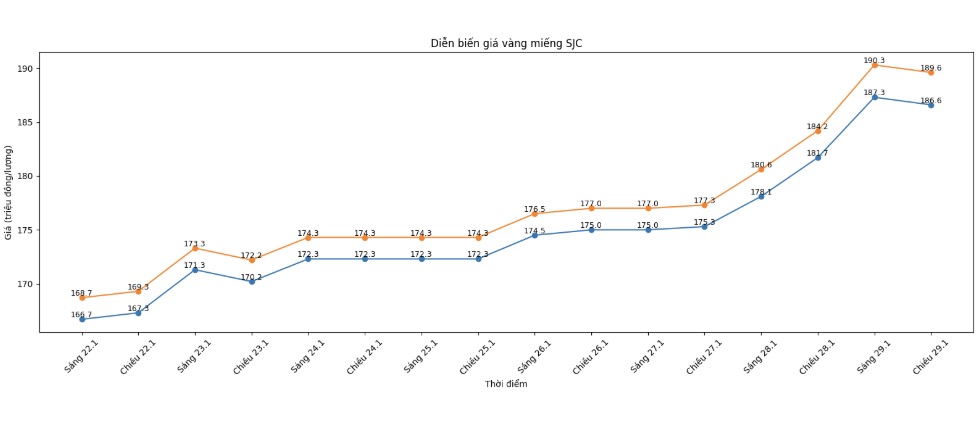

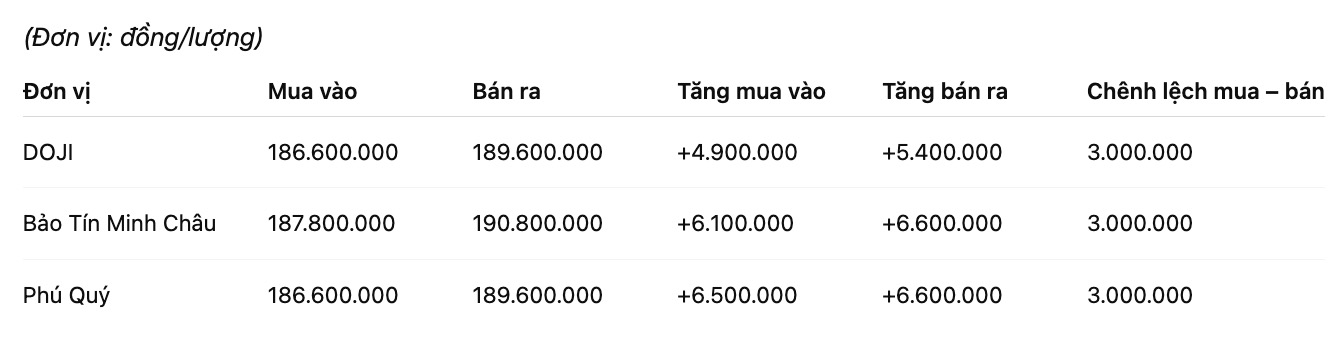

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 186.6-189.6 million VND/tael (buying - selling), an increase of 4.9 million VND/tael on the buying side and an increase of 5.4 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 187.8-190.8 million VND/tael (buying - selling), an increase of 6.1 million VND/tael on the buying side and an increase of 6.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 186.6-189.6 million VND/tael (buying - selling), an increase of 6.5 million VND/tael on the buying side and an increase of 6.6 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 3 million VND/tael.

