BIDV increases interest rates after nearly 1 year

After Tet, BIDV updated the new interest rate table on February 5, 2025. This is the first time BIDV has adjusted deposit interest rates since March 2024. Notably, this bank has kept interest rates unchanged or reduced for more than 2 years. BIDV is currently the bank with the largest deposit market share in the system, with total customer deposits reaching 1.95 million billion VND by the end of 2024.

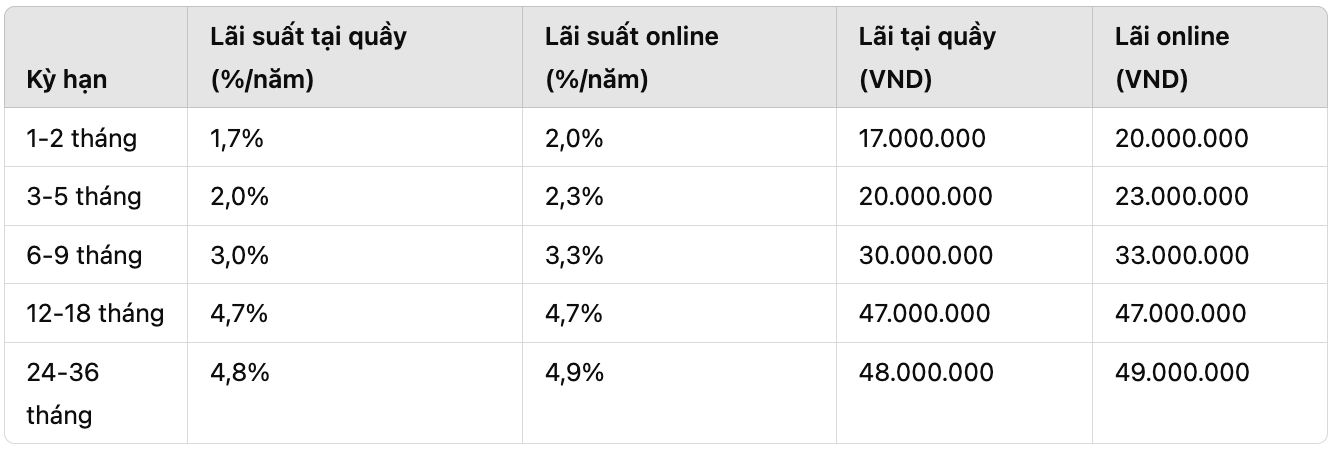

Savings interest rates at BIDV counters

24-36 month term: 4.8%/year (highest when depositing at the counter).

12-18 month term: 4.7%/year.

6-9 month term: 3%/year.

3-5 month term: 2%/year.

1-2 month term: 1.7%/year.

BIDV online savings interest rate (0.0002.0 percentage points higher than counter deposit)

24-36 month term: 4.9%/year (highest when depositing online).

12-18 month term: 4.7%/year.

6-11 month term: 3.3%/year.

3-5 month term: 2.3%/year.

1-2 month term: 2%/year.

Highest interest rate for depositing 1 billion VND at BIDV

Depending on the deposit term and the form of savings (at the counter or online), the interest received at the end of the term will be different. Here is a detailed table:

Accordingly, with a deposit of 1 billion VND, the highest interest rate that can be received is 49 million VND/year if you choose to deposit online for a term of 24-36 months.

That is, after 3 years of saving 1 billion VND, you can receive:

144 million VND if deposited at the counter (interest rate 4.8%/year).

147 million VND if deposited online (interest rate 4.9%/year).

The total amount after 36 months will be 1.144 billion VND (at the counter) or 1.147 billion VND (online).