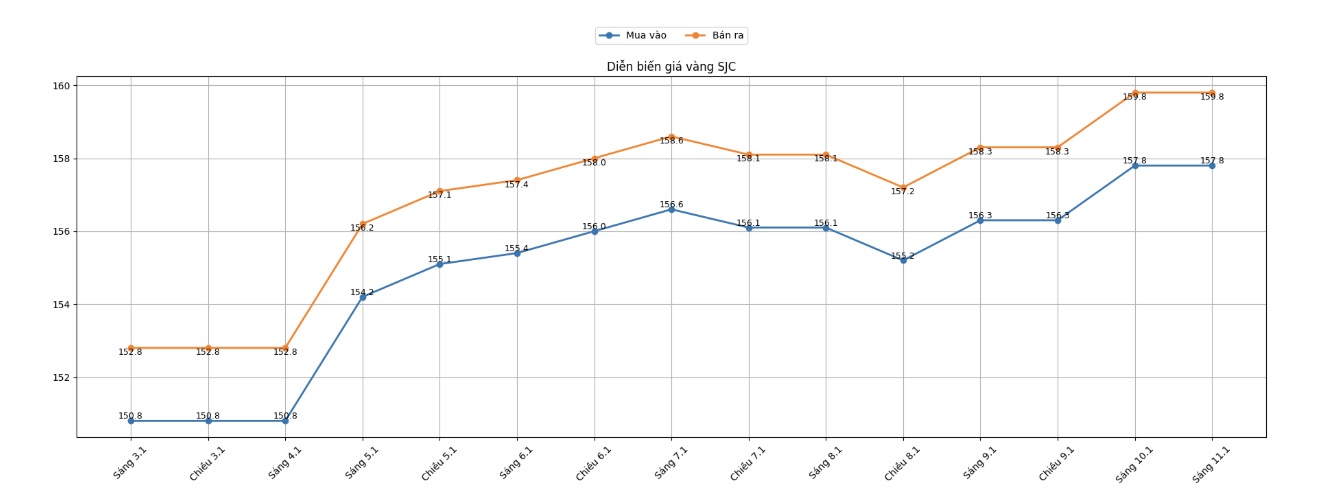

SJC gold bar price

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold price at 157.8-159.8 million VND/tael (buying - selling). The buying - selling difference is 2 million VND/tael.

Compared to the closing session of the previous week (January 4, 2026), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 7 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 157.8-159.8 million VND/tael (buying - selling). The difference between buying and selling is 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 7 million VND/tael by Bao Tin Minh Chau in both directions.

If you buy SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on the November 4th session and sell it on today's session (January 11th), buyers will make a profit of 5 million VND/tael.

