Mr. Michael Widmer - Head of Metal Research at Bank of America - said that gold price increase cycles in history often do not end just because prices have risen.

According to him, the peak of a cycle only truly forms when the initial fundamental factors driving the upward momentum begin to weaken. In other words, high prices themselves are not the reason why gold reverses downwards.

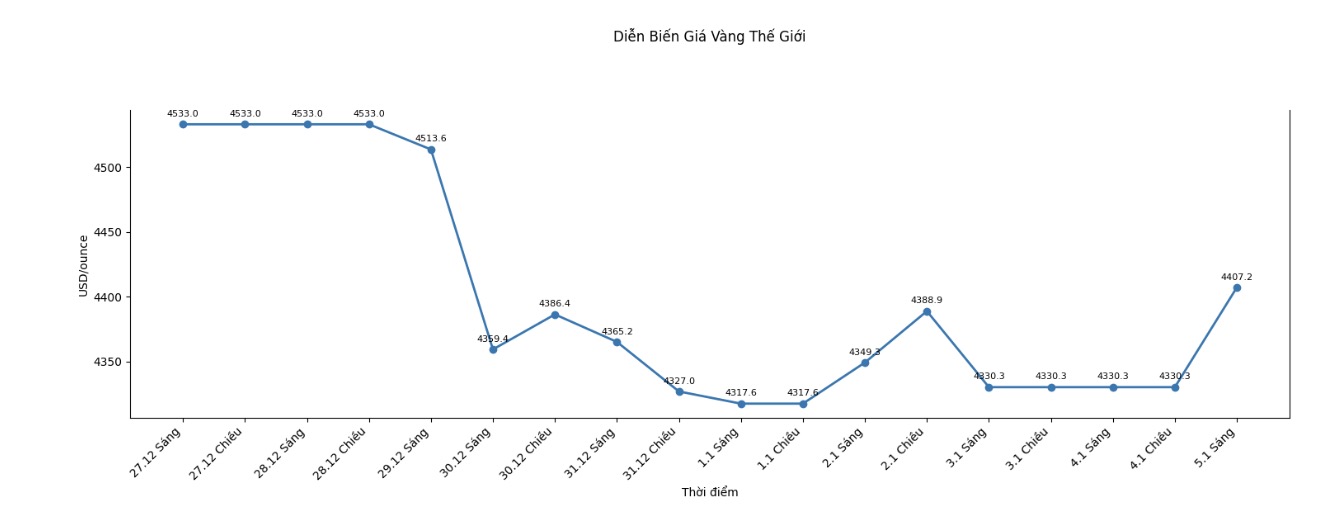

On that basis, Bank of America's official forecast shows that the average gold price may reach 4,538 USD/ounce in the coming period, while the market peak does not rule out the possibility of reaching the 5,000 USD/ounce mark.

This is a forecast level reflecting expectations that economic and geopolitical risks will continue to exist, creating a foundation for gold holding demand.

This optimistic view is also shared by European financial institutions. Analysts at Societe Generale said they continue to maintain a 10% gold ratio in their multi-asset portfolio. At the same time, the bank reaffirmed its forecast that gold prices could reach $5,000/ounce by the end of 2026.

According to a report by Societe Generale, individual investors are playing an increasingly clear role in promoting gold demand. Cash flow is recorded flowing strongly into gold bars, coins and gold ETF funds, as part of an asset diversification strategy.

Experts at this bank recommend buying when prices adjust, arguing that unaffiliated central banks will continue to reduce dependence on USD-denominated assets.

In that context, gold is seen as an effective defensive tool against many risks, including the possibility that the US Federal Reserve (Fed) will shift to a more moderate stance after senior personnel changes.

However, compared to the excitement of individual investors, most precious metal analysts remain cautious. Many experts believe that gold has positive prospects for next year, but the level of optimism varies significantly between organizations. Notably, many forecasts from independent experts are even more positive than the views of large banks.

From the industry's perspective, Mr. Juan Carlos Artigas - Head of Global Research at the World Gold Council, said that gold has surpassed the general market in 2025 thanks to two key macroeconomic drivers.

First, the geopolitical and geo-economic environment is particularly tense; second, the weakening of the USD along with a slightly lower interest rate level. When combined with positive price dynamics, investment demand has become an important pillar supporting gold performance.

Discussing the prospects for 2026, Mr. Artigas emphasized the interaction between macroeconomic factors. According to him, gold prices currently reflect market consensus expectations about economic prospects. If the global economy operates as predicted, gold prices may only fluctuate within a narrow range.

However, reality rarely happens according to the scenario and it is the deviations from expectations that can push gold prices up or down sharply.

Among the supporting factors, Mr. Artigas pointed out that economic data in the US and globally is issuing mixed signals. If the US economy slumps slightly, forcing the Fed to cut interest rates and dragging on the continued weakening of the USD, gold prices could increase by 5% to 15%, depending on the speed and scale of monetary easing.

In worse-case scenarios, if the economy seriously weakens due to escalating geopolitical tensions or the consequences of some current policies, investment demand in gold may explode strongly.

Mr. Artigas also said that the room for increased investment demand is still very large. Since May 2024, gold ETF funds have accumulated about 800 tons of gold. Although this figure is noteworthy, in the historical context, it is still less than half compared to previous high-risk periods.

Therefore, if economic and financial conditions worsen significantly, demand may increase sharply not only from ETFs but also from OTC markets, derivatives markets and central banks. In such scenarios, gold prices are entirely likely to exceed the 5,000 USD/ounce mark.

Conversely, this expert also does not rule out the possibility of gold prices adjusting down if investment demand weakens. According to him, part of the current "risk premium" of gold reflects existing instabilities.