In the latest updated report of the WGC, Ms. Kavita Chacko - Head of India Market Research at the World Gold Council (WGC) said that gold prices continue to rise due to global geopolitical instability.

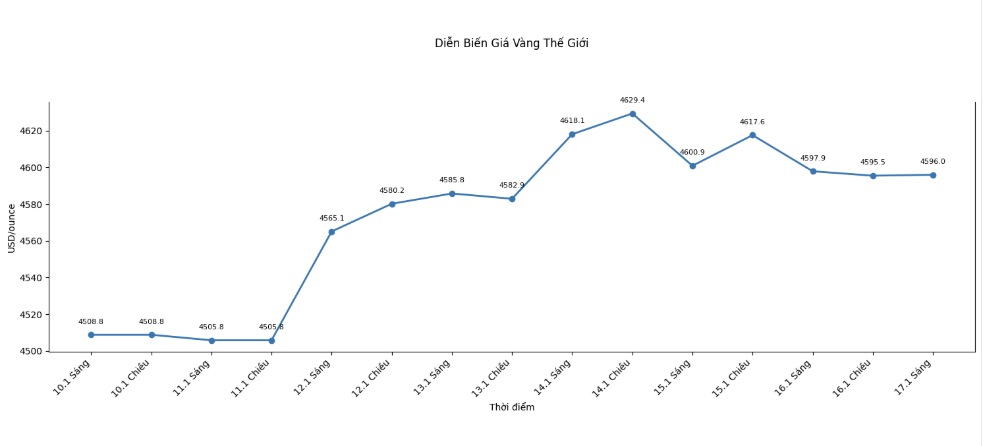

Gold prices have extended their upward trend to 2026 and continuously set new peaks. In the first 13 days of the year, world gold prices increased by nearly 6%, recording 5 new record highs and exceeding the threshold of 4,600 USD/ounce. Previously, gold prices increased by 4.2% in December and up to 67% in 2025 - the highest annual increase since 1979," she said.

In the domestic market, Indian gold prices also increased in parallel with the world, to 139,799 INR/10 grams. According to Ms. Chacko, this increase was mainly driven by escalating geopolitical tensions, uncertainty in economic policy and persistent safe haven needs. In addition, the continuous flow of capital into global gold ETF funds also contributed to supporting prices.

Feedback from businesses and traders shows that domestic gold demand still maintains stability, although somewhat cautious. High gold prices cause jewelry purchases and the value of each transaction to decrease, as consumers stick to the fixed budget and switch to lighter products with lower processing costs.

22K gold jewelry is still the main choice, but demand for gold with lower purity such as 18K and 14K is increasing, reflecting a sensitive price psychology. The demand for buying gold for weddings - essential - remains stable, playing a role in supporting the market.

Retailers are also applying a more cautious and disciplined inventory management strategy, prioritizing data, selecting effective goods categories, increasing turnover and creating differentiation in design. Meanwhile, investment demand continues to be strong, attracting more new investors thanks to the increase in gold prices.

According to Ms. Chacko, listed jewelry businesses recorded strong revenue growth in the fourth quarter of 2025, but mainly due to price factors. The 15% price increase in this quarter has compensated for the decrease in output.

Plain gold jewelry grew well, while gold bar and gold coin sales nearly doubled compared to the same period last year. Digital sales and e-commerce also broke through, with some businesses recording annual revenue growth of over 100%.

In December alone, net capital flow into gold ETFs reached 1.29 billion USD - the highest level ever. This is the 8th consecutive month recording positive capital flow, showing sustainable investment demand. Gold holdings increased to a record high of 8.6 tons in the month, raising the total scale to 95 tons - the highest level in history.

Investors are supported by the less positive developments of the stock market and the upward momentum of gold prices, thereby strengthening the role of gold ETFs as a portfolio diversification tool.

2025 is considered a particularly successful year for gold ETF funds in India. Total net capital flow reached 430 billion INR (equivalent to 4.9 billion USD), with a net demand of 37 tons - the highest ever, accounting for 5% of total global gold ETF capital flow. Total managed assets (AUM) of gold ETFs increased to 1,279 billion INR (14.2 billion USD), raising India's proportion in the global AUM gold ETF from 1.9% in 2024 to 2.5% in 2025.

The number of gold ETF investors also increased sharply, with accounts increasing by 60% compared to the same period. As of the end of December, the total number of accounts reached 10.2 million, of which 3.8 million newly opened accounts in 2025.

In addition, digital gold also recorded significant progress. The transaction value of digital gold through the UPI payment system increased nearly three times in the year, from 8 billion INR in January to 21 billion INR in December, with about 13.5 tons of gold purchased in the whole year.

Trading activity recovered after a short-term decline in November, when the Indian Securities and Exchange Authority (SEBI) warned that digital gold was not yet managed within the current legal framework. This development shows the increasing role of digital gold in the market, while emphasizing the need to improve the legal framework.

Contrary to civilian demand, the demand for gold of the Reserve Bank of India (RBI) decreased sharply in the context of high prices. In 2025, RBI only bought 4 tons of gold - the lowest level in 8 years, a sharp decrease compared to 72.6 tons in 2024. However, RBI's total gold reserves still reached a record level of 880.2 tons.