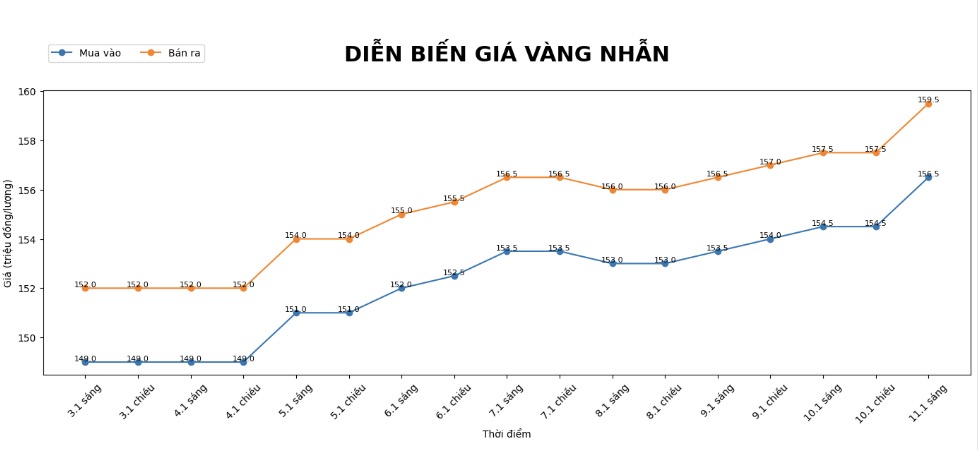

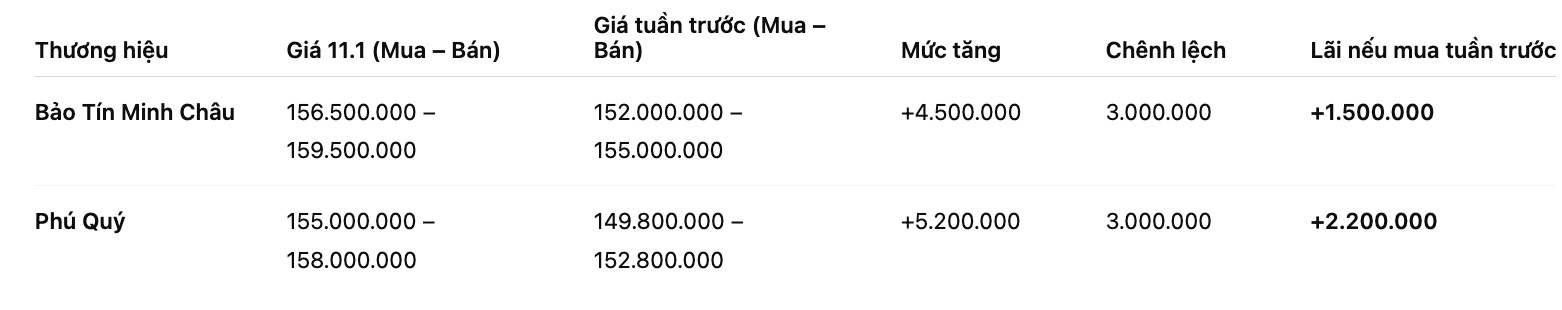

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 156.5-159.5 million VND/tael (buying - selling); an increase of 4.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 5.2 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If buying gold rings in the session on January 4 and selling out in today's session (January 11), buyers at Bao Tin Minh Chau will make a profit of 1.5 million VND/tael, while the profit when buying gold rings in Phu Quy is 2.2 million VND/tael.

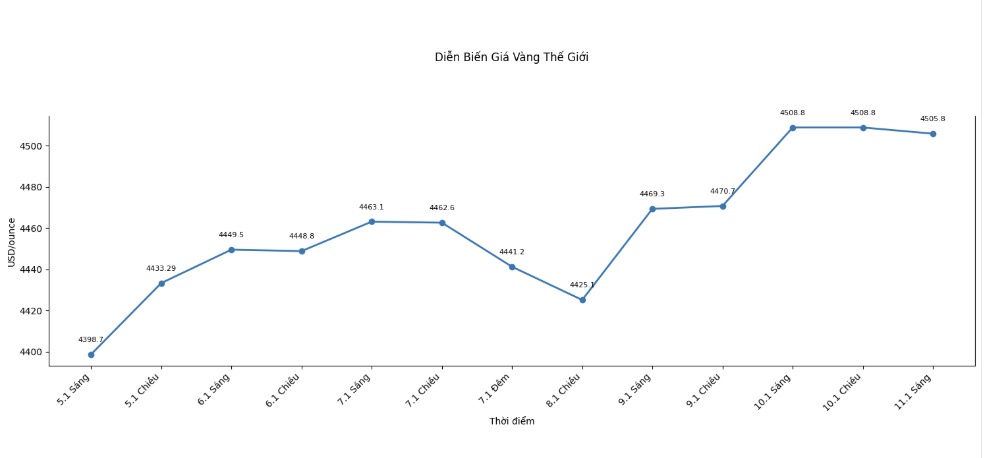

World gold price

Closing the weekly trading session, world gold prices were listed at the threshold of 4,505.8 USD/ounce, a sharp increase of 175.5 USD compared to a week ago.

Gold price forecast

After a week of strong increases in both domestic and international markets, the outlook for gold prices in the short term continues to receive great support from analysts and investors. Kitco News' latest weekly gold survey shows that optimistic sentiment is clearly dominant on Wall Street as well as in the individual investor community.

Specifically, among the 16 Wall Street experts participating in the survey, up to 14 people, equivalent to 88%, predicted that gold prices would continue to rise next week. Only one opinion suggested that the precious metal could fall in price, while another expert predicted that the market would go sideways.

In the group of individual investors, the positive trend also prevailed when 69% of survey participants expected gold prices to increase, showing that cash flow is still heading towards this shelter channel.

According to Mr. Darin Newsom - senior analyst at Barchart.com, the current trend of gold shows no signs of reversal. He believes that in a market that is forming a clear trend, prices often continue in that direction until strong enough resistance appears.

In the context that gold buying demand from investors and central banks is still maintained at a high level, the possibility of the upward momentum ending soon is quite low.

Sharing the same view, Mr. Rich Checkan - Chairman and CEO of Asset Strategies International - said that entering the new year does not change the fundamental factors that support the gold market.

According to him, the fact that central banks continue to increase gold reserves, prolonged geopolitical tensions, the weakening USD, and low interest rates are still important supports for the precious metal in the coming time.

However, analysts also noted that the 4,500 USD/ounce mark is playing a role as an important psychological threshold for world gold prices. Whether the price can break through or adjust around this zone will largely depend on macroeconomic information to be released soon.

In the coming week, the market will closely monitor a series of important US economic data, especially the consumer price index (CPI), producer price index (PPI), retail sales and data related to the housing market. These figures will help investors better assess the inflation outlook and monetary policy of the US Federal Reserve (Fed), thereby directly impacting the trend of gold prices.

In the context of global economic and geopolitical risks still present, gold is expected to continue to play the role of a safe haven asset, with the ability to maintain strong fluctuations in the short term.

See more news related to gold prices HERE...