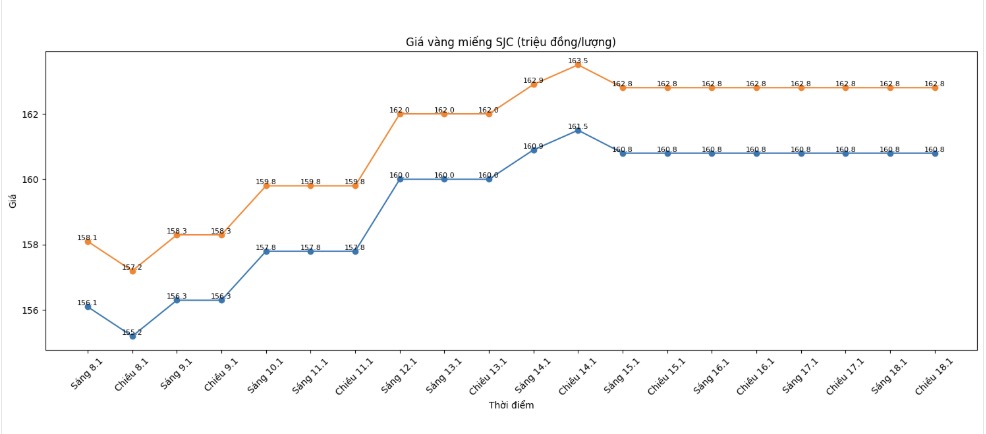

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 160.8-162.8 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 160-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling price difference is at 2.8 million VND/tael.

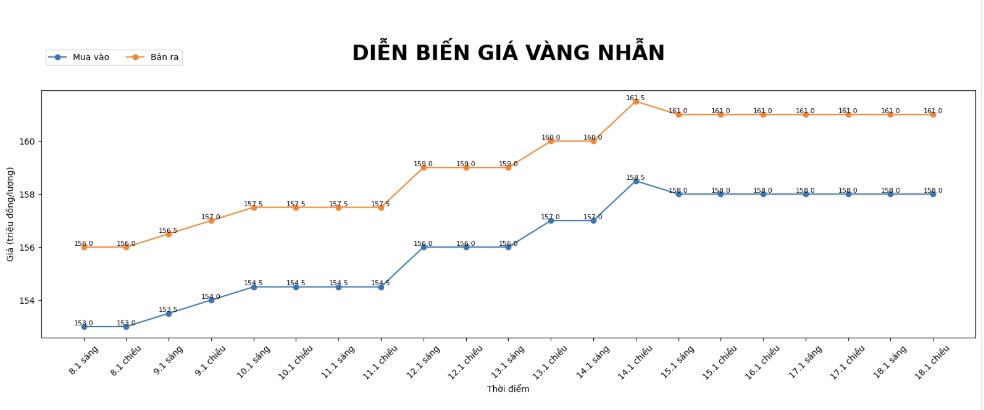

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling), going sideways in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at the threshold of 158-161 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold rings is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

