As of 6:15 p.m. ET, the April gold futures contract - the largest such contract - was fixed at $3,001.30 an ounce, up $27.9 (1.97%) today.

The strong fluctuations in gold prices today came after the US Bureau of Labor Statistics released the February Producer Price Index (PPI) report.

This wholesale price index increased by 3.2% over the same period last year, lower than the 3.7% of the previous month and lower than Fact Set's forecast of 3.3%.

Core PPI - excluding volatile food and energy prices - fell 0.1% from January, while the previous month increased by 0.5% and was forecast to be 0.3%.

The PPI report shows that the US economy is cooling down, causing traders to bet on the possibility that the US Federal Reserve (FED) will cut interest rates or make cuts earlier than expected.

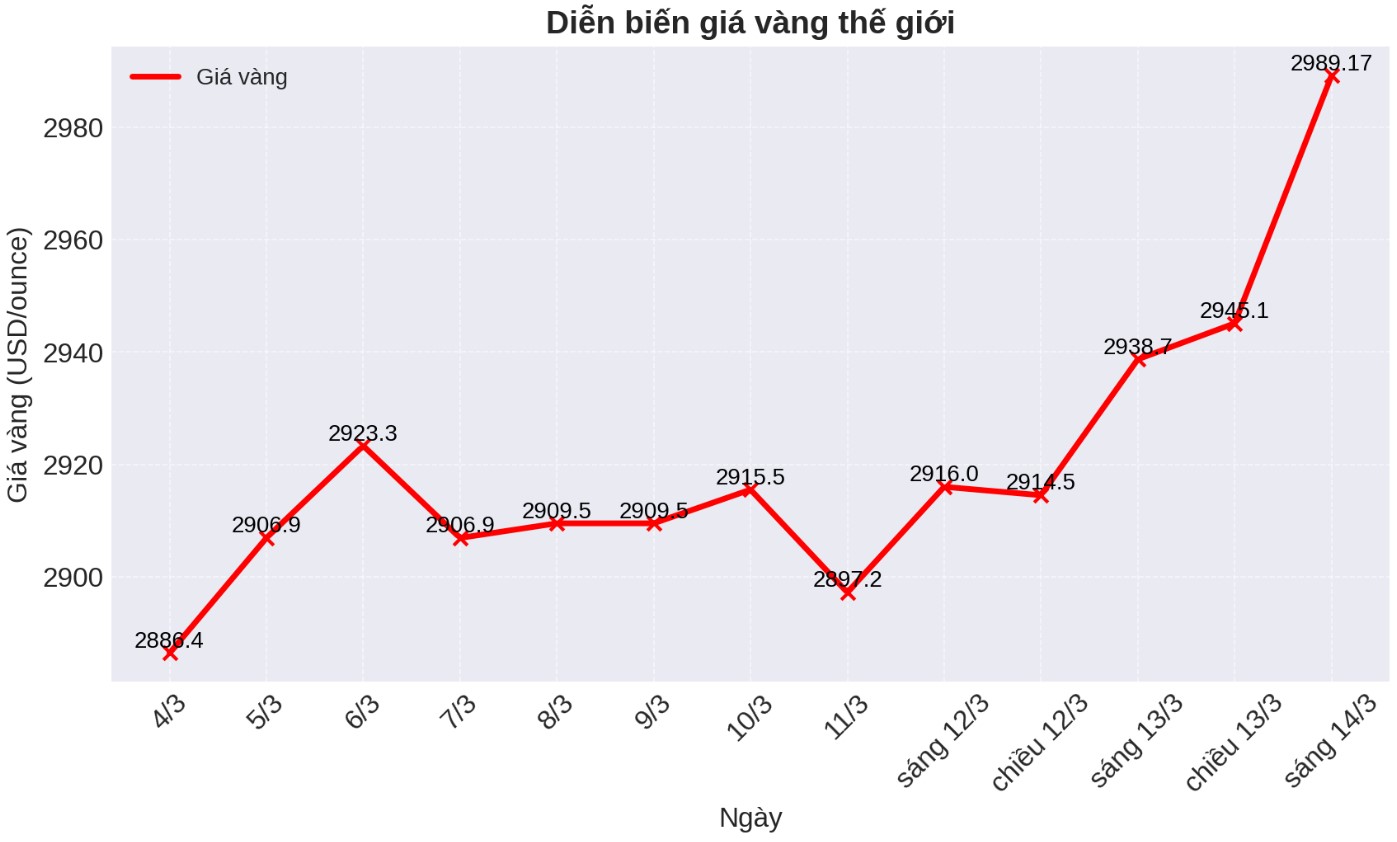

Not only the price of gold futures, the price of spot gold is also increasing strongly. Recorded at 8:18 a.m. on March 14, 2025 (Vietnam time), the world gold price listed on Kitco was at 2,989.17 USD/ounce.

The next meeting of the Federal Open Market Committee (FOMC) will take place on March 18-19. Although recent inflation reports show a stagnant US economy, the Fed is likely to keep interest rates unchanged at its upcoming meeting.

Since the US abandoned the gold standard, it has taken 38 years for gold to reach the $1,000/ounce mark - from a previous fixed of less than $40/ounce.

The $1,000/ounce mark was set in 2009, marking an important milestone after more than a century of gold prices under the control of monetary policies and the gold standard system.

Today's $3,000 milestone highlights gold's skyrocketing rally over the past year, especially as gold surpassed the long-term trend line on the historical chart in February 2023.

With the highest inflation rate ever, gold's recent increase is considered extremely strong compared to previous increases.

See more news related to gold prices HERE...