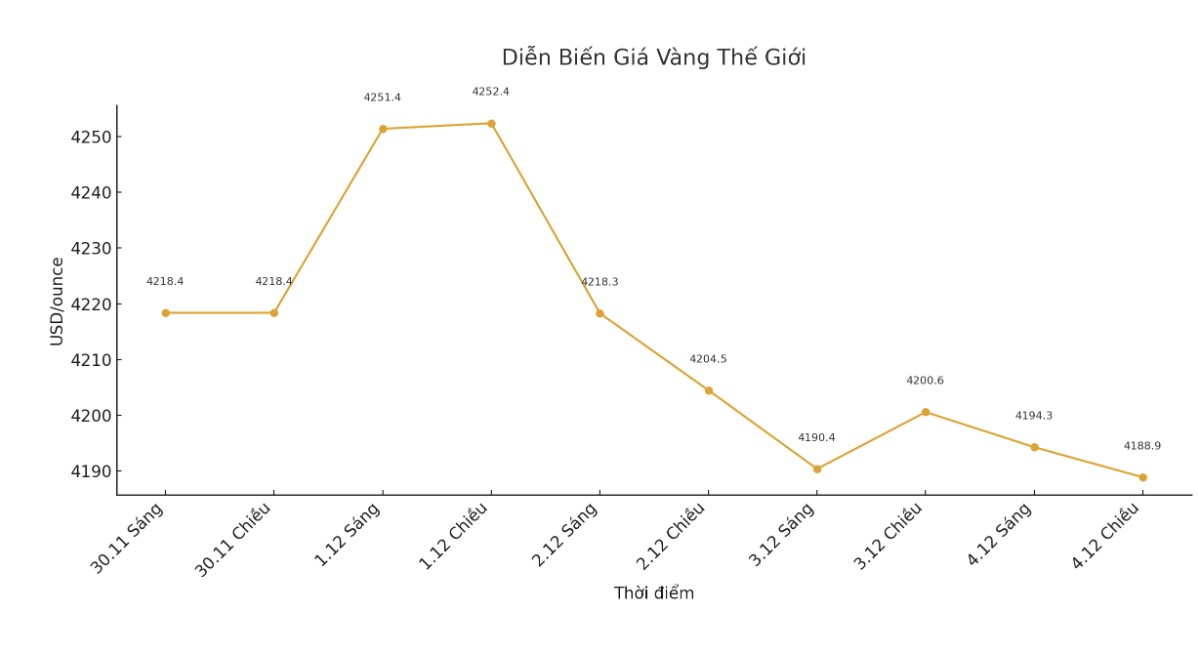

World gold prices fell in the session of Thursday as investors took profits and became cautious before the US Federal Reserve (Fed) meeting next week, in the context of the market waiting for more data to have clearer signals about the interest rate outlook.

Spot gold prices fell 0.5% to $4,179.71/ounce at 6:17 a.m. GMT. The December US gold futures also fell 0.5% to $4,210.2 an ounce.

As investors are somewhat hesitant ahead of the FOMC meeting, the general market is pricing in the possibility of a 25 basis point Fed rate cut... What the market needs right now is a new catalyst for gold prices to continue to rise, said Soni Kumari, commodity strategist at ANZ.

Ms. Kumari added that profit-taking activities continue and any decline around the $4,000/ounce threshold is likely to attract new buyers, given gold's solid foundation.

The ADP private-sector employment report released on Wednesday showed that the US private-sector employment number fell by 32,000 in November, the sharpest decline in more than two and a half years, although the number of fires is still low, showing that this weakness may not accurately reflect the real health of the labor market.

The market is now assessing an 89% chance of a Fed rate cut next week, according to CME's FedWatch tool. Major brokerage firms also forecast the possibility of easing at the meeting on December 9-10.

Low interest rates are often beneficial for non-yielding assets such as gold.

Investors are now waiting for US weekly jobless claims data for the day and the personal consumption expenditure (PCE) price index for September - the Fed's preferred inflation measure due out on Friday.

Meanwhile, silver prices fell 2.1% to $27.22 after hitting a record high of $28.98 on Wednesday.

Since the beginning of the year, silver has increased by 101% due to concerns about market liquidity after capital flows into US stocks, the list of strategic minerals in the US, and a sectoral supply deficit.

Since mid-November, inventories in Shanghai have fallen from about 531 tons to about 700 tons the lowest level since 2015, when exports from China increased sharply, said Mr. Ajay Kedia, director of Kedia Commodities in Mumbai.

platinum fell 0.9% to $1,640.3, while palladium fell 1.4% to $1,439.91.

See more news related to gold prices HERE...