SJC gold bars increase sharply, buyers make big profits

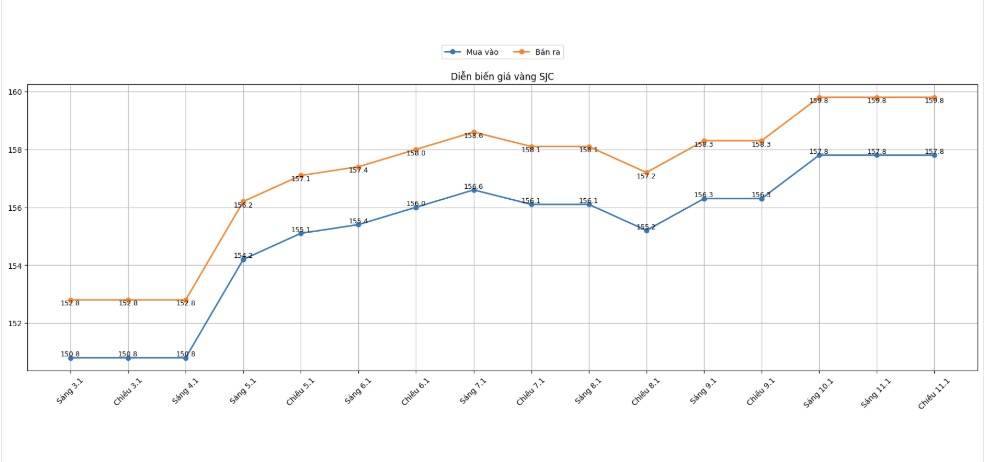

Closing the weekly session, Saigon SJC Jewelry Company listed the price of SJC gold bars at 157.8 - 159.8 million VND/tael (buying - selling), the buying - selling difference was 2 million VND/tael. Compared to the closing price last week (January 4, 2026), the price increased by 7 million VND/tael in both directions.

Similarly, Bao Tin Minh Chau listed SJC gold bars at the threshold of 157.8 - 159.8 million VND/tael, a difference of 2 million VND/tael, an increase of 7 million VND/tael compared to a week ago.

Thus, if buying SJC gold in the session on January 4th and selling it in the session on January 11th, buyers can make a profit of about 5 million VND/tael.

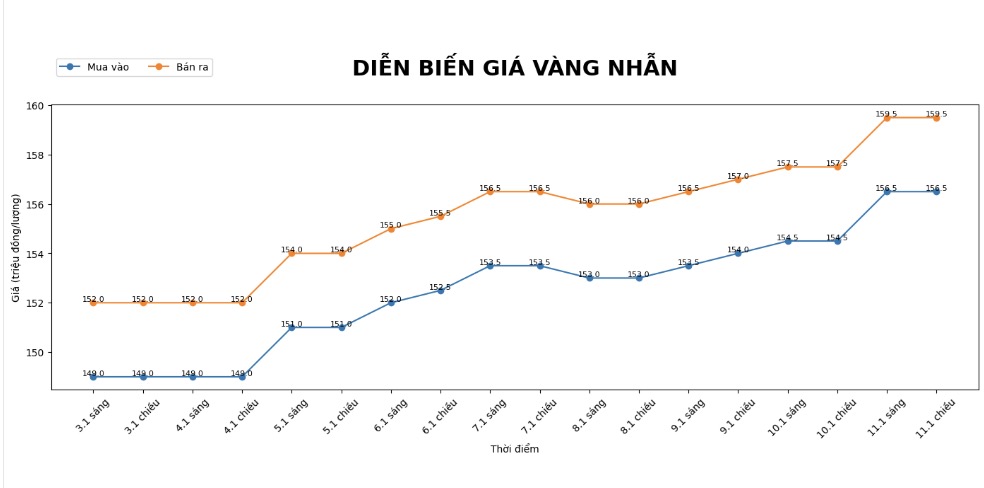

Gold rings increase sharply, but buyer profits are thin

In the 9999 gold ring group, the price also increased significantly. Bao Tin Minh Chau listed the price of gold rings at 156.5 - 159.5 million VND/tael (buying - selling), an increase of 4.5 million VND/tael in both directions. However, the buying - selling difference is up to 3 million VND/tael.

Meanwhile, Phu Quy Jewelry Group listed gold rings at 155 - 158 million VND/tael, an increase of 5.2 million VND/tael compared to a week ago, the buying - selling difference was also at 3 million VND/tael.

Because of the high difference, even though the price increased sharply, the actual profit of buyers was significantly "eroded". If buying gold rings on January 4 and selling on January 11, buyers at Bao Tin Minh Chau only make a profit of about 1.5 million VND/tael; while at Phu Quy, the profit is about 2.2 million VND/tael.

In strong fluctuations, businesses often widen the buying - selling price difference to reduce risks when prices reverse quickly. With gold rings, the difference is often higher than gold bars due to liquidity and brand standardization not being uniform like SJC, and also related to processing and distribution costs.

In other words, gold ring buyers who want to make a profit must surpass this "level" difference. The price increases by 4-5 million VND/tael, but the buying - selling difference is up to 3 million VND/tael, making the remaining net profit not much.

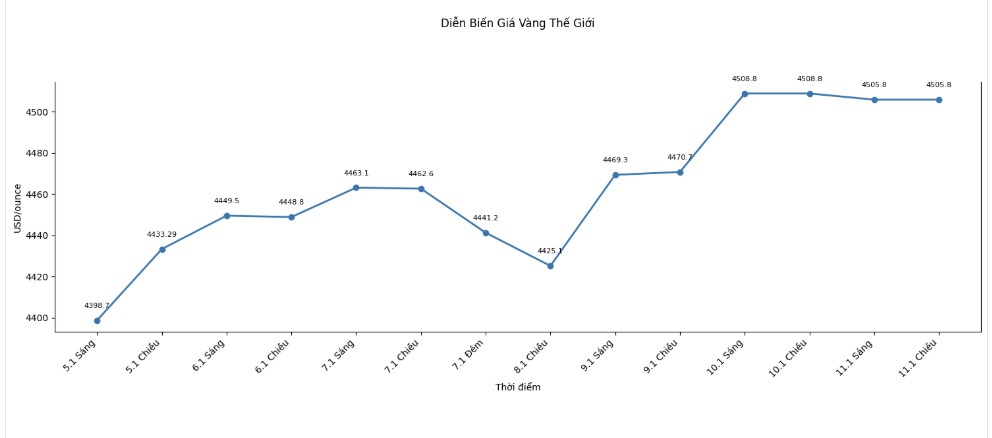

Domestic gold prices increased sharply partly due to the impact of the world market. Closing the weekly session, gold prices were listed at 4,505.8 USD/ounce, up 175.5 USD/ounce compared to a week ago, creating momentum for the domestic market.

In general, gold ring prices increased sharply, but buyers made slim profits mainly due to the widening buying-selling difference. Investors, if trading in the short term, need to pay special attention to this difference, because this is the decisive factor in real profit when selling.

Although gold prices are increasing sharply, experts recommend that investors should not FOMO (purchase following crowd psychology), especially with gold rings when the buying-selling price difference is high.

Reality shows that just by reversing or adjusting slightly the price, buyers can fall into a loss situation right after trading, because the difference has been "deducted" from the profit. Therefore, people need to carefully consider their holding targets, calculate the difference and fluctuation risk before spending money.