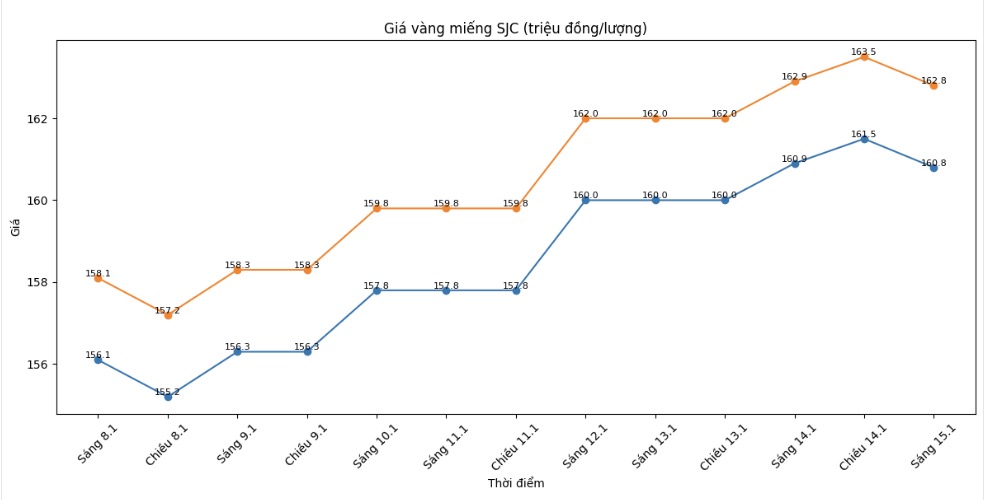

SJC gold bar price

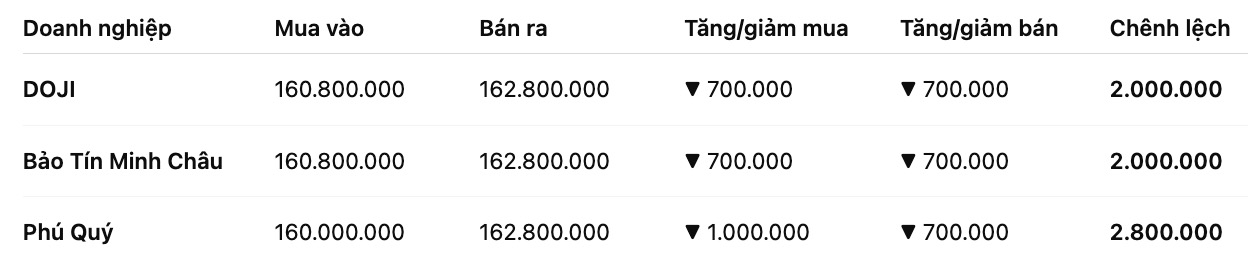

As of 6:00 AM on January 16, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), down 1 million VND/tael on the buying side and down 700,000 VND/tael on the selling side. The difference between buying and selling prices is at 2.8 million VND/tael.