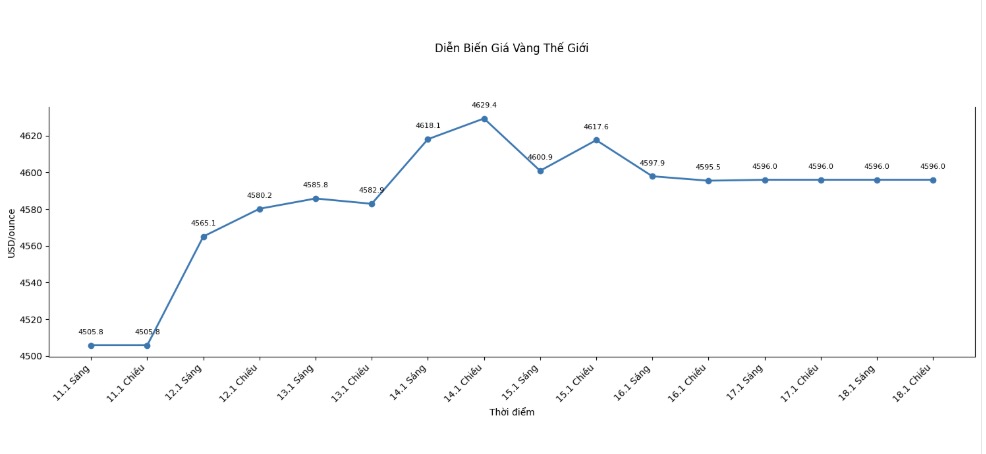

World gold price

At 6:00 AM, world gold prices were listed around the threshold of 4,596 USD/ounce, without much change compared to the previous day.

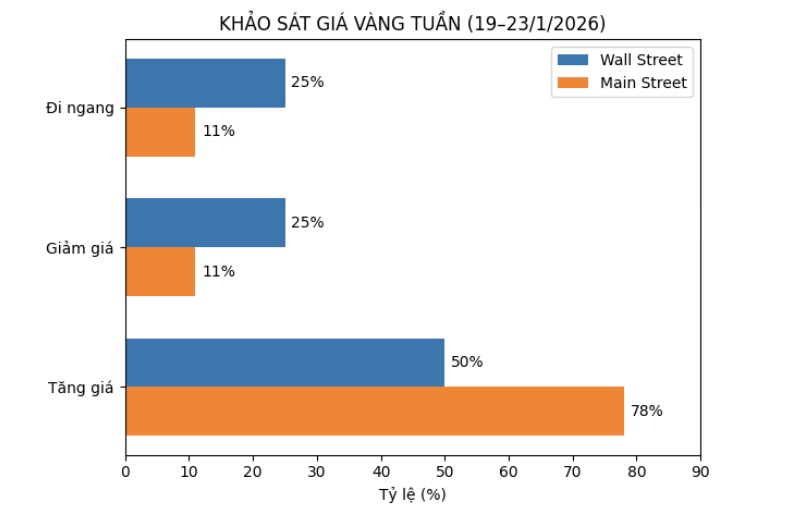

Gold price forecast

The latest weekly gold survey with Wall Street experts shows that analysts are having mixed views on the short-term outlook for gold prices, while individual investors continue to consolidate the optimistic trend.

This week, 16 experts participated in the gold survey. Among them, only half of Wall Street maintained a positive view of the short-term outlook for gold prices.

Accordingly, 8 experts, equivalent to 50%, predict that gold prices will continue to rise this week; 4 others, accounting for 25%, believe that gold prices will decrease. The remaining 4 analysts (25%) predict that this precious metal will continue to move sideways and accumulate this week.

Meanwhile, the online poll recorded a total of 247 votes, with the optimism of individual investors increasing after gold prices set new peaks. Up to 192 small investors, equivalent to 78%, expect gold prices to continue to rise this week.

27 people (11%) predicted gold prices would weaken. The remaining 28 investors, accounting for 11% of the total, believe that gold prices will remain unchanged in the near future.

According to general assessments, short-term correction pressure on gold prices mainly comes from the recovery of the USD and US bond yields, as expectations that the US Federal Reserve (Fed) will soon ease monetary policy are gradually weakening.

In addition, information surrounding the process of finding personnel to succeed the Fed Chairman also made the global financial market fluctuate more strongly, activating profit-taking after the hot gold rally period.

Mr. Neil Welsh - Head of Metals at Britannia Global Markets, said that gold price fluctuations around the 4,600 USD/ounce range reflect the necessary accumulation state of the market.

According to him, this is a technical "rest" process after the previous strong increase, instead of a signal that the upward trend has ended. The market needs more time to absorb macroeconomic factors and establish new momentum.

From a technical analysis perspective, some experts warn of the risk of deeper correction if important support levels are breached. Mr. Lukman Otunuga - senior market analyst at FXTM, said that in the event that gold prices fall sustainably below the 4.570 USD/ounce range, the possibility of a clear correction is unavoidable. However, in a positive scenario, if the nearest peak is surpassed, gold still has room to conquer higher levels.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...