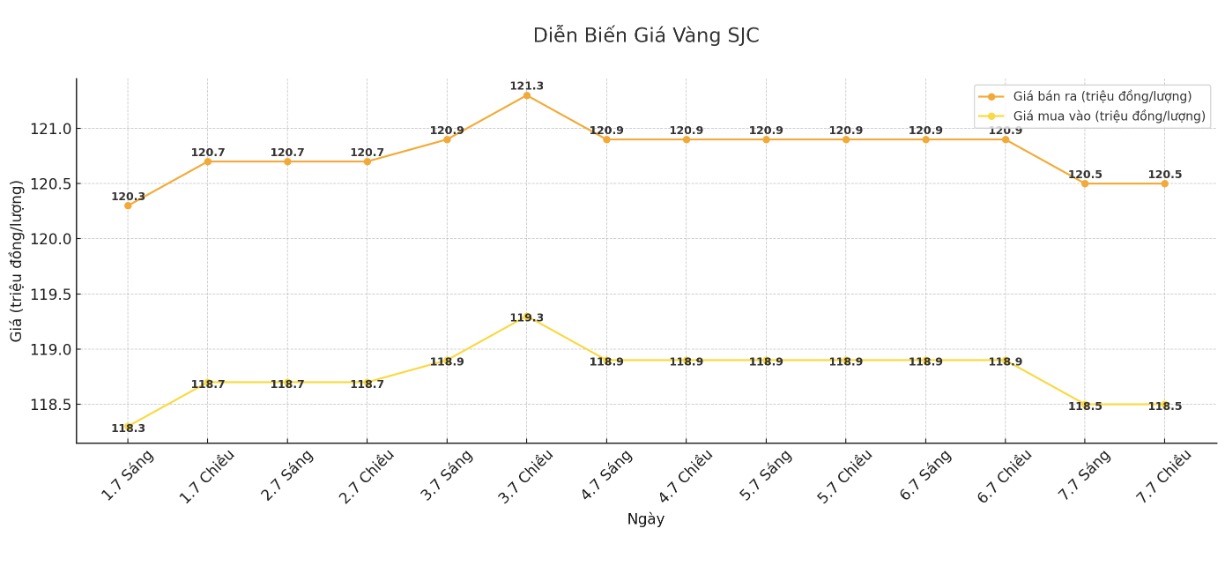

SJC gold bar price

As of 6:45 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out); down VND 400,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.5-120.5 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.8-120.5 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

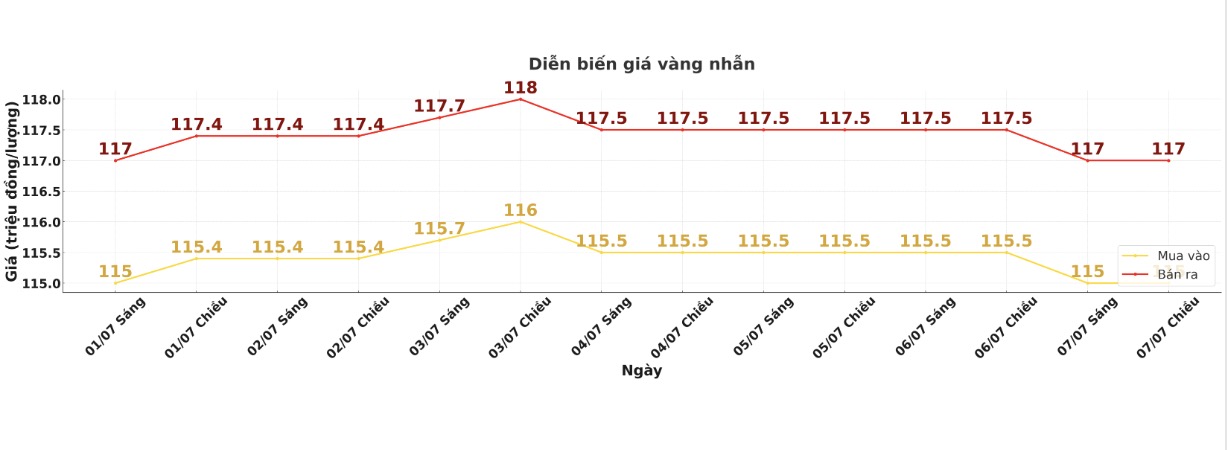

9999 gold ring price

As of 6:50 p.m., DOJI Group listed the price of gold rings at VND115-117 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.2-118.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.9-116.9 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

