SJC gold bar price increases sharply but profit is only 1 million VND/tael

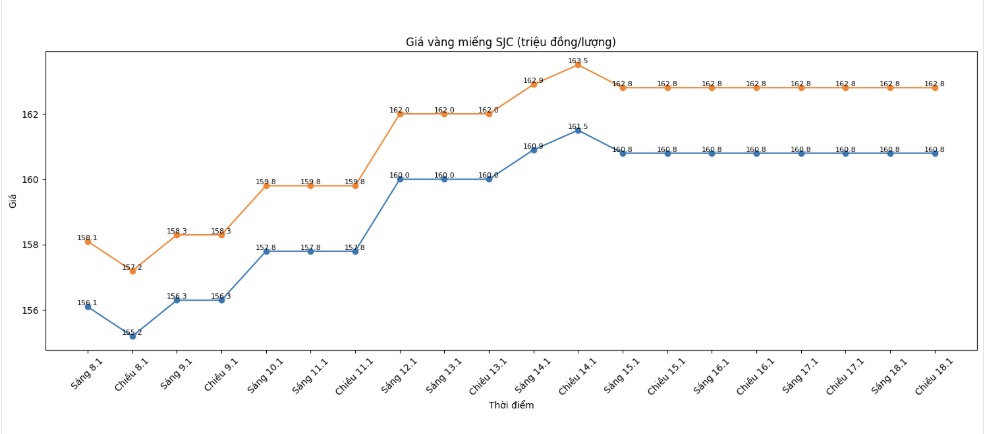

Closing the trading session on January 18, 2026, Saigon SJC Jewelry Company listed SJC gold bar prices at 160.8 - 162.8 million VND/tael (buying - selling). Compared to the closing session of the previous week (January 11, 2026), SJC gold prices increased by 3 million VND/tael in both directions. However, the buying - selling difference remained at 2 million VND/tael, causing the profit margin of investors to narrow.

Similarly, Bao Tin Minh Chau also listed SJC gold prices at the same threshold of 160.8 - 162.8 million VND/tael, an increase of 3 million VND/tael compared to a week ago, with a difference of 2 million VND/tael between buying and selling.

If investors buy SJC gold at the session on January 11, 2026 and sell it in the session on January 18, 2026, the actual profit will only reach about 1 million VND/tael, much lower than the nominal increase of gold prices.

9999 gold ring: Prices increase sharply but profits are almost negligible

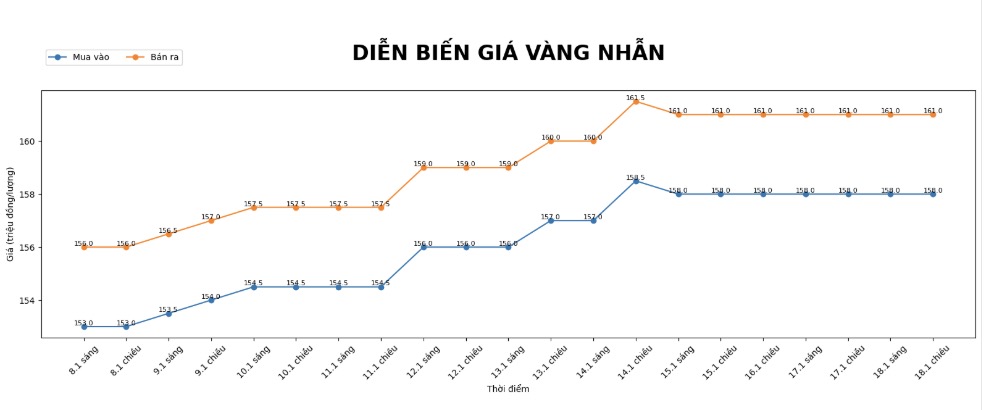

For 9999 gold rings, Bao Tin Minh Chau listed the price at 1598.8 - 162.8 million VND/tael, an increase of 3.3 million VND/tael compared to a week ago. However, the buying - selling difference was pushed up to 3 million VND/tael, higher than SJC gold bars.

Meanwhile, Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158 - 161 million VND/tael, an increase of 3 million VND/tael, with the buying - selling price difference also at 3 million VND/tael.

With a large difference, if buying gold rings at the session on January 11, 2026 and selling on January 18, investors at Bao Tin Minh Chau will only make a profit of about 300,000 VND/tael, while buyers at Phu Quy are almost at full cost.

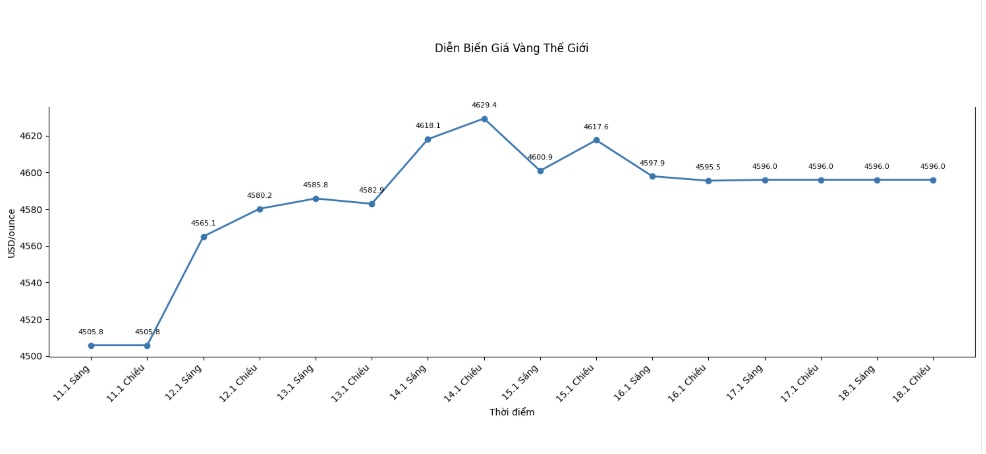

Strong increase in world gold prices is the main driving force

On the international market, world gold prices closed the week at 4,596 USD/ounce, up 90.2 USD/ounce compared to a week ago. The strong upward momentum of world gold is the main factor supporting domestic gold prices to rebound quickly.

However, the widening buying-selling gap in the country has caused even though gold prices soared, the actual profits of investors are still quite thin.

Current developments show that, in the context of strong gold price fluctuations, short-term investors may face the risk of low profits due to large buying-selling differences. The fact that "profits on the price list" but "real profits are not much" is a reality happening in the domestic gold market.

In the short term, investors need to carefully consider the buying and selling times, and closely monitor the developments of world gold prices as well as the price adjustment policies of gold businesses.

See more news related to gold prices HERE...