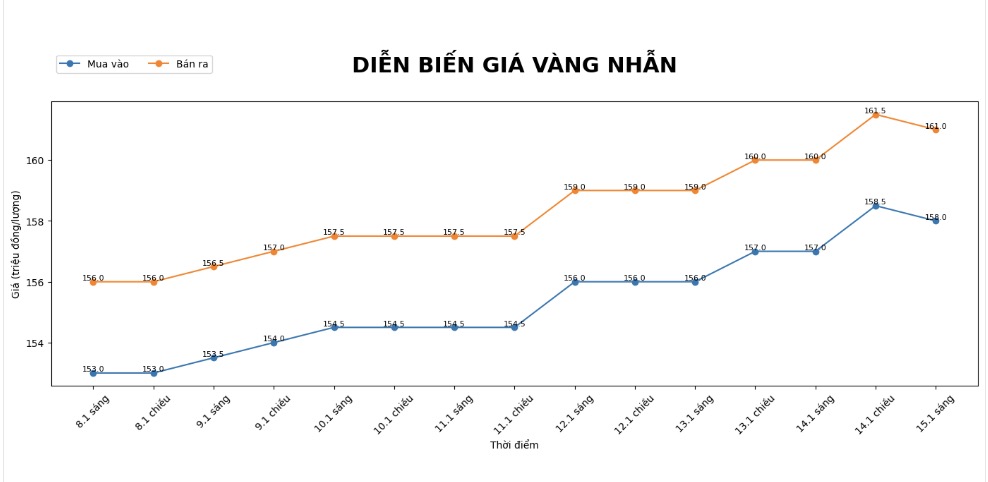

9999 gold ring price

As of 6:00 AM on January 16, DOJI Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), down 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), down 500,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

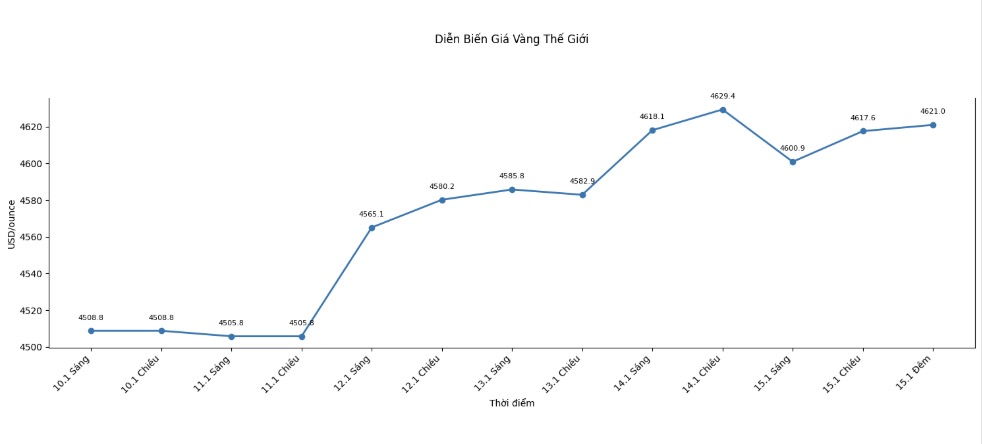

World gold price

World spot gold price listed at 11:20 PM on January 15 was at the threshold of 4,621 USD/ounce, up 7.6 USD.

Gold price forecast

Although world gold prices showed signs of slight correction in the most recent session after hitting a historical peak, many fundamental factors are still supporting the precious metal to maintain a high price level in the medium and long term.

In the session of January 15, spot gold prices retreated to around 4,610 - 4,620 USD/ounce, after hitting a record high above 4,640 USD/ounce earlier. Profit-taking pressure appeared when investors reacted to some softer statements from US President Donald Trump related to foreign policy and the US Federal Reserve (Fed), causing temporary safe haven demand to decline.

However, according to Mr. Ilya Spivak - Global Macro Director at Tastylive, the current correction is only technical: "Mr. Trump's signal may not intervene strongly in Iran to cool down gold in the short term, but the bigger story behind gold's upward momentum is still there." According to this expert, geopolitical tensions, policy risks and inflation instability are still important supports for gold prices.

In fact, recent US economic data shows a rather contrasting picture. Retail sales and housing markets are recovering well, reflecting that the economy's demand is still persistent. However, producer price inflation (PPI) and core PPI are higher than forecast, showing that cost pressure has not cooled down. This puts the Fed in a difficult position when it both wants to support growth and control inflation.

In that context, expectations of the Fed continuing to cut interest rates still exist, but the speed and level of easing are becoming more unpredictable. This uncertainty makes cash flow continue to turn to gold as a defensive tool.

From a long-term perspective, Mr. Peter Boockvar - an independent analyst believes that the market is entering a "commodity inflation" phase, when prices of many metals and basic materials simultaneously increase sharply. "The Fed's successor central bank will face an extremely complex problem as input costs escalate on a large scale," Mr. Boockvar said.

With the context of tense geopolitics, inflation risks and the weakening of the USD, analysts believe that gold still has a lot of room to hold its price in the high zone. Short-term corrections, if they appear, are likely to create more accumulation opportunities than signs of trend reversal.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...