Precious metals analysts at Heraeus said that although gold has not increased sharply since its peak in April, demand from central banks is still holding gold prices high, while cash flow into ETFs shows that investors expect silver prices to continue to increase. platinum, after a recent spike, may have hit a near-term peak.

In the latest updated report, experts said that central banks are still playing a solid role as a "support" for gold demand.

In May 2025, central banks net bought 20 tons of gold. Kazakhstan, Turkey and Poland are the leading countries in terms of purchases. Although the buying rate has slowed somewhat, the sentiment is still very optimistic 95% of central banks surveyed expect global gold reserves to continue to increase, and 43% plan to increase their own reserves, a record high.

This reflects a structural shift in reserve management, with a shift away from the US dollar and increasing the role of gold as a hedge against geopolitical risks and inflation, the report said.

Over the past three years, central banks have added more than 1,000 tonnes of gold per year, far exceeding the long-term average. Experts say: This could be one of the factors driving gold prices, even if the correlation between gold and other assets is broken.

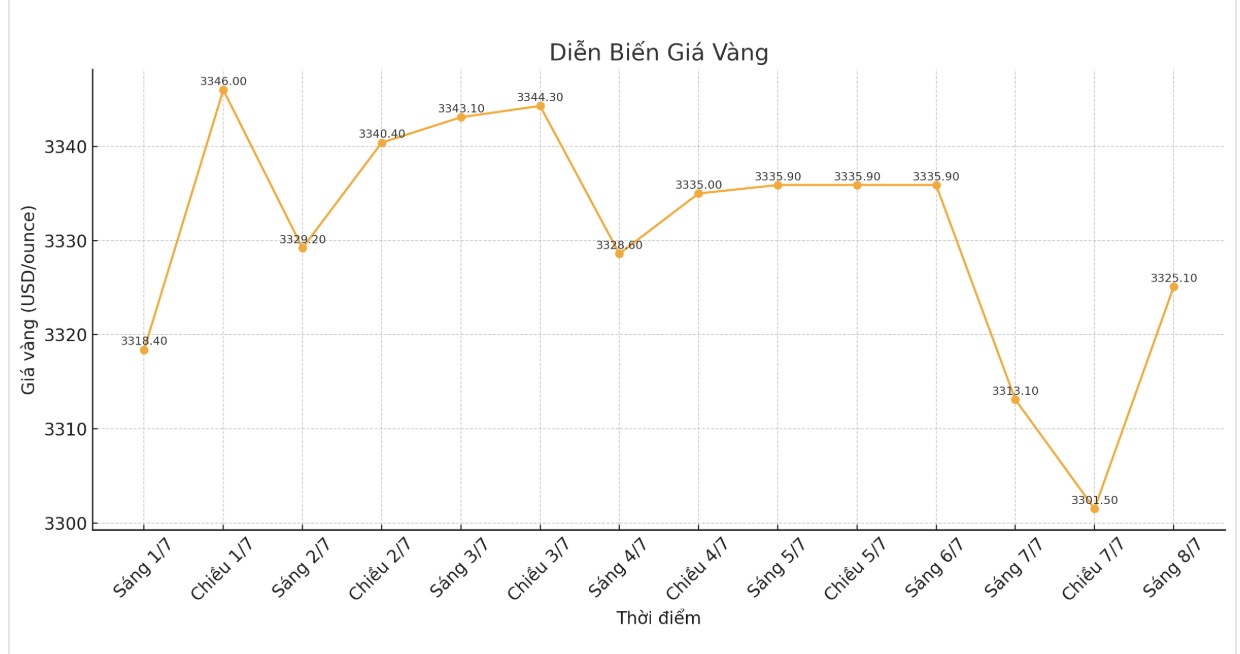

For example, gold and US 10-year government bond yields used to have a strong correlation, until central banks began to increase buying. Over the past 18 months, bond yields have fluctuated mainly between 3.5%-5.0%, while gold prices have increased from $ 2,000/ounce to about $ 3,400/ounce. It is forecasted that in the remainder of 2025, gold purchases by central banks, especially from emerging countries, will continue to be an important support for gold prices".

