Ross Norman said that gold has long been an asset that attracts investors' attention, but this increase has many unusual factors.

In his latest article in Bullion World, he emphasized that gold is often dominated by a series of economic, geopolitical and market factors. However, the recent developments of this precious metal are going against traditional rules, raising many questions about the real reason behind the price increase.

Gold is often seen as a hedge against inflation. When inflation increases, gold prices also tend to increase. But 2024 will see another scenario, although inflation in the West is falling sharply, gold continues to increase in price.

The relationship between gold and the USD was also broken when both increased sharply, a rare thing in market history.

In addition, rising US bond yields often undermine gold's appeal as the precious metal fails to yield. However, this year, gold and bond yields have risen together, showing that the gold market is moving away from conventional rules.

The abnormality is also shown through the movement of silver. During periods of rising prices in the precious metals market, silver tends to increase more strongly than gold. But this time, the gold/ silwer ratio skyrocketed, showing that silver is being left behind. Demand for gold from Asia is also surprising as it remains high despite record prices.

According to Norman, Asian gold buyers are often very sensitive to prices, especially in the jewelry industry, which has a thin profit margin. However, this time, they continue to buy even though domestic gold prices have reached an all-time high.

Given the market's abnormality, Norman proposed three theories. One is that gold is no longer tied to other assets as before, but this possibility is unlikely because correlations are all logically well-founded, even if sometimes interrupted.

The second possibility is that the gold market is gradually being dominated by Asia, as the region plays an increasingly important role in the gold valuation process.

Norman said that China, as the world's largest gold producer and consumer, is increasingly influencing the global gold market.

However, the third possibility is receiving the most support: a large and mysterious entity is behind this price increase. Norman said that market data does not provide any clue about the identity of buyers, as there is no clear information about import and export activities or treasury data. This raises the question, is this a move by central banks hoarding gold or is it just the participation of short-term investors?

Gold has been rising steadily for nearly a year without any significant adjustments. According to Norman, the buying volume seems very concentrated, and the lack of transparency shows that there is a single entity manipulating the market.

He said there are two main possibilities to explain the 34% increase in gold prices over the past year. One is large-scale derivatives trading on the Shanghai Securities Exchange (SHFE) and the OTC market, creating a self-strengthening effect. When a Chinese investor betting on gold will increase prices by buying a large number of buying options, the partner bank will have to buy physical gold to prevent risks, thereby pushing prices higher, creating a continuous loop.

The second possibility is that central banks are secretly buying gold to reduce their dependence on the USD in the context of global financial instability.

With global economic and financial policy fluctuations, some central banks may have increased their gold reserves to reduce their dependence on the USD. In this context, they can order directly from refineries without having to worry about prices.

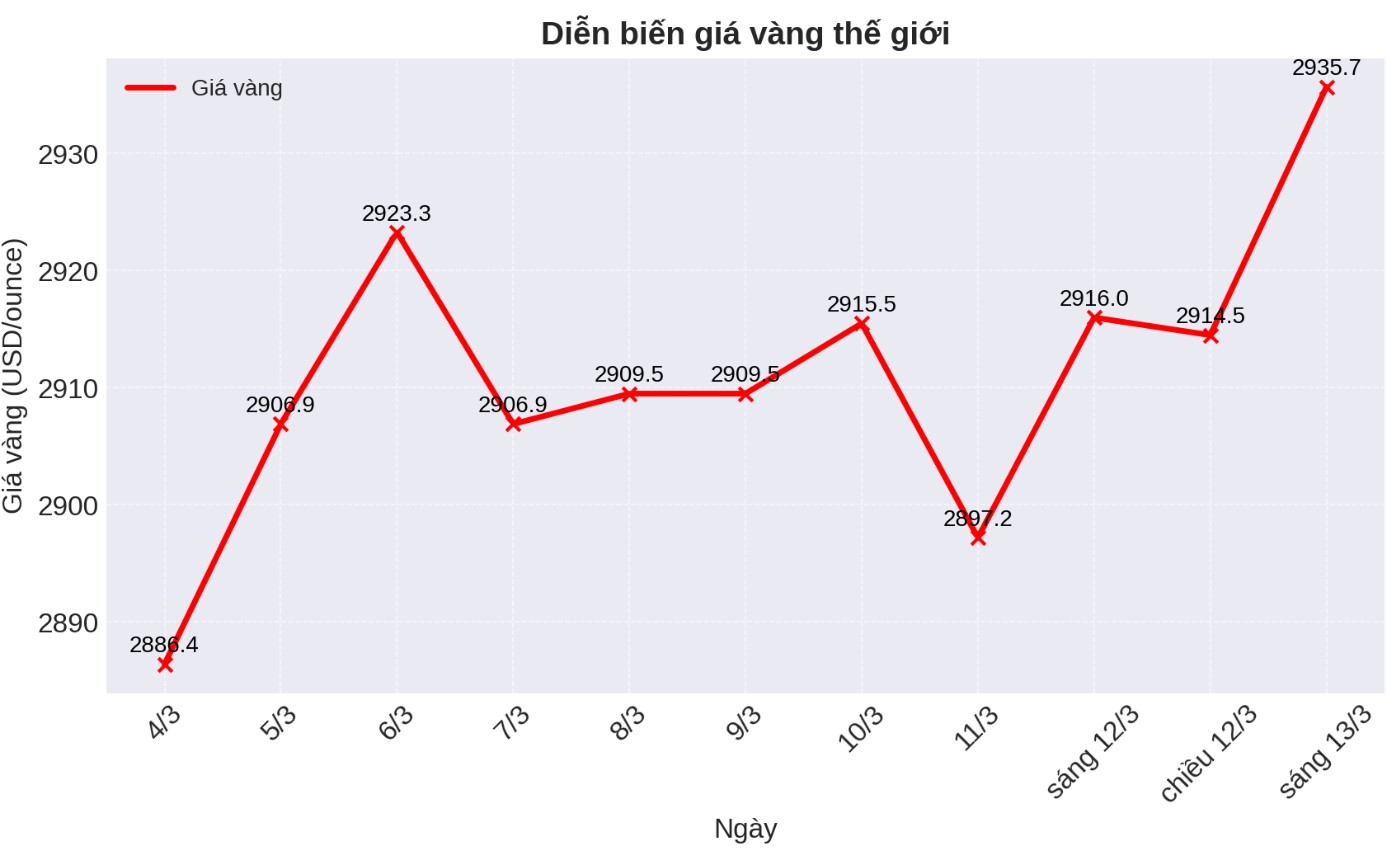

Regardless of any momentum to boost the market, Norman said gold may need to adjust after a period of hot gains. Gold prices hit a record high of $2,955 an ounce in February 2025, completing much of the forecast for the first half of the year in just the first 6 weeks. However, the uptrend remains intact despite declining momentum.

He said this is not a negative thing, as gold needs a period of accumulation to create a solid foundation for further gains.