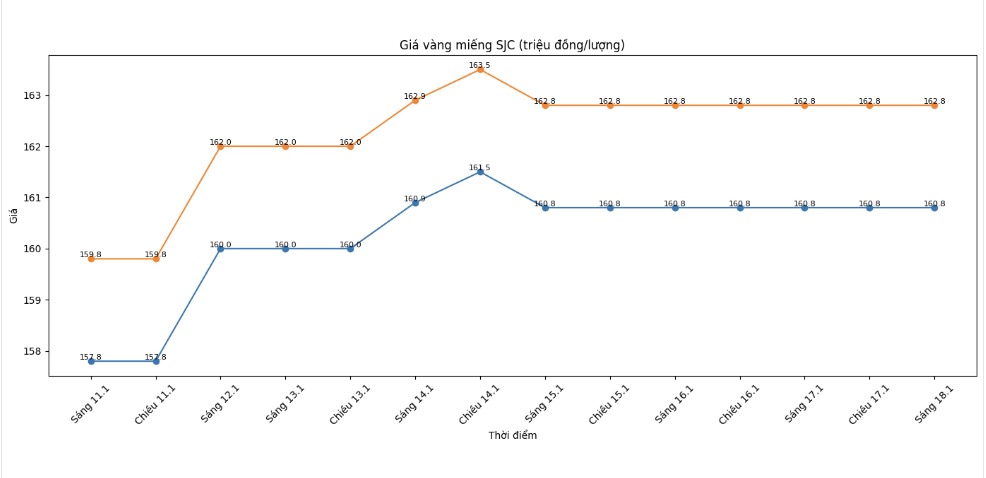

SJC gold bar price

Closing the weekly trading session, Saigon SJC Jewelry Company listed SJC gold prices at 160.8-162.8 million VND/tael (buying - selling). The buying - selling difference was 2 million VND/tael.

Compared to the closing session of the previous week (January 11, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3 million VND/tael in both directions. The difference between buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at the threshold of 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 160.8-162.8 million VND/tael (buying - selling). The buying - selling difference is at 2 million VND/tael.

Compared to a week ago, the price of SJC gold bars was increased by 3 million VND/tael by Bao Tin Minh Chau in both directions.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau on November 11th and selling it on today's session (January 18th), buyers will make a profit of 1 million VND/tael.

