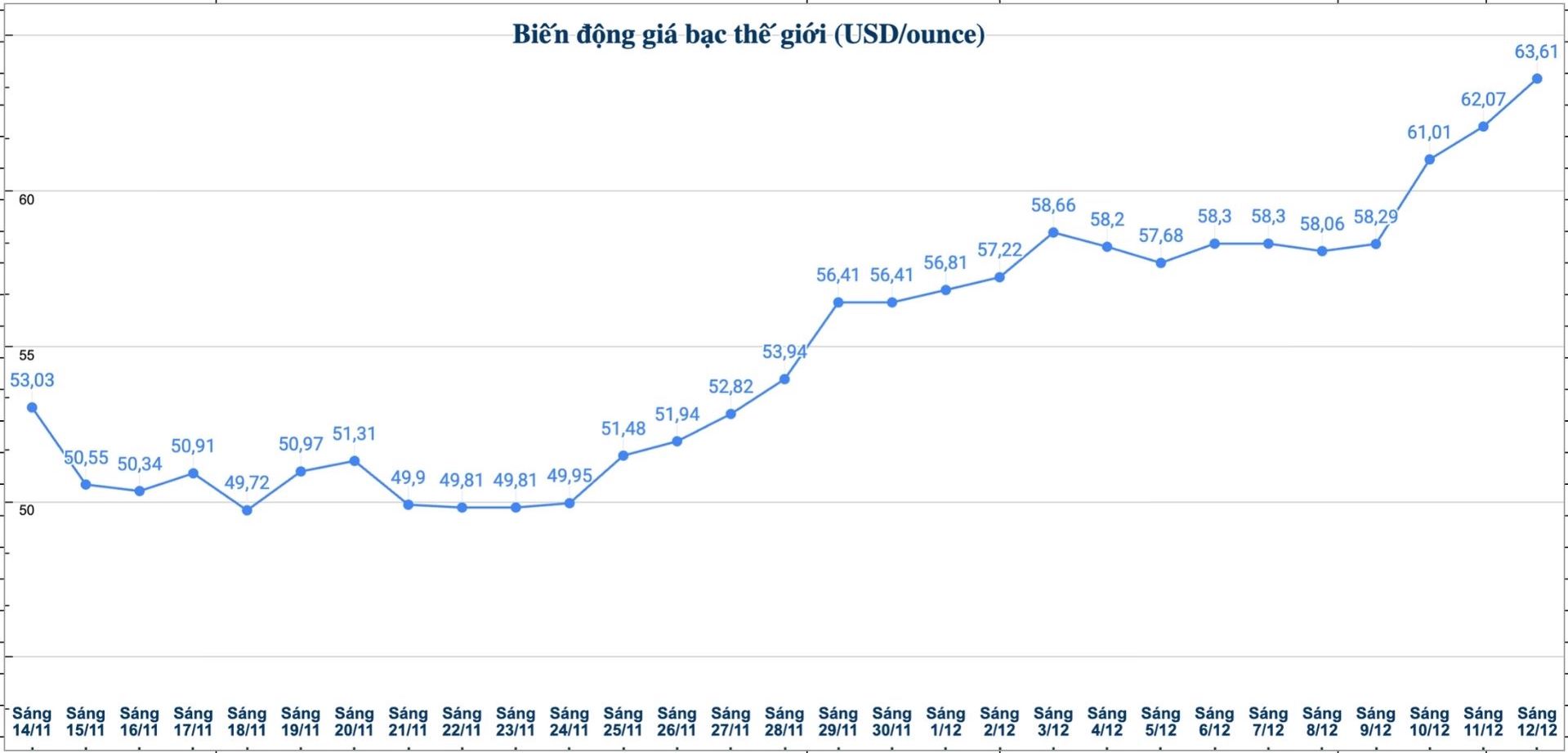

Silver futures ended the week up 3.34 USD, equivalent to 5.68%, to 62.13 USD/ounce - the highest weekly closing price in history for white precious metals.

