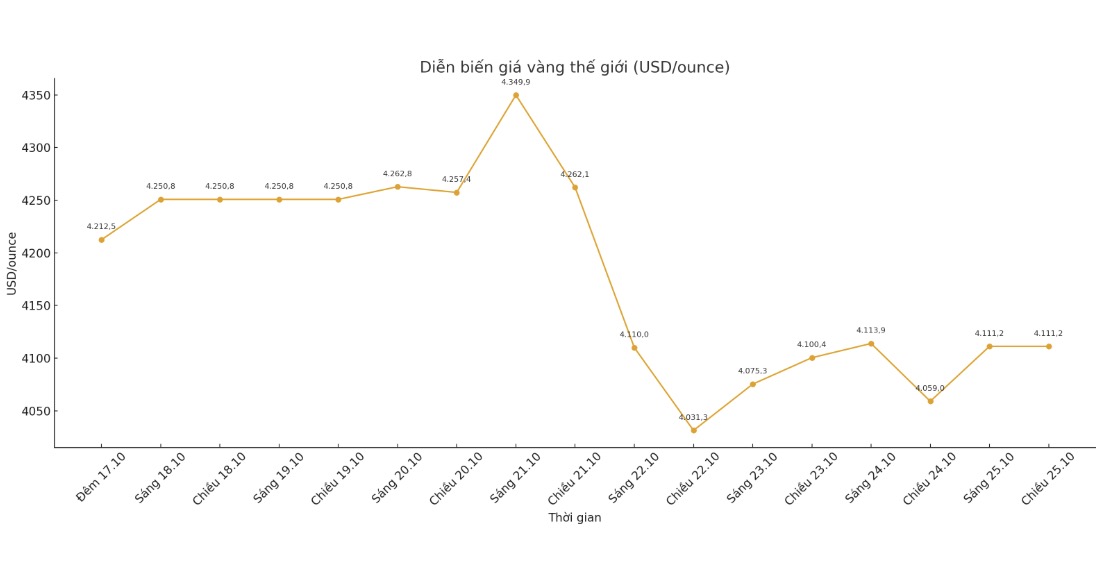

The precious metals market has recorded outstanding profits over the past two years, with gold and silver prices increasing by about 149% since October 2023.

Notably, half of this strong increase has occurred in just the past two months, reflecting the heat of money flowing into precious metals. However, the increase has slowed down since the beginning of the week as gold and silver entered a technical correction that was assessed as healthy.

The decline helped silver prices retreat to a 38% Fibonacci retracement threshold, while gold also approached the same level. These calculations are based on price movements in 61 trading sessions from August 20 to October 20, a period in which both metals have continuously increased for nine consecutive weeks - an extremely rare achievement in the commodity market.

In history, gold has only recorded a 9-week increase streak of three times since 1978 and this is the fourth time in nearly half a century. In particular, there has never been a time when gold has extended its increase streak to 10 weeks without appearing a week down.

Historical data also shows that after long periods of increase, gold prices often adjust slightly in the short term. According to research by market analyst Eric L., with 25 years of experience, profit rates in the weeks after the increase chain ends often have a negative tone due to profit-taking pressure.

In the following 1 to 20 weeks, gold prices tended to decrease with a probability of ranging from 82% to 100%, before returning to a more balanced state in the medium term.

Meanwhile, macroeconomic factors continue to affect investor expectations. The US Consumer Price Index (CPI) report for September showed inflation rose 3% year-on-year, slightly below the forecast of 3.1%. This figure helps the market to somewhat reduce concerns about the risk of escalating prices.

However, expectations for the Federal Reserve's monetary policy have remained almost unchanged.

The CME FedWatch tool shows that the probability of the Fed cutting interest rates by 0.25 percentage points at next week's meeting will only decrease slightly from 98.3% to 96.7% after the inflation data was released.

According to analysts, the current adjustment mainly reflects profit-taking and technical pressure rather than changes in fundamental factors. After the hot increase, the price "slowing down to create a foundation" is considered necessary to maintain a sustainable uptrend.

The long-term outlook for precious metals remains positive amid expectations of monetary policy easing, persistent inflation and investors' un Cooled demand for value.

Experts say this correction could become a buying opportunity for long-term investors, but also emphasize the need to be cautious with short-term fluctuations as history shows that the market often tends to decline after long-term upward chains.

See more news related to gold prices HERE...