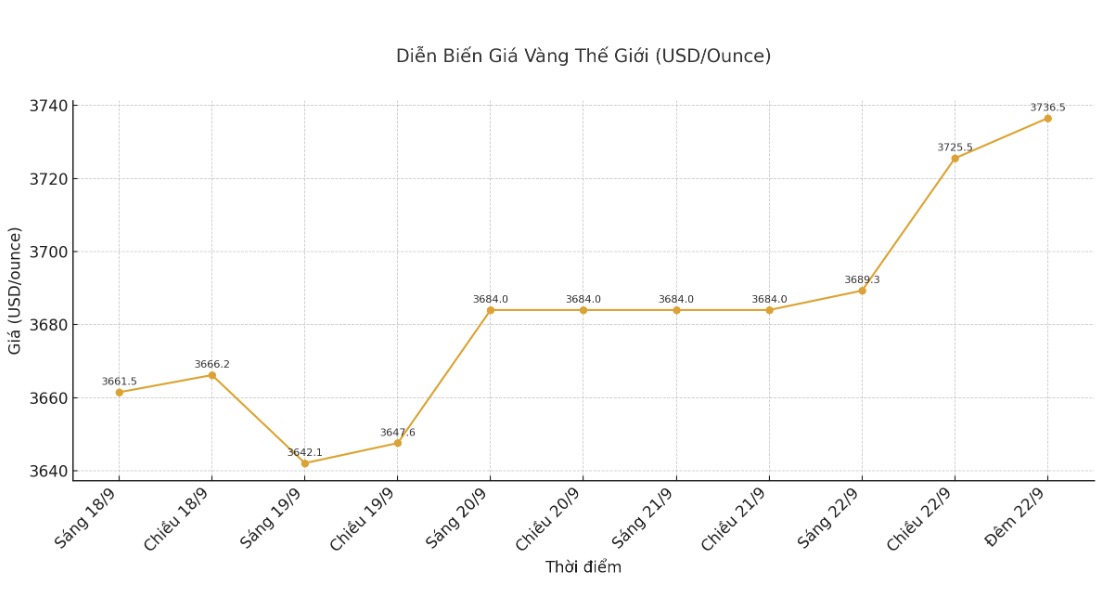

World gold prices last night increased beyond the 3,735 USD/ounce mark, double compared to the end of 2022. The increase is expected to continue thanks to many factors.

The strong buying wave from central banks and large investment demand, reflected in capital flows into physical gold ETFs, is considered the main driver.

In addition, the increase was driven by the overturned Western security policy under US President Donald Trump, trade wars and concerns about the Fed's independence.

How do central banks buy gold?

According to consulting firm Metals Focus, from 2022 to now, each year, central banks have net bought more than 1,000 tons of gold. In 2025, this figure is expected to be about 900 tons, double the average of 457 tons/year in the 2016-2021 period.

Several developing countries seek to diversify away from the US dollar after the West froze nearly half of Russia's foreign exchange reserves in 2022.

The World Gold Council (WGC) said that the official report to the IMF only accounts for 34% of total estimated demand in 2024 and the group contributes 23% of total global gold demand for the period 2022-2025, double the average of the 2010 decade.

Will the demand for jewelry continue to plummet?

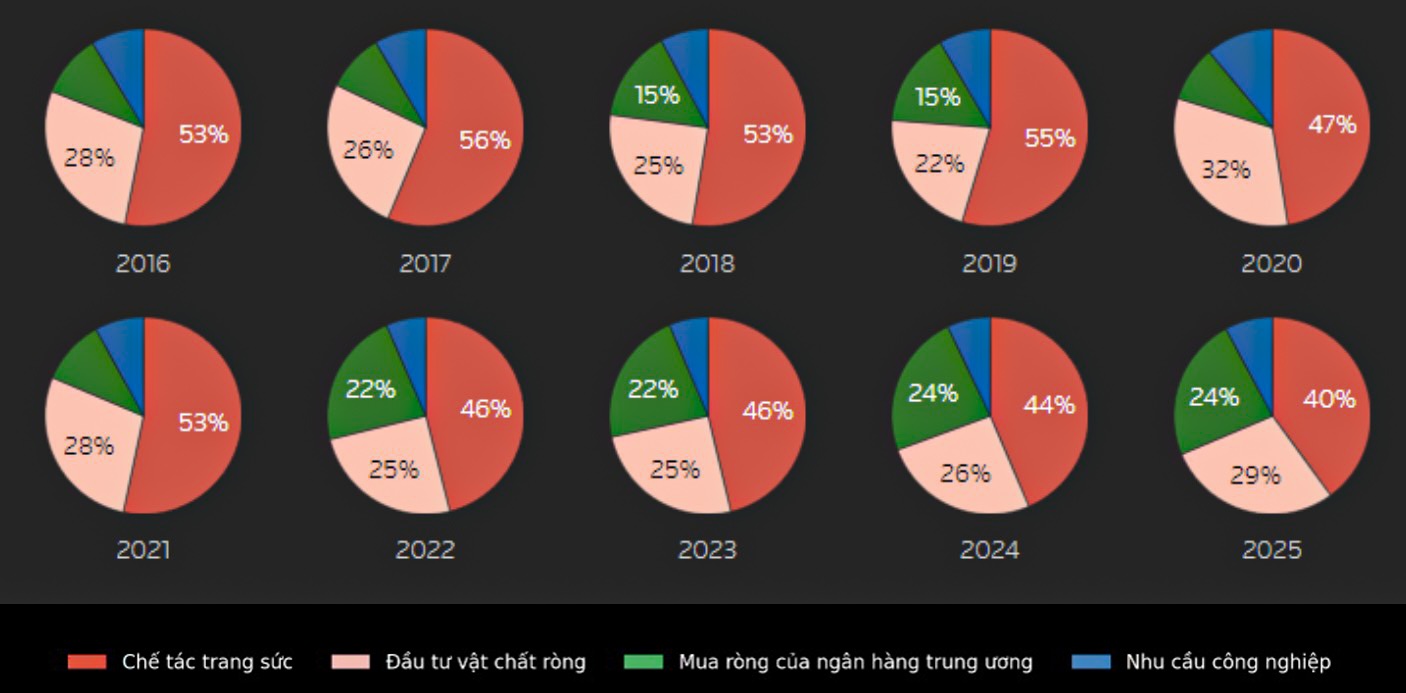

Demand for gold jewelry - the largest source of physical demand - decreased by 14% to 341 tons in the second quarter of 2025, the lowest since the third quarter of 2020 due to high prices, making buyers hesitant.

China and India, the two largest markets, for the third time in five years, have a market share of less than 50%. Metals Focus estimates that gold jewelry production will decrease by 9% in 2024 and may decrease by another 16% this year.

Personal investors still favor gold bars and coins?

Product tastes in retail investment have changed sharply, but total demand is still high. According to the WGC, demand for gold bars will increase by 10% in 2024 while buying coins will decrease by 31%, and this trend will continue in 2025.

Metals Focus forecasts a 2% increase in net material investment to 1,218 tons thanks to Asia still expecting high prices.

Will gold ETFs attract more capital?

Gold ETFs are playing an increasingly important role, recording a capital flow of 397 tons in the first half of 2025, the highest since 2020. Total gold holdings reached 3,615.9 tons at the end of June, the highest since August 2022, just five years behind the record of 3,915 tons.

Metals Focus predicts that net capital flow into ETP funds in 2025 will reach 500 tons, after recording 7 tons of net withdrawals in 2024.

See more news related to gold prices HERE...