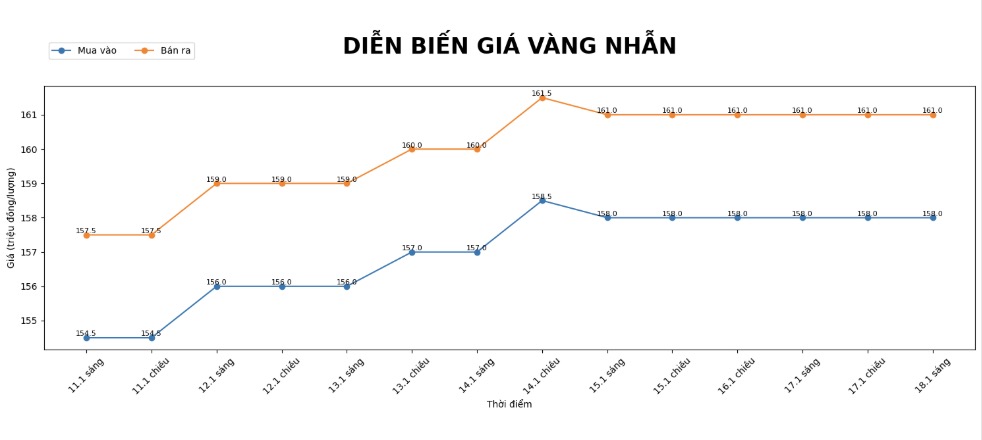

9999 gold ring price

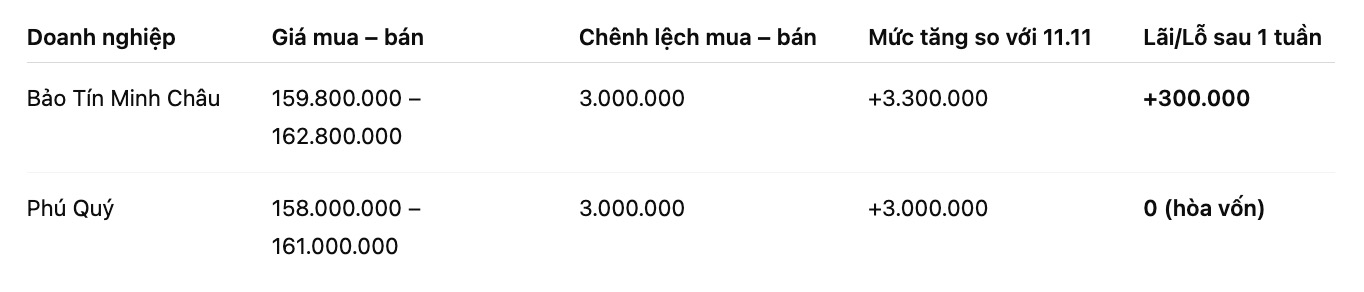

Bao Tin Minh Chau listed the price of gold rings at 1598.8-162.8 million VND/tael (buying - selling); an increase of 3.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 158-161 million VND/tael (buying - selling), an increase of 3 million VND/tael in both directions compared to a week ago. The buying - selling difference is at 3 million VND/tael.

If you buy gold rings in the session on November 11 and sell them in today's session (January 18), buyers at Bao Tin Minh Chau will make a profit of 300,000 VND/tael, while buyers of gold rings in Phu Quy will make a profit.

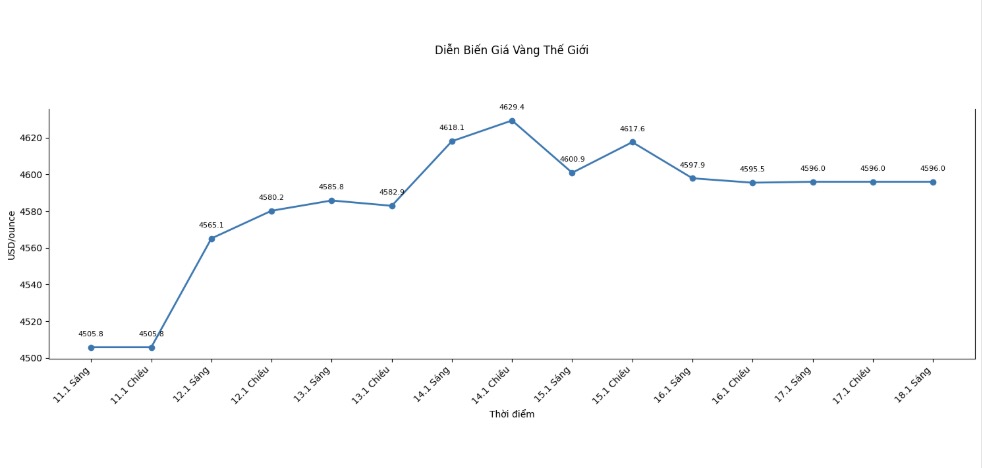

World gold price

Closing the weekly trading session, world gold prices were listed at the threshold of 4,596 USD/ounce, up sharply by 90.2 USD compared to a week ago.

Gold price forecast

Gold prices recorded their sharpest decline in more than two weeks on Thursday, as uncertainties surrounding the leadership position of the US Federal Reserve (Fed) weakened investor demand for precious metals.

According to international experts, short-term pressure on gold prices comes from the recovery of the USD and US bond yields, in the context of expectations that the US Federal Reserve (Fed) will soon cut interest rates gradually cooling down. Statements related to the process of finding a successor to the current Fed Chairman have caused strong fluctuations in global financial markets, leading to profit-taking activities in the precious metal market.

Mr. Neil Welsh - Head of Metals at Britannia Global Markets, said that gold fluctuating around the 4,600 USD/ounce mark reflects a necessary accumulation period after a period of hot gains. According to him, this is not a sign that the upward trend has ended, but rather the market's self-balancing process before determining the next growth momentum.

The latest weekly gold survey with Wall Street experts shows that analysts are having mixed views on the short-term outlook for gold prices, while individual investors continue to consolidate the optimistic trend.

This week, 16 experts participated in the gold survey. Among them, only half of Wall Street maintained a positive view of the short-term outlook for gold prices.

Accordingly, 8 experts, equivalent to 50%, predict that gold prices will continue to rise next week; 4 others, accounting for 25%, believe that gold prices will decrease. The remaining 4 analysts (25%) predict that this precious metal will continue to move sideways and accumulate next week.

Meanwhile, Kitco's online poll recorded a total of 247 votes, with the optimism of individual investors increasing after gold prices set new peaks. There are 192 small investors, equivalent to 78%, expecting gold prices to continue to rise next week.

Meanwhile, 27 people (11%) predicted gold prices would weaken. The remaining 28 investors, accounting for 11% of the total, believe that gold prices will remain unchanged in the near future.

See more news related to gold prices HERE...