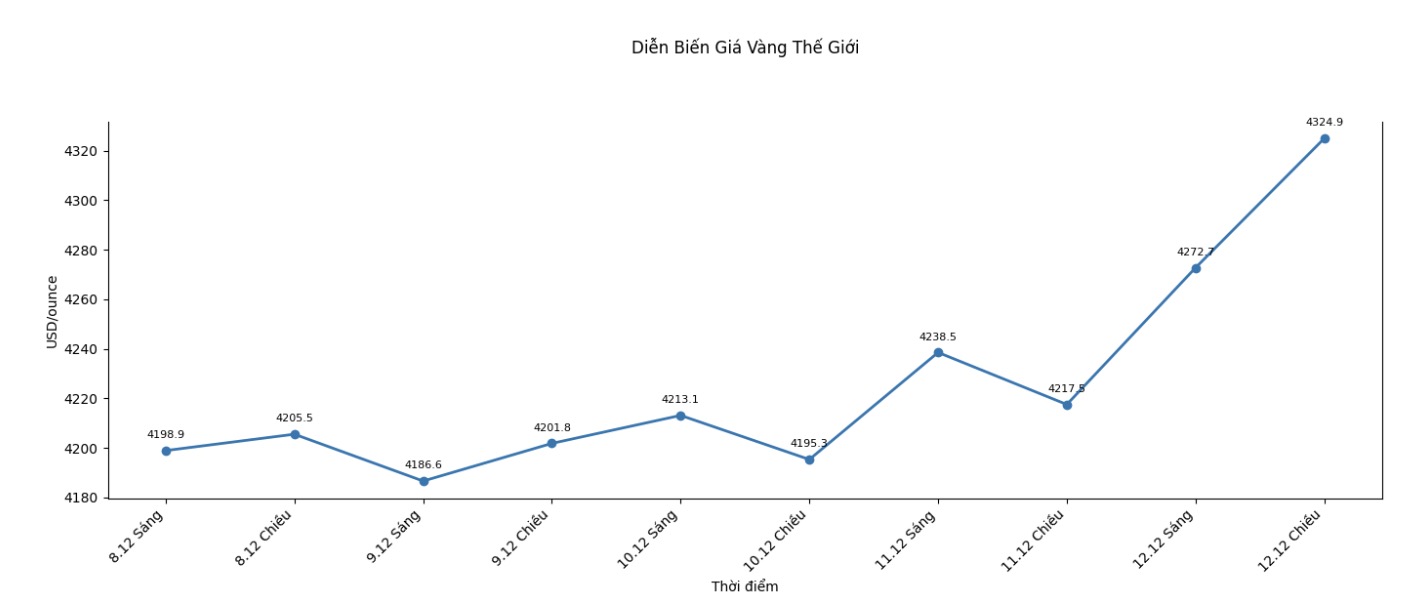

Meanwhile, gold futures rose 103.5 USD, equivalent to 2.45% for the week; at the time of writing, the price was trading around 4,332 USD/ounce, also the highest weekly closing price ever for the precious metal yellow.

The metal that increased the most in the metal group this quarter was palladium, up 110.6 USD, equivalent to 6.68%, to 1,765 USD/ounce.

In the weekend session, palladium hit an unprecedented price since 2011, when the metal once peaked above $1,800, specifically $1,804.3/ounce.

This week's star has no doubt that it is silver. Although silver prices fell by 1.87 USD (-2.92%) in the weekend session, silver futures still recorded an increase in price for three consecutive weeks, with a total increase of 12.28 USD, equivalent to an impressive increase of 24.64% in less than a month.

In the spot market, silver has been increasing by 114% since the beginning of the year, compared to an increase of about 64% for spot gold in the same period.

Silver (both spot and futures) has set four consecutive record highs this week, so a day-to-day downward correction is not surprising, as profit-taking after a strong week of breakouts is inevitable.

Therefore, trading developments early next week will be particularly important, to determine whether silver prices will enter an adjustment phase or continue to climb higher.

In the event that silver continues to conquer new peaks next week, investors need to be cautious, because silver prices have exceeded our year-end target of $60. Although there is still room for increase, we believe that the increase will likely be limited to around the $70 range.

On the other hand, silver futures contracts are still maintaining and even increasing the volume of open interest contracts, a notable development in the context of the holiday trading season - a time when liquidity often decreases in most markets until after the new year.

In addition to October 9, the trading volume of silver futures contracts in today's session reached the highest level since the beginning of the year, with about 180,000 contracts traded. This could show that bullish momentum is not weakening and silver prices could continue to rise.

In contrast, gold futures maintain stable trading volumes, instead of decreasing as usual at the end of the year. The number of contracts opened in today's session exceeded 280,000 contracts, the highest level of the day since October for gold.

This development is in line as the 20-dollar increase in the day has brought gold futures back to an unprecedented price range since October, while recording the third highest closing price in history.

Gold's daytime peak at $4,387.8 was just $10.20 lower than the all-time record set on October 20. Gold futures have risen for four consecutive sessions, accompanied by a gradual increase in trading volume, showing a strong return of interest in this precious metal.

However, the long-standing candle ball in today's candle chart also showed very strong resistance at the historical peak of 4,398 USD/ounce.

The world gold and silver market operates through two main pricing mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.