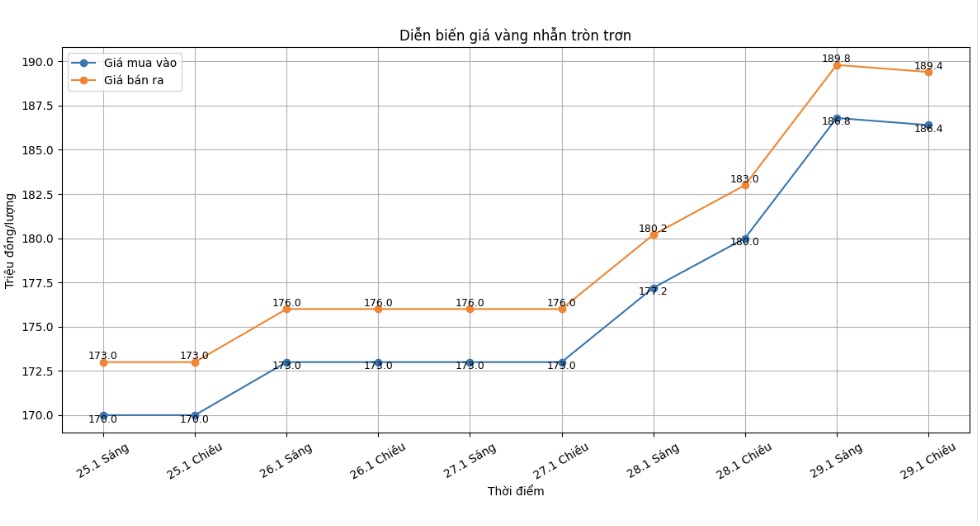

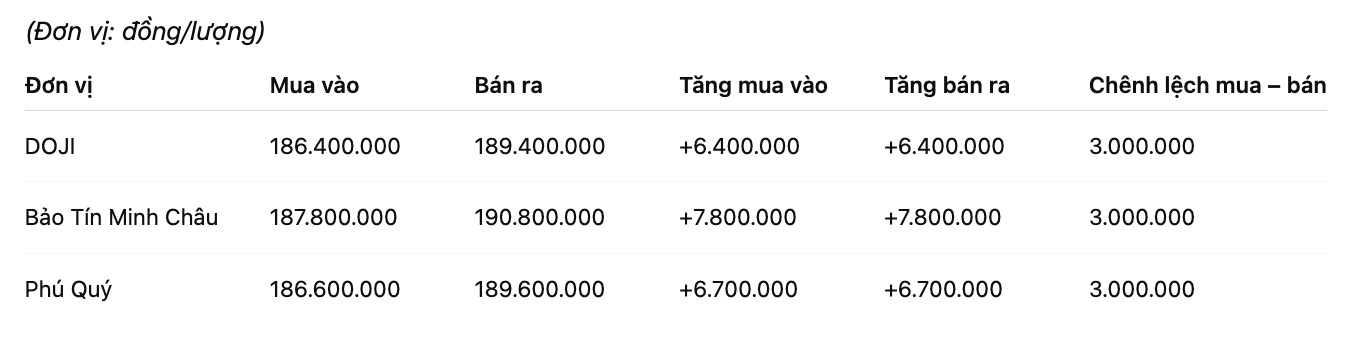

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 186.4-189.4 million VND/tael (buying - selling), an increase of 6.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 187.8-190.8 million VND/tael (buying - selling), an increase of 7.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 186.6-189.6 million VND/tael (buying - selling), an increase of 6.7 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

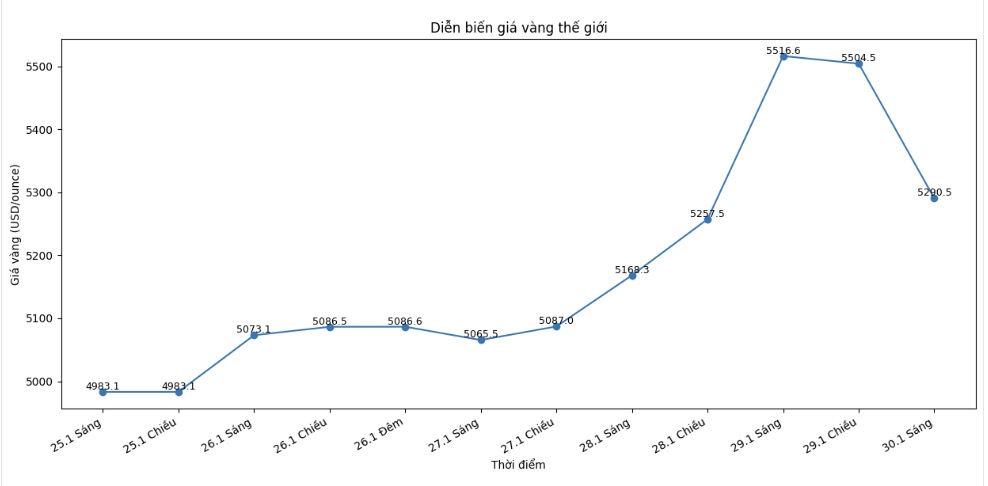

World gold price

At 2:33 AM, world gold prices were listed around the threshold of 5,290.5 USD/ounce, down 123.5 USD.

Gold price forecast

After setting a new historical peak, world gold prices suddenly turned down sharply in the most recent session, marking a remarkable correction after a long hot streak. Selling pressure mainly came from short-term profit-taking activities of speculators, in the context that gold prices have increased rapidly and continuously surpassed record levels. The fact that the precious metal has fallen nearly 50 USD/ounce in a short time shows that cautious sentiment is returning to the market.

According to analysts, this decline carries more technical factors than the change of supporting platforms. In the context of escalating geopolitical tensions, especially unpredictable developments in US-Iran relations, the need for safe haven is still present. At the same time, the risk of the US government falling into a state of shutdown if the parties do not reach a budget agreement also increases the defensive mentality of global investors.

In addition, the money market still has many potential fluctuations. The USD weakened after mixed signals from the US government on monetary policy and exchange rates, while US bond yields have not shown a clear stable trend. These factors continue to create support for gold in the medium and long term, despite short-term corrections.

From a longer-term perspective, many experts believe that gold's upward momentum is no longer temporary. Mr. Joseph Cavatoni - senior market strategist at the World Gold Council - said that gold's breakthrough in 2025 has changed the market's perception of this precious metal. According to him, gold is being repositioned as a core asset in the investment portfolio, instead of just a cyclical speculative tool.

Data shows that investment capital flows, especially through gold ETF funds, are still maintained at a high level even when prices have peaked. This reflects investors' long-term confidence in the context of the world facing prolonged geopolitical risks, increased public debt and the decline in the defense role of bonds.

Analysts believe that gold prices may continue to fluctuate in the short term as profit-taking pressure has not completely ended. However, if global instability factors have not been removed, the upward trend of gold is assessed not to have ended and this precious metal is likely to maintain a high price level in 2026.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...