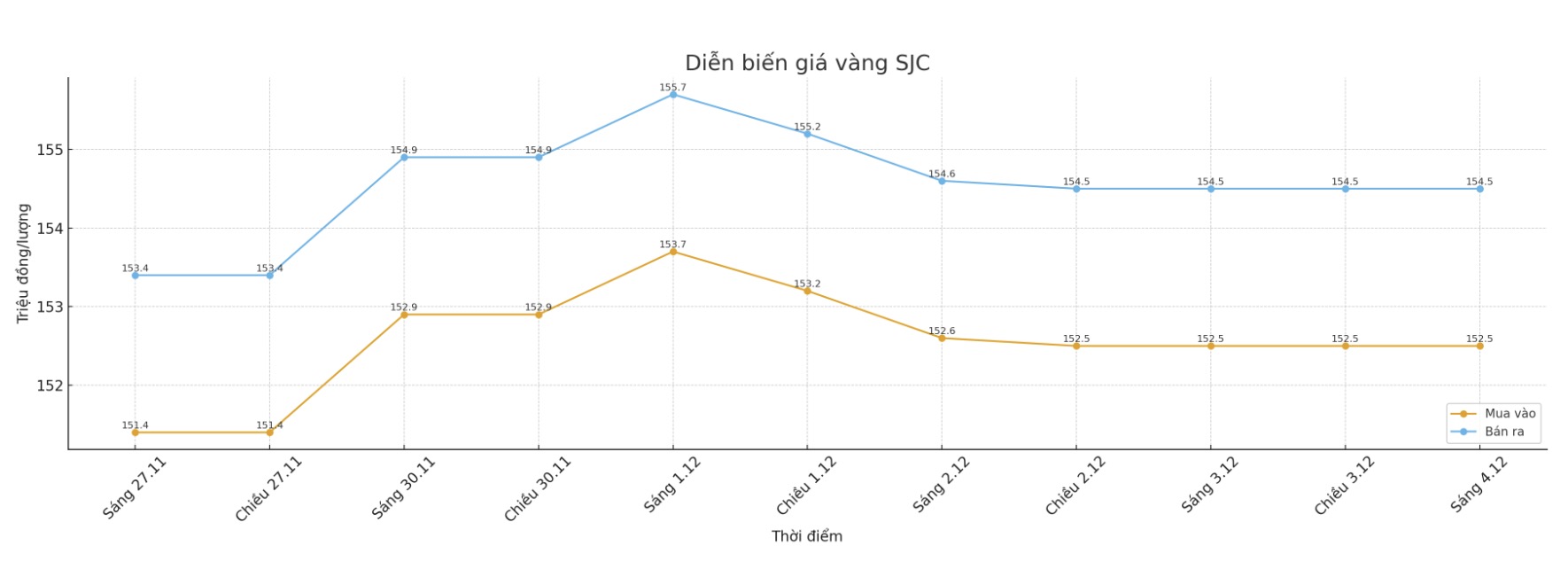

Updated SJC gold price

As of 10:10, the price of SJC gold bars was listed by DOJI Group at 152.5-154.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153-154.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.5-154.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

