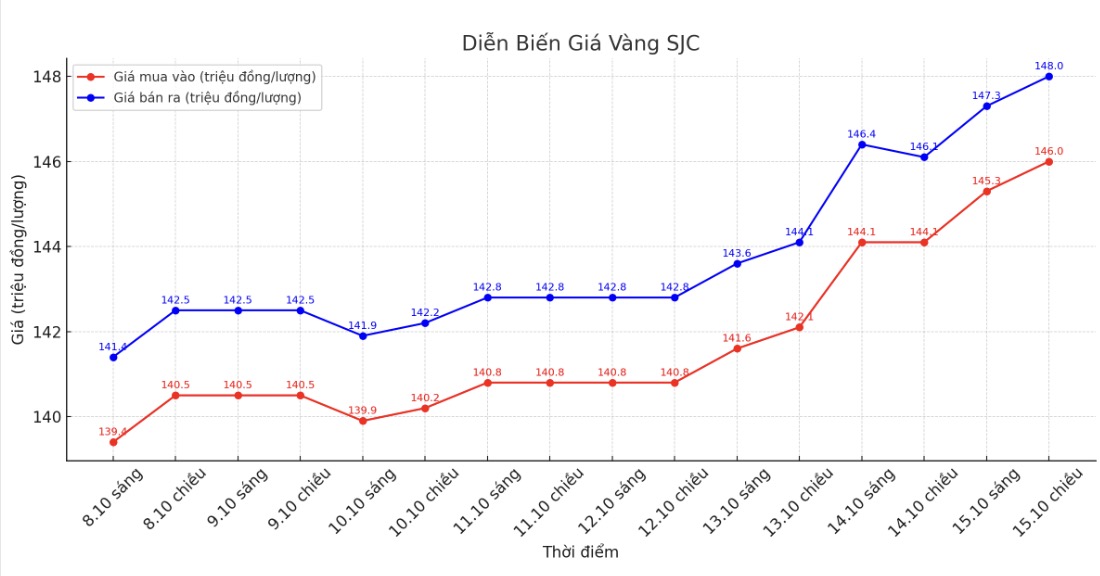

SJC gold bar price

As of 6:45 p.m., DOJI Group listed the price of SJC gold bars at 146-148 million VND/tael (buy in - sell out), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146-148 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.4-148 million VND/tael (buy - sell), an increase of 1.9 million VND/tael in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

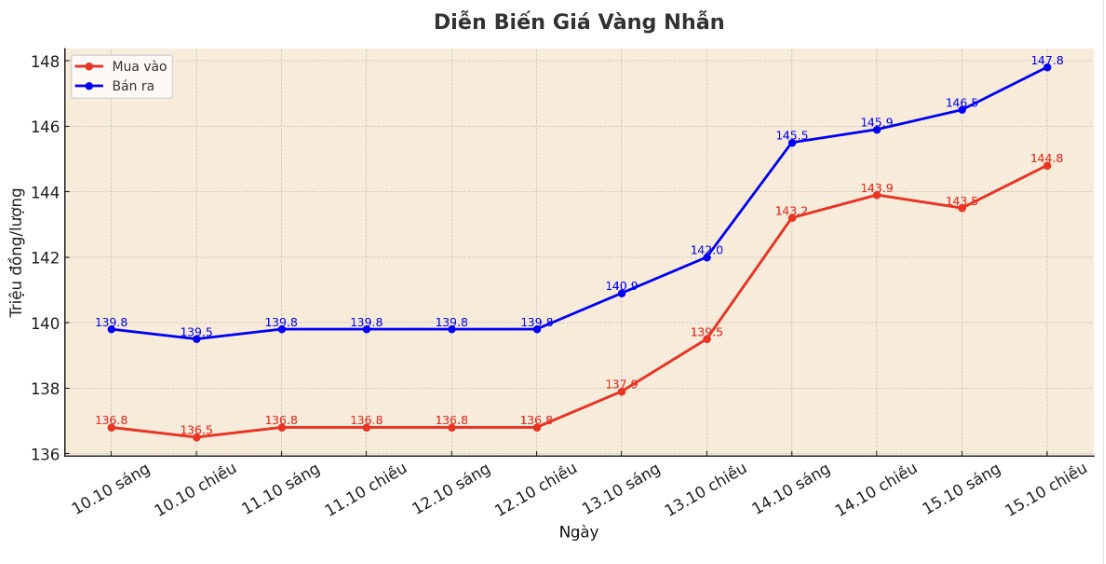

9999 gold ring price

As of 6:45 p.m., DOJI Group listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), an increase of 900,000 VND/tael for buying and an increase of 1.9 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.3-152.3 million VND/tael (buy - sell), an increase of 5.7 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 144.8-147.8 million VND/tael (buy - sell), an increase of 1.8 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