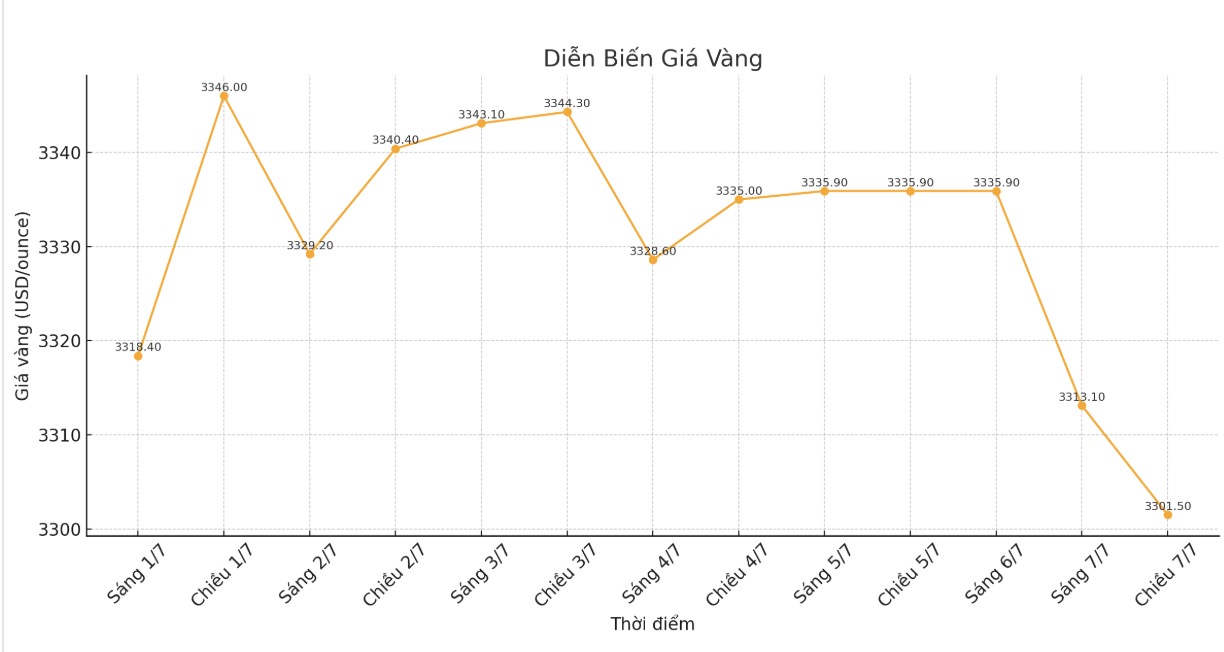

World gold price

The world gold price was listed at 6:51 p.m. at 3,301.5 USD/ounce, down sharply by 33.4 USD/ounce compared to 1 day ago.

Gold price forecast

This afternoon (July 7), world gold prices have fallen to a nearly weekly low. The reason for this move is the increase in the USD, in the context that investors are waiting for detailed information about trade before the tax deadline of US President Donald Trump.

Nitesh Shah - commodity strategist of WisdomTree, commented: "We are witnessing a slight correction due to the short-term increase of the USD, which could come from the strong US economic data, making the need for immediate interest rate cuts not really urgent".

Sean Lusk believes that cutting interest rates at this time could push up living expenses and recreate the inflation problem that the US Federal Reserve (FED) wants to solve. He also pointed out that part of the downward pressure comes from concerns about the real estate market, which is struggling due to high borrowing costs.

Regarding gold prices, Lusk assessed that the precious metal is being overbought above the threshold of 3,300 USD/ounce and is likely to adjust to the range of 3,123 - 3,225 USD, although the long-term trend is still positive. He predicted that any price decline will be temporary and gold prices will continue to increase in 2025, especially as the market gradually becomes more certain about trade agreements and economic policies.

On the contrary, Adrian Day - Chairman of Adrian Day Asset Management, said that gold prices will face correction pressure. There is a possibility of a series of negative factors appearing together, including a number of tariff agreements and increased speculation about the FED cutting interest rates in July in the context of slowing gold purchases by central and Chinese banks outside the official market. However, any adjustment could be shallow and short-term," he said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...