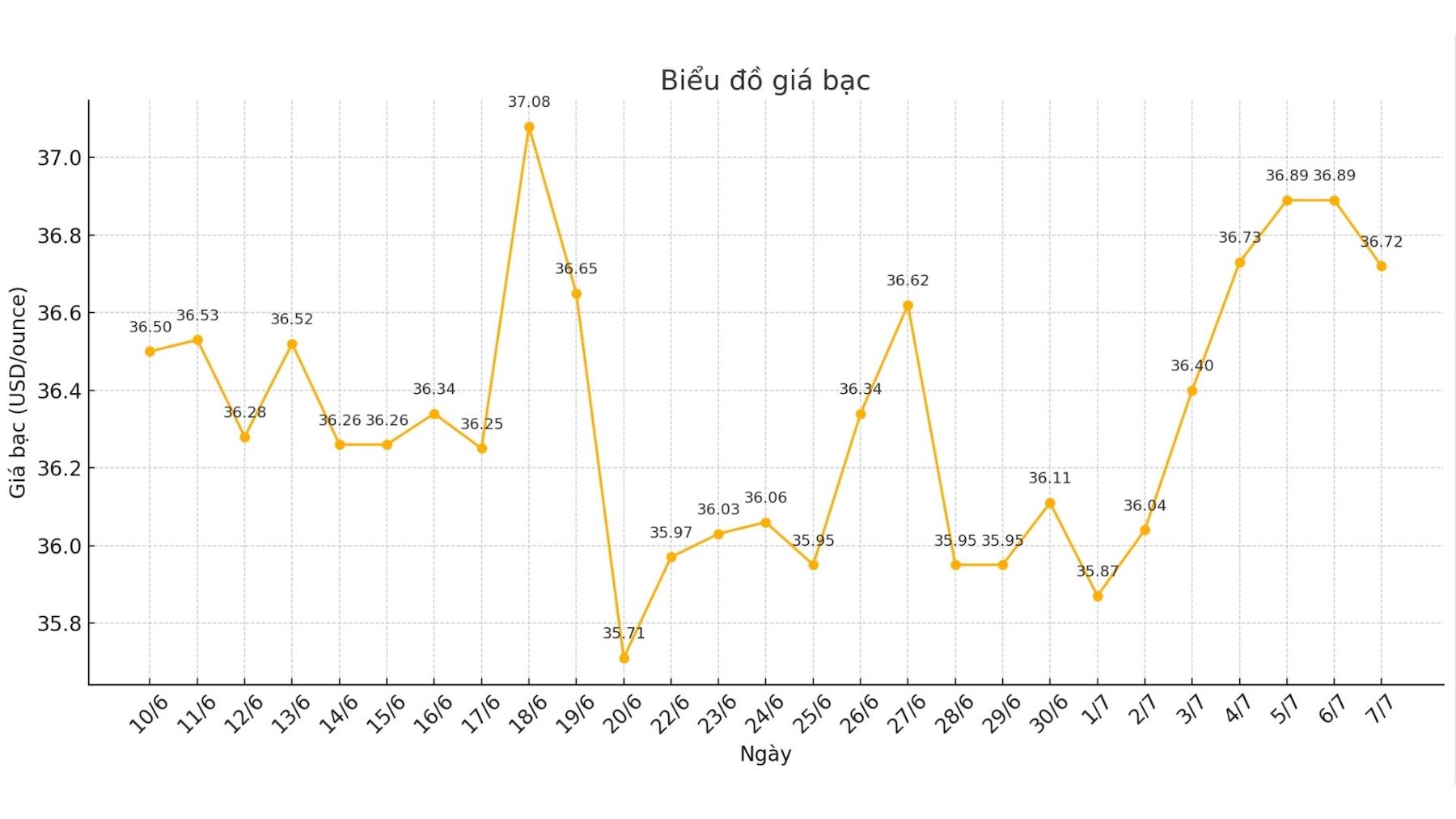

For silver, Heraeus analysts said investors still see value in this metal. From the beginning of June to July 4, net capital flows into silver ETFs reached 990 tons. Most of the capital flow came from the price increase in the first half of the month (+509 tons), followed by opportunities when silver prices stabilized above the threshold of 36 USD/ounce.

From June 14 to now, an additional 426 tons have been net poured into silver ETFs. Thus, within just one month, this investment has accounted for more than 50% of the total net capital flow since the beginning of the year. As a result, the total amount of silver held by the funds has risen to more than 24,000 tons the highest level since August 2022 the report said.

As of last weekend, the total assets of silver ETFs reached 28.5 billion USD. Silver is still priced lower than gold (gold/silver ratio is 90.3). If silver prices continue to rise, ETFs could continue to flow in, as investors bet that this rate will return to a 10-year average of 80.2 experts said.

On platinum, Heraeus said manufacturers are looking to cut costs to increase profits.

Last week, Impala platinum officially merged the operations of Impala and Royal Bafokeng platinum (RBP) in South Africa, after the acquisition of RBP in 2023. The goal is to effectively utilize the two border mines to reduce production costs.

In the second half of 2024, RBP's exploitation axes have made a profit, thanks to a 2% cost reduction compared to the same period, through cost control and labor restructuring. In Impala, lower-than-average labor costs also help control costs, although inflation in the mining sector still causes total costs to increase compared to last year, the report said.

With the adjacent location of the two mining areas, more optimal exploitation and more effective ore mixing in the ore collection phase can help continue to reduce costs. Recent increases in platinum price in South Africa have also helped improve short-term profits and reduce pressure on the most expensive mines.

platinum has risen for five consecutive weeks, and last week reached its highest closing price in this recovery - $1,394/ounce. The price process is quite fluctuating, sometimes fluctuating up to 50 USD/ounce per day. The RSI index is showing signs of price differentiation, showing that the market is likely to enter a prolonged accumulation phase after a rapid increase" - the report wrote.