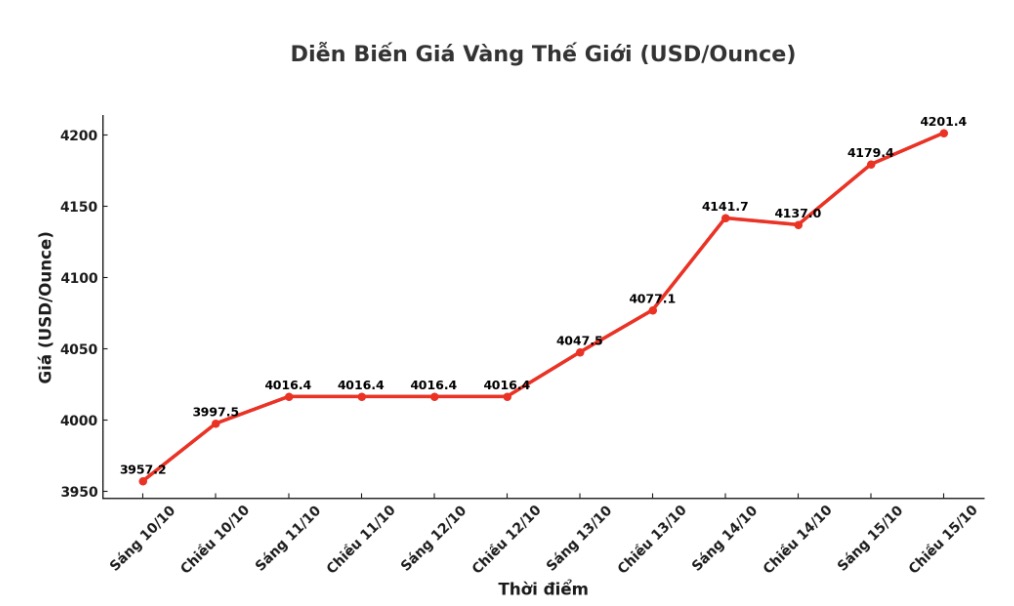

World gold price

The world gold price was listed at 6:45 p.m. at 4,201.4 USD/ounce, up 64.4 USD compared to a day ago.

Gold price forecast

Gold broke the key psychological threshold of $4,200/ounce on October 15, fueled by expectations that the US Federal Reserve (FED) will continue to cut interest rates, while new concerns about US-China trade have increased safe-haven demand.

US President Donald Trump said his administration is expected to announce on Friday a list of Democratic programs that will be closed as the federal government stops operating.

Matt Simpson, senior analyst at StoneX, said: Following the US government shutdown and loose comments from Fed Chairman Jerome Powell, gold continues to have more reasons to accelerate.

Mr. Powell said that the US labor market is still weak, although the economy "may be on a more solid trajectory than expected". The Fed will make interest rate decisions at each meeting, balancing the weakness of the labor market and persistent inflation on target.

Investors are now almost certain that the Fed will cut interest rates by 0.25 percentage points in both October and December. Gold often benefits in a low interest rate environment and periods of political and economic instability.

Since the beginning of the year, gold has increased by 59%, supported by a series of factors such as geopolitical and economic instability, expectations of the FED lowering interest rates, strong demand from central banks, the trend of de-dollarization and large capital flows into gold ETFs.

The current rally in gold has also become a game in a hand, as investors rush to buy for fear of missing out on opportunities, Trump added.

President Trump also said that Washington is considering cutting some trade relations with China, including the oil sector. The two countries began imposing tariffs in retaliation against each other on October 14.

The International Monetary Fund (IMF) has just raised its global growth forecast for 2025, saying that financial and trade conditions will improve, but warned that US-China trade tensions could hold back the recovery.

Notable economic data next week

Tuesday: FED Chairman Jerome Powell attends a discussion at the National Association for Business Economics (NABE) Annual Meeting.

Wednesday: New York FED manufacturing survey.

Thursday: survey of FED Philadelphia's business performance.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...