US consumption surges

The US Department of Commerce announced that retail sales in November increased by 0.6%, reversing the 0.1% decrease in October and exceeding economists' forecast of 0.4%. In 12 months, US retail increased by 3.3%, higher than the expected level of 3%.

Notably, core retail sales (excluding cars) also increased by 0.5%, showing that US consumer spending remains quite stable, despite high interest rates.

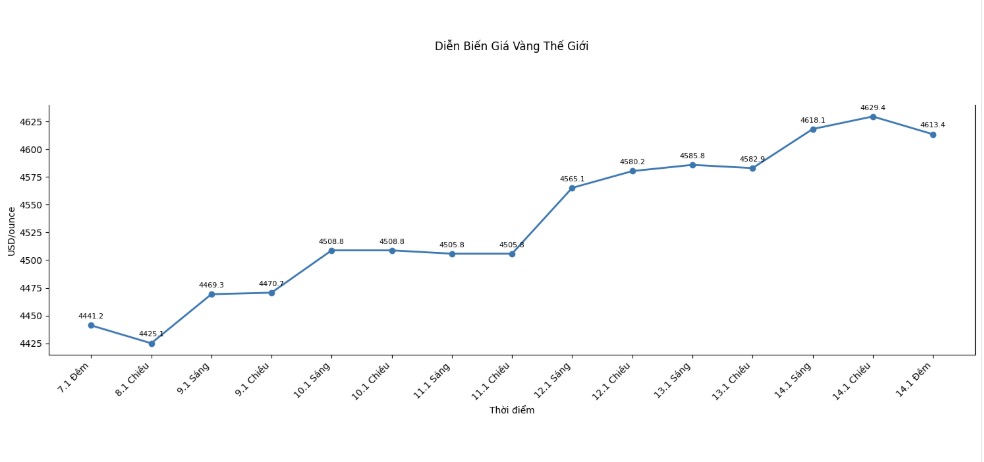

Usually, strong consumer data can put downward pressure on gold prices due to reducing expectations of monetary easing. However, the gold market is hardly negatively affected, continuing to maintain around the 4.630 USD/ounce range.

US housing boom

At the same time, the US real estate market is showing clear signs of recovery. The US National Realtors Association (NAR) said that existing home sales in December increased by 5.1%, reaching 4.35 million units, exceeding forecasts by 4.21 million units.

Although compared to the same period last year, sales still decreased by 1.4%, December was assessed as the strongest in nearly 3 years, when mortgage interest rates cooled down and house price increases slowed down.

Right before the data was announced, gold prices at times retreated to the support level of 4,600 USD/ounce, but quickly recovered to about 4,606 – 4,630 USD/ounce, continuing to maintain a sideways trend in the high zone.

Mr. Lawrence Yun - Chief Economist of NAR - said: "The housing market began to improve in the fourth quarter, thanks to reduced mortgage interest rates and slower house price increases. However, supply is still very limited, as many homeowners are not ready to sell.

Mid-range house prices in the US in December reached 405,400 USD, up 0.4% over the same period, marking the 30th consecutive month of price increases.

Manufacturing price inflation hotter than forecast

The important factor helping gold prices maintain in the record zone is that US inflation has not yet cooled down.

The US Department of Labor said the November Productivity Index (PPI) increased by 0.2%, after increasing by 0.1% in October. In 12 months, PPI increased by 3.0%, much higher than the forecast of 2.7%.

In particular, the core PPI – excluding food and energy – increased by 3.5% over the same period, the highest level since March, showing that cost pressure is gradually "sweating deeper" into the economy.

Although the US Federal Reserve (Fed) is still expected to continue to cut interest rates in the near future, higher than forecast inflation is creating uncertainty about the pace of monetary easing. This factor is causing investors to continue to turn to gold as a defensive channel against inflation risks.

Summarizing the latest data shows that the US economy is still quite healthy, but inflationary pressure has not been completely controlled. In that context, gold continues to play the role of a safe-haven asset, helping the price remain around the historical peak above 4,630 USD/ounce, despite positive economic indicators.