According to records on January 22, 2026, Cake by VPBank Digital Bank has updated a new deposit interest rate schedule with extremely attractive yields, especially focusing on terms from 6 months or more.

6-month term interest rates belong to the "top" of the market

The most notable highlight in this adjustment is that the interest rate for the 6-month term has reached 7.3%/year when customers choose the form of interest payment at the end of the term. This is considered the leading competitive interest rate in the market today for medium-term terms.

For short terms under 6 months (from 1 to 5 months), this bank lists a ceiling interest rate of 4.75%/year.

For longer terms, from 7 months to 36 months, Cake by VPBank maintains a stable interest rate of 7.1%/year. This interest rate is applied evenly for terms of 12, 13, 15, 18, 24 and 36 months, creating favorable conditions for customers who want to lock in high interest rates in the long term without worrying about market fluctuations.

In addition, Cake by VPBank also launched a special promotion program for first-time savings depositors with an additional bonus of 0.9%/year, bringing the highest savings interest rate possible up to 8.2%/year.

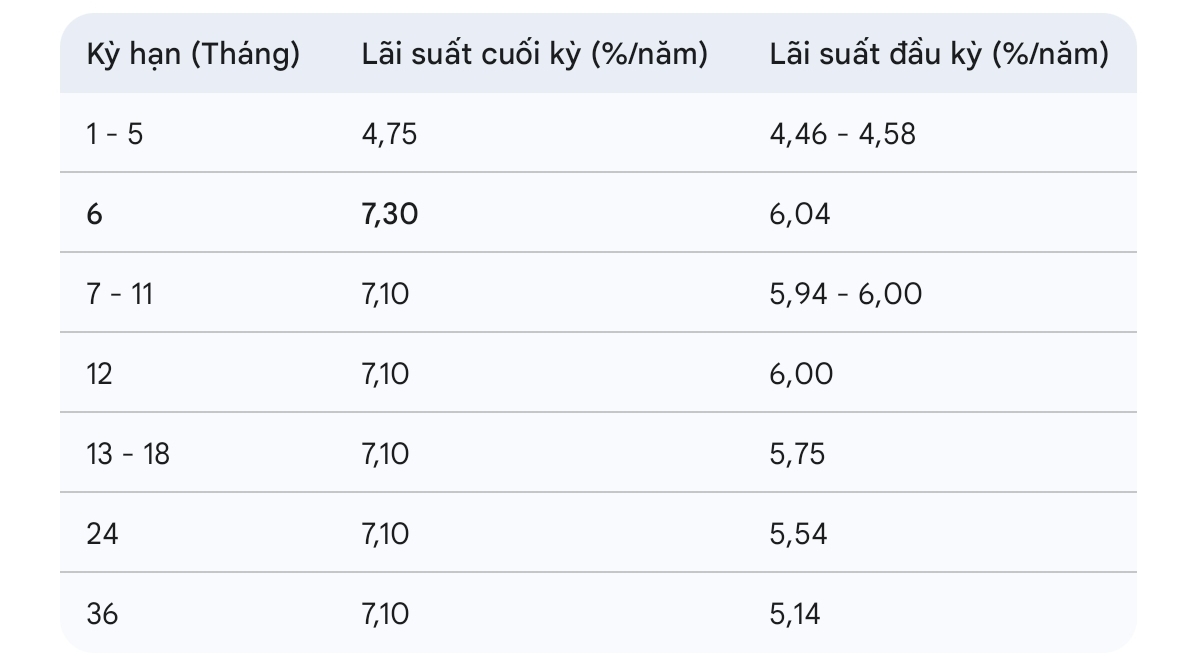

Below is a detailed deposit interest rate table for individual customers (%/year):

Deposit 1 billion VND online savings, how much interest will you receive?

Expected interest for the deposit of 1 billion VND (1,000.000.000 VND) in the form of interest payment at the end of the term at Cake by VPBank.

Calculation formula: Interest = Deposit amount x Interest rate (%/year) / 12 x Months deposited

Below is the estimated interest calculation table:

Optimal short-term profit: If choosing a 6-month term, customers will enjoy the highest interest rate in the listing table of 7.3%, bringing in 36.5 million VND in interest after only half a year. This is the optimal choice for medium-term idle cash flow.

Highest total profit: If there is no need to use capital for a long time, a 36-month term will help customers maximize the actual amount received. With an interest rate of 7.1%, the total interest customers receive is up to 213 million VND.

The interest rate table is for reference and may change at different times. Customers should contact the bank directly to update the most accurate information.