Policy pressure makes experts advise to "stand aside

Commenting in a cautious direction, Mr. Adam Button - Head of Monetary Strategy at Forexlive.com, said that the current policy environment is not clear enough for precious metals to break through.

According to Mr. Button, recent statements related to the independent role of the US Federal Reserve (Fed), along with legal developments surrounding tariff policies, are creating a high level of uncertainty for the financial market. In that context, gold - which is sensitive to monetary policy and interest rates - is at risk of being under adjustment pressure.

When there is no clarity about tariffs as well as the position of Fed Chairman, standing outside the precious metal market at this time is a reasonable choice" - Mr. Button said.

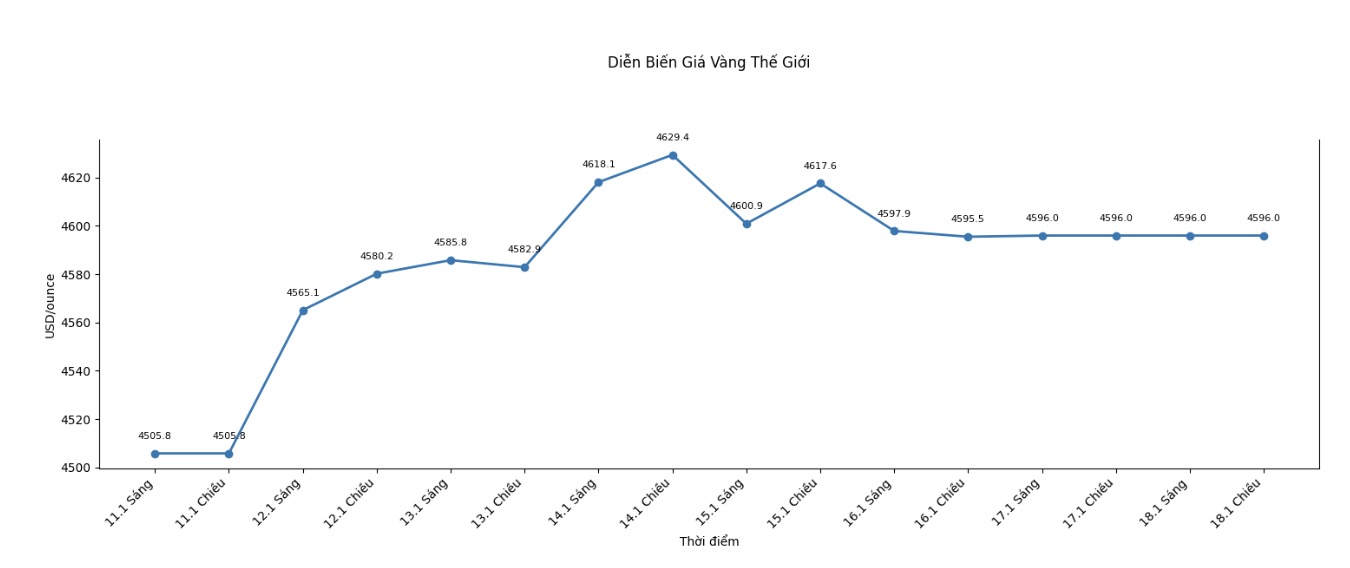

Gold accumulates, may retreat to the 4,550 USD/ounce zone

From a technical perspective, Mr. Marc Chandler, Managing Director of Bannockburn Global Forex, believes that gold prices are entering a period of accumulation after a strong increase streak.

According to Mr. Chandler, the upward trend of gold has not been broken, but current signals suggest that the market may need more time to "cool down". "This accumulation process may pull gold prices down to around the 4-550 USD/ounce mark" - he said.

This expert also noted that the schedule for announcing economic data next week is quite sparse, in addition to the fast PMI index and the meeting of the Bank of Japan (BOJ). This makes the market lack new momentum, thereby increasing the possibility that gold will continue to move sideways or adjust slightly.

Mr. Chandler warned that if the yield of US 10-year government bonds increases sharply and remains above the threshold of 4.20%, gold will face further downward pressure, due to increased opportunity costs to hold non-profit assets.

Profit-taking in silver turns to gold

Sharing the view of short-term adjustment, Mr. Ole Hansen - Head of Commodity Strategy at Saxo Bank, said that profit-taking is the main influencing factor, especially in the silver market, thereby spreading to gold.

According to Mr. Hansen, the strong increase in silver in the past time has triggered a wave of profit realization, leading to a general adjustment of the precious metal group. However, he emphasized that this is not a reversal of the trend.

Short-term correction, long-term trend not yet denied

Summarizing the opinions, it can be seen that Wall Street has not reached consensus on the short-term developments of gold prices, but most experts admit that the market is in a high price zone and technical corrections are likely to appear.

The adjustment of gold prices to lower levels does not mean that the upward trend has ended, but reflects the cautious sentiment of investors in the context that US monetary policy, tariffs and interest rates still contain many variables.

In the short term, gold is forecast to fluctuate in a narrow range, under the intertwined impact of profit-taking pressure and safe-haven demand. The developments in US bond yields and policy signals from the Fed will continue to be key factors orienting the market in the coming sessions.

See more news related to gold prices HERE...