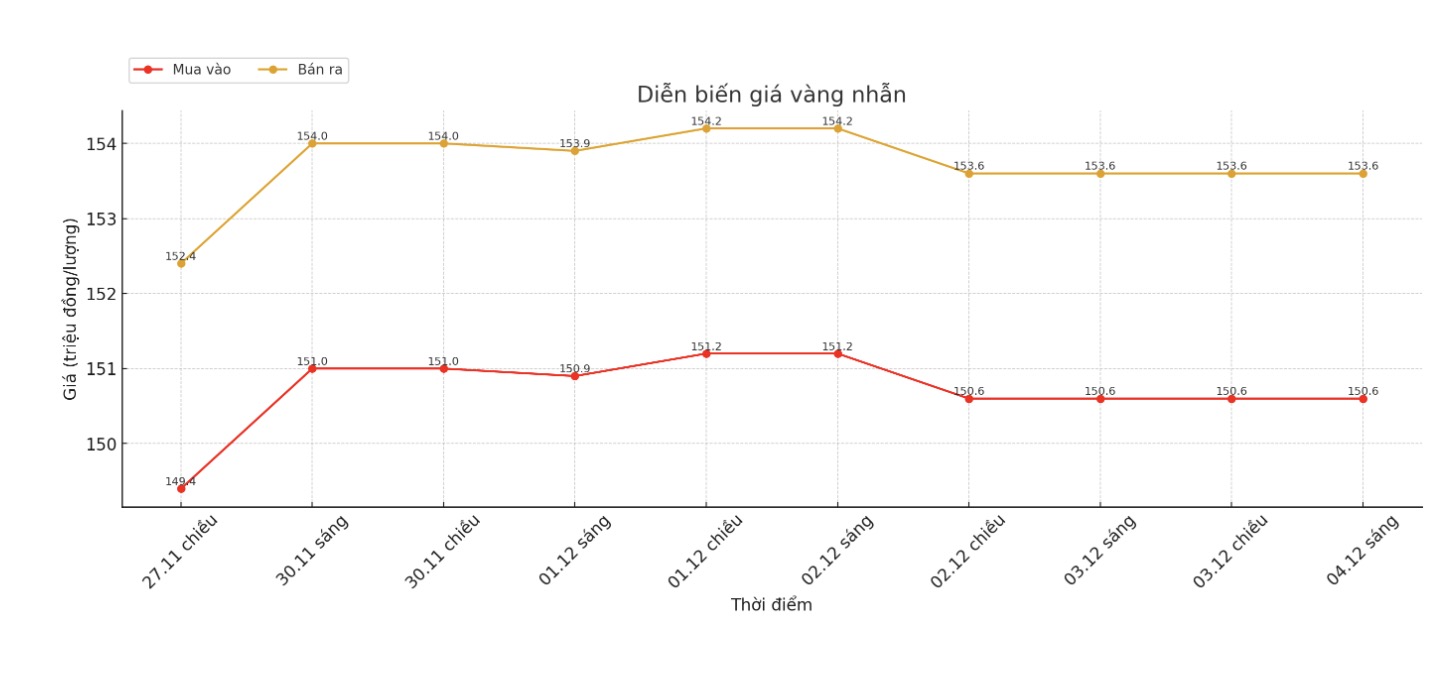

9999 round gold ring price

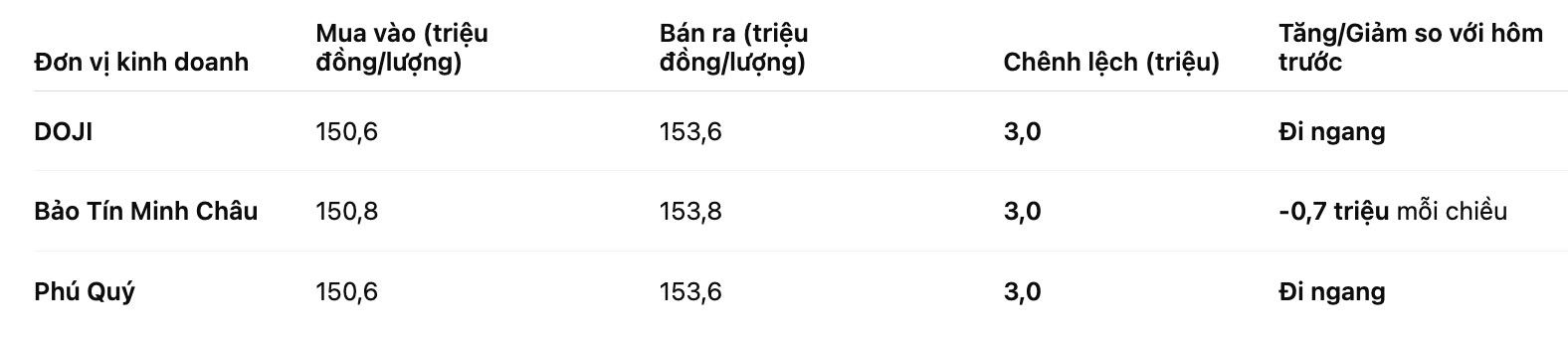

As of 9:25, DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.8-153.8 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

