Gold prices ended the week with a solid increase, continuing to hold above 3,300 USD/ounce. However, Thorsten Polleit - Distinguished Professor of Economics at Bayreuth University and publisher of the Boom & Bust Report said that he did not rule out the possibility of gold having further adjustments.

He noted that gold is still caught amid growing concerns about the risk of an upcoming recession and a relatively sustainable US economy and labor market.

Any short-term economic improvement or announcement of new trade deals could push gold prices down to $3,000/ounce.

However, he emphasized that any short-term price decline should be viewed as a buying opportunity, as the long-term upside potential of gold remains firm.

He said gold prices could rise as investors begin to lose confidence in US government bonds due to unsustainable public debt levels.

Doubts about the US government's reliability increased sharply last week after Moody's lowered its US government debt rating from Aaa to Aa1. At the same time, the organization changed the US outlook from negative to stable.

An unsuccessful midweek 20-year bond auction also showed investors' growing concerns about holding US debt.

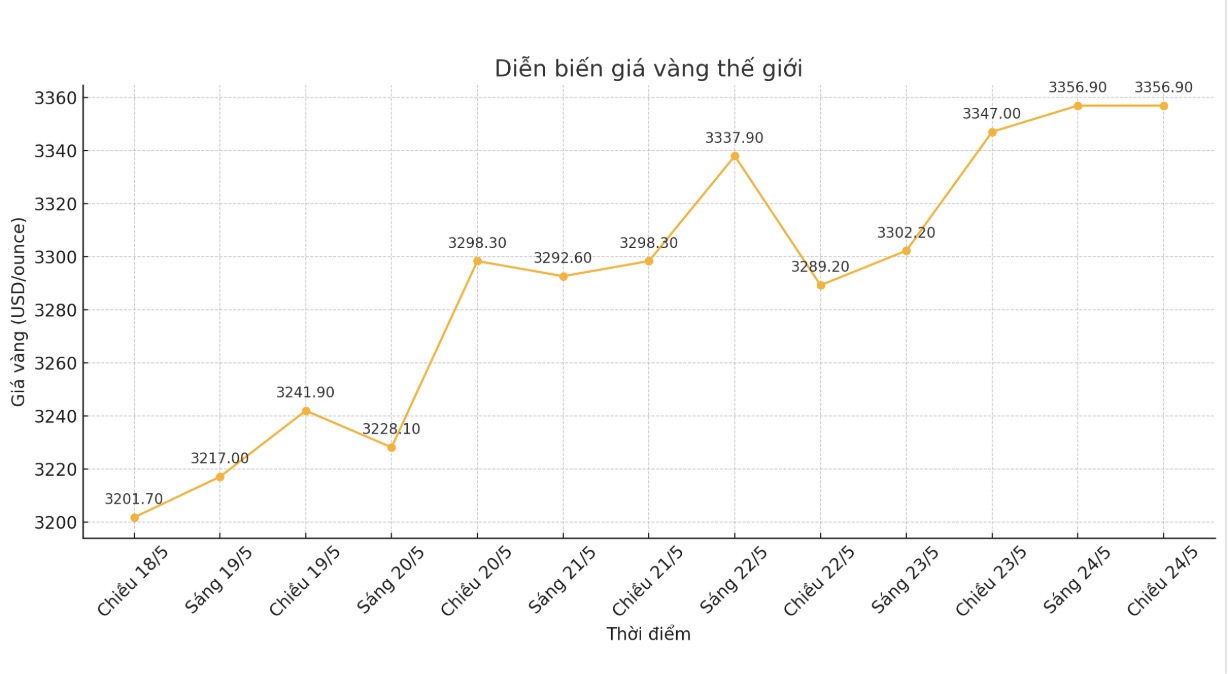

These two events further highlight gold's upside potential as prices have regained above $3,300/ounce.

Polleit said the economy is starting to be affected by decades of uncontrolled spending, as rising public debt slows growth and stimulates inflation. He explained that the US is currently in a difficult situation with no way out.

If the US Federal Reserve (FED) maintains a neutral monetary policy to cope with high inflation, rising interest rates could push the economy into deep recession.

Conversely, if the Fed cuts interest rates to reduce bond yields, this could stimulate inflation, reduce real yields and reduce the opportunity cost of holding non-interest-bearing gold.

When risks accumulate, gold is an asset that investors need to own, the expert said.

Although prolonged economic uncertainty and persistent inflation are still a supporting factor for gold, Polleit admitted that some investors may be hesitant when gold prices are at a high level.

However, he said that although popular investors can be cautious, he is closely monitoring the formal sector and expects central banks to continue buying gold in the current context.

He added that central bank demand could keep gold in support around $3,000 an ounce.

Polleit said the current accumulation period of gold is an opportunity for investors to evaluate the precious metal before they can enter the next rally.

Investment demand has increased, but is still not at the peak of 2020. The story in this context is that gold is on the uptrend, and investors have the opportunity to optimize their portfolios to determine the role of gold, he said.