Last week will probably be repeated by investors for a long time, as the world gold market witnessed rarely seen violent fluctuations: prices increased sharply, continuously breaking historical records, before suddenly reversing to a deep decrease at an unprecedentedly fast pace in recent years. However, closing the whole trading week, gold prices only decreased by about 2.64% compared to the beginning of the week.

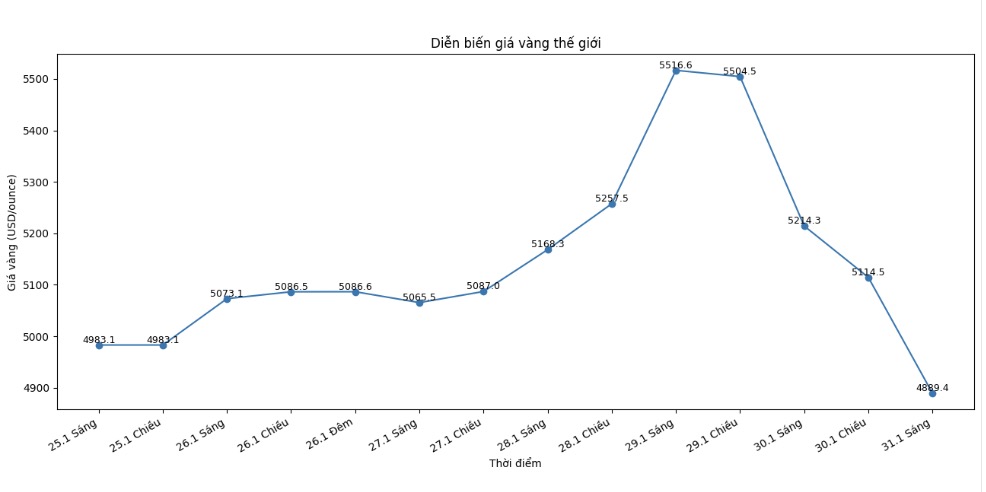

At the beginning of the week, spot gold prices stood at 5,021.97 USD/ounce. In the early sessions, it was quite quiet, gold fluctuated in the range of about 60 USD, around 5,000 - 5,100 USD/ounce. Even, right after the North American stock market closed on Monday, the price retreated to test the support level of 5,000 USD/ounce before recoiling.

A real turning point appeared on Tuesday afternoon. Before 3 pm (Eastern US time), gold surpassed the 5,100 USD/ounce mark and in just over an hour it jumped to 5,185 USD. In the Asian session, the excitement did not decrease: from around 5,170 USD/ounce, the price continued to climb straight, approaching the 5,300 USD/ounce mark in the early morning of Wednesday.

On Wednesday morning, the market temporarily stagnated as investors held their breath waiting for the interest rate decision of the US Federal Reserve (Fed). The Fed kept interest rates unchanged as predicted, but that did not stop the "craze" of gold prices.

When Fed Chairman Jerome Powell entered the press conference at 2:30 PM, gold was around 5,310 USD/ounce; just one hour later, this number increased to 5,384 USD. At the end of the session, gold broke again, easily surpassing the 5,500 USD/ounce mark to reach 5,531 USD at around 6:30 PM.

Real fluctuations exploded overnight. Before midnight, gold set a new historical peak at 5,600 USD/ounce, then quickly turned down to 5,483 USD/ounce in the early morning of Thursday. After a short recovery, the price tried to re-attack the old peaks before the opening of the North American market, but failed.

This failure led to an "unstoppable" drop. In just over an hour, from 9:15 am to 10:30 am on Thursday, gold prices plummeted from 5,544 USD/ounce to 5,124 USD/ounce. However, bottom-fishing demand was also no less fierce: by 11:15 am, gold had returned to the 5,300 USD/ounce zone, then continued to climb to 5,370 USD/ounce at 12:30 pm and approached 5,450 USD/ounce in the evening.

However, market sentiment has become extremely fragile. Failing to hold the 5,400 USD/ounce mark after 8 pm caused the price to quickly slip below 5,200 USD/ounce, opening a new sell-off wave. In the early morning of Friday, gold fell through the 5,000 USD/ounce mark. The subsequent waves of recovery became weaker, showing that sellers are dominating.

The decisive "break" occurred after 11 am on Friday, pulling gold prices to the bottom of the week at 4,679.51 USD/ounce in the early afternoon. The subsequent recovery efforts could not bring gold back to the 5,000 USD/ounce mark. At the end of the week, gold fluctuated in the range of 4,889.4 USD/ounce, closing one of the most extreme trading weeks in the history of the precious metals market.

See more news related to gold prices HERE...