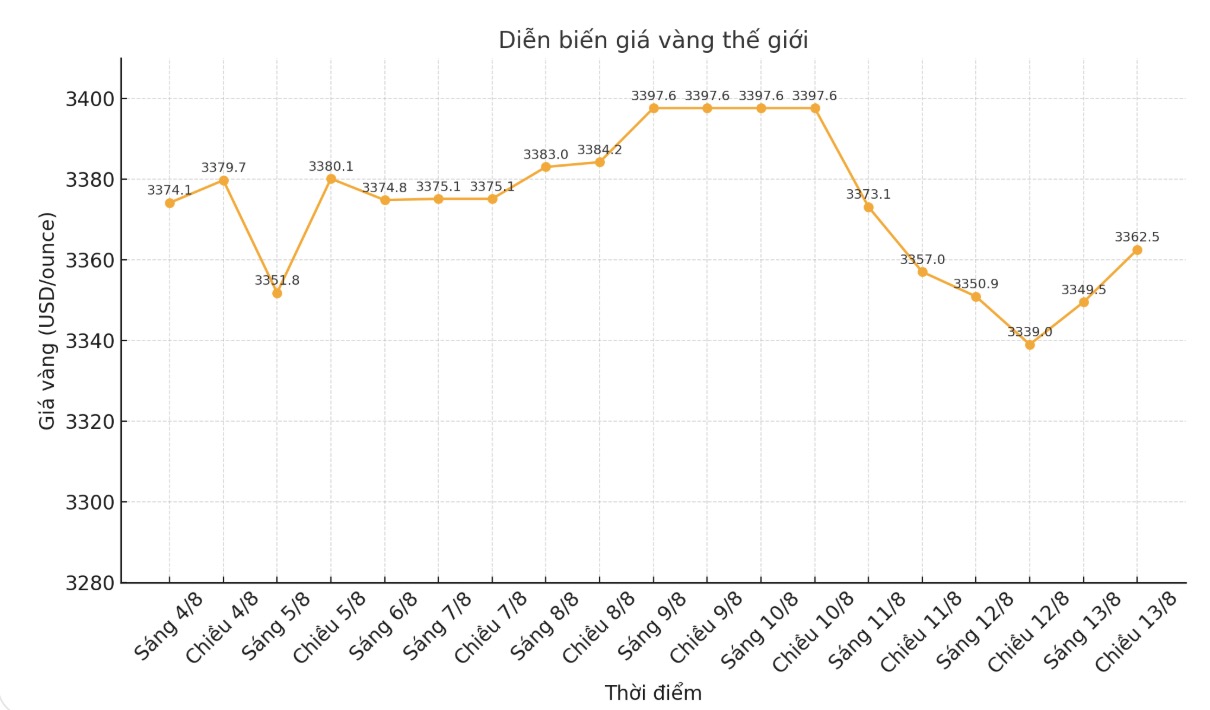

Gold prices increased in the fourth session as expectations of the US Federal Reserve (FED) cutting interest rates in September increased after the data of dovish inflation, while the weakening of the USD boosted demand for this precious metal.

Spot gold prices increased by 0.3% to $3,354.77/ounce at 08:02 GMT. US December gold futures increased 0.1% to $3,403.20/ounce.

Investors are starting to debate whether the Fed will implement a 50 basis point cut at its September meeting, following the comments of US Treasury Secretary Bessent yesterday, focusing on the upcoming weak US economic data supporting this view, said UBS commodity analyst Giovanni Staunovo.

The market is now pricing in a more than 90% chance of a Fed rate cut next month, after July's slight inflation showed a limited impact of US import taxes on consumer prices, and it is expected that there will be at least one more rate cut before the end of the year.

Gold an unying asset, often seen as a safe haven in times of economic or geopolitical uncertainty often benefits in a low-interest-rate environment.

The USD (.DXY) hit a two-week low, making gold priced in greenback cheaper for overseas buyers.

Mr. Tim Waterer - Head of Market Analysis at financial services company KCM Trade - commented that the weakness of the USD has created conditions for a slight recovery in gold prices, with this precious metal fluctuating around 3,350 USD/ounce ahead of the meeting between the heads of the two countries Russia and the US on August 15.

The analyst added that if the meeting fails to resolve the issue and the conflict in Ukraine continues, gold may once again move towards the $3,400/ounce mark. Gold is often considered a safe investment channel in the context of many political and financial uncertainties.

European and Ukrainian leaders held online talks with US President Donald Trump on Wednesday, ahead of his summit with Russian President Vladimir Putin, to highlight the risks of bargaining Ukraine's interests for a ceasefire.

Dont expect these discussions to have a significant impact on the gold market, but they can cause short-term volatility. In the short term, gold prices are likely to move sideways until upcoming US economic data supports a faster Fed rate cut cycle, Gioved Staunovo added.

Meanwhile, the US and China have extended the tariff ceasefire by 90 days to avoid imposing three-digit tariffs on each other's goods.

In other precious metals markets, spot silver rose 1.3% to $38.39 an ounce, platinum rose 0.8% to $1,346.05, and gold rose 0.4% to $1,133.72/ounce.

See more news related to gold prices HERE...