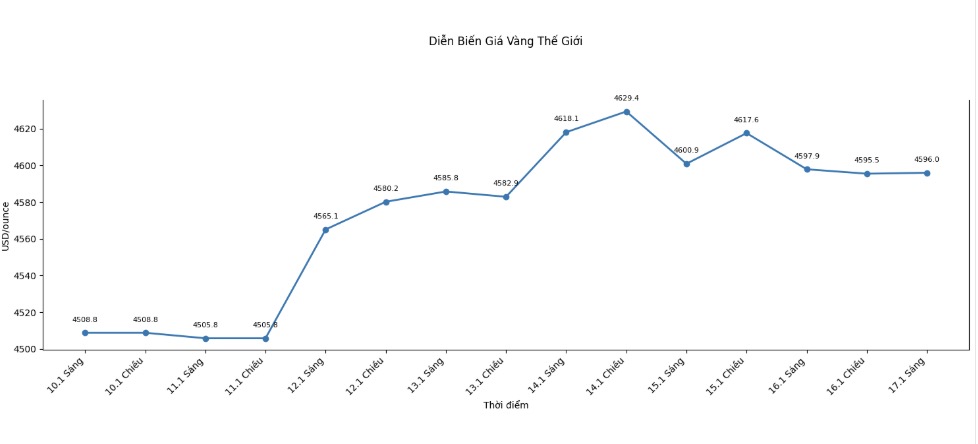

After a strong rally, spot gold contracts entered the end of the week below the threshold of 4,600 USD/ounce. The last spot gold price was traded at 4,582.20 USD/ounce, up 1.6% in the week, but decreased by 1.2% compared to the peak set on Wednesday.

Silver also had a similar development, but the level of volatility was significantly greater. The last spot silver price was at $88.69/ounce, up nearly 11% in the week, but down about 5% compared to the peak on Wednesday.

Although it is only the first two weeks of 2026, gold is having the best start of the year in history, increasing by a total of 256 USD since the beginning of the month. In the past two weeks, gold prices have increased by 5.6%, but are still inferior to the increase of more than 7% in January last year.

The silver market also recorded the strongest year-on-year increase ever, with prices increasing by nearly $17.5 since the beginning of the month. In the past two weeks, silver prices have increased by more than 24% and are on track to reach the highest percentage increase since 1983, when the metal increased by 26% in the first month of the year.

With the strong increases in gold and silver from the beginning of the year, combined with the upward momentum from the second half of 2025, experts believe that it is very difficult to predict the next developments. However, a period of sideways and stable will be positive for the market.

For me, gold holding around the 4,600 USD mark shows that this is a typical accumulation period after a year of continuous growth" - Mr. Neil Welsh, Head of Metals at Britannia Global Markets, commented - "In my opinion, this is not a market that runs out of momentum, but a market that is rotating, rebalancing and determining where the next growth wave will come from.

Mr. Welsh added that the temporary stagnation of both gold and silver is understandable, because the economic data released last week did not create more pressure for the US Federal Reserve (Fed) to change its current cautious monetary policy stance.

According to CME FedWatch tool, the market assesses the possibility of the Fed cutting interest rates in the first quarter as very low.

After 12 months of strong increases, a part of investors are wondering if there is still much room for short-term gold price increases, and whether other metals or other types of assets will bring a more attractive risk-benefit ratio for the next period. This rotation does not weaken the long-term support trend of gold, but makes the market more selective when chasing high prices," he said.

Mr. Lukman Otunuga - senior market analyst at FXTM - said that even when gold enters a new accumulation phase, the long-term trend remains unchanged.

“The underlying factors are still leaning heavily towards gold, due to concerns about the independence of the Fed, trade tensions and stable buying power from central banks" - he said. “Technically, the price is still in a clear upward trend, but the RSI indicator is in a strong overbought zone. If the price falls sustainably below $4,570, it may trigger a sell-off to the $4,500/ounce zone, even $4,450/ounce before buyers regain strength. Conversely, if it exceeds $4,645/ounce, gold may head to the next important milestone of $4,700/ounce”.

Mr. Elior Manier - market analyst at OANDA, said that gold and silver may face more resistance when the market becomes too "heavy" on the buying side.

Although the fundamentals are still long-term supportive, technical signals are increasingly showing the risk of stagnation" - he commented - "Banks, hedge funds, and even those who do not pay much attention to the market are also making year-end price forecasts that are increasingly high - this is a typical sign of excitement. Excessive excitement in any type of asset can lead to a strong correction, especially when the market position leans completely to one side; just a small correction can trigger a chain of cut-loss wave.

Mr. Manier added that growing expectations that the Fed will have to cut interest rates until June will also reduce demand for precious metals in the short term.

Even if the trend stagnates or adjusts, the current global context is very different from a few years ago" - he said - "Don't expect prices to return to the level of the 2021-2022 period in the near future, but it should also be noted that in parabolic markets, strong corrections are common.

See more news related to gold prices HERE...

It's a bit of a bit of a bit of a bit of a bit of a bit.