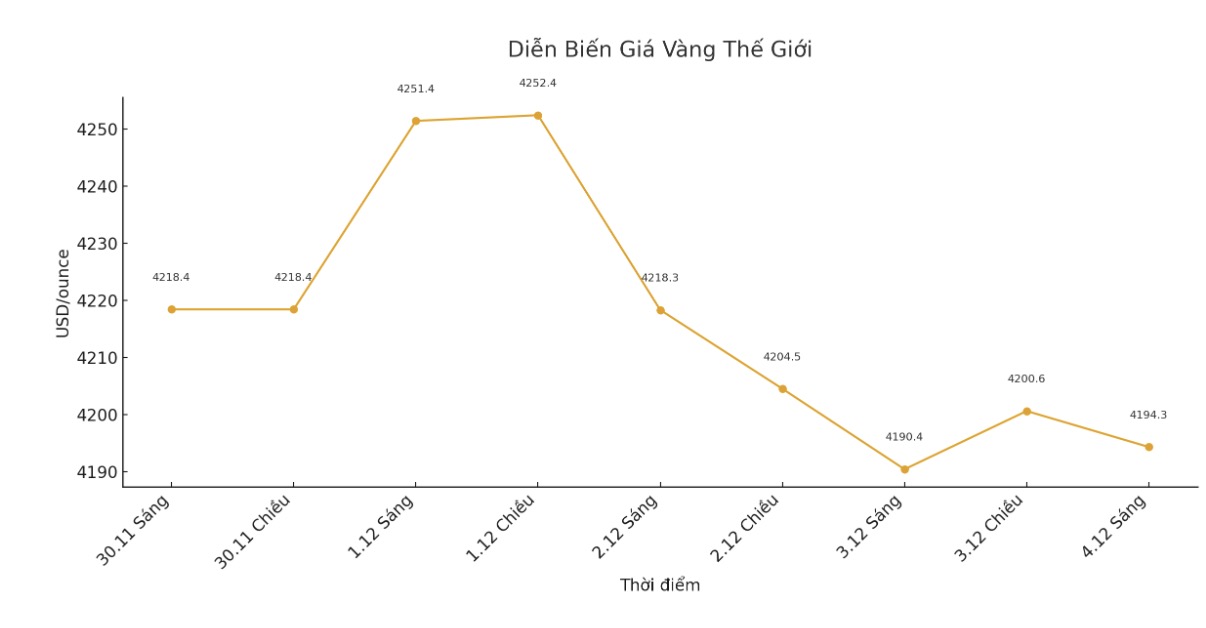

World gold price

At 10:10, the world gold price was listed around 4,194.3 USD/ounce, down 25 USD compared to a day ago.

Gold price forecast

In the report Outrageous Predictions 2026 (Se la du doan 2026), UK bank Saxo Bank pointed out two extreme but feasible events that could change the way the market prices gold.

Scenario 1: Q-Day - quantum computers break security, gold skyrockets to 10,000 USD/ounce.

Neil Wilson, market strategist at Saxo Bank, warned about the time when a quantum supercomputer strong enough to break the current cryptography layers. At that time, confidence in digital assets, banking systems and online transactions was seriously shaken.

Bitcoin could fall to near zero as its security infrastructure is disabled. The money flow panicked to find physical shelter, not depending on encryption.

In this scenario, gold prices could soar to $10,000 an ounce, becoming a passwordless asset that is safeest when confidence in digitalization collapses.

Scenario 2: China issues Gold yuan, pushing gold above $6,000/ounce

Another forecast from Saxo Bank shows the possibility of Beijing using gold to secure a version of the commercial yuan to challenge the leading position of the USD.

A gold-backed currency will strongly attract emerging economies. The global financial system must re-evaluate gold as a basic asset.

As a result, gold prices could rise above $6,000 an ounce, as central banks across the country's demand for gold accumulation spikes.

In a recent interview, Nitesh Shah - Head of Commodity & Macroeconomic Research at WisdomTree - said that with so much widespread instability in the global economy, it is no surprise that the gold market - despite strong fluctuations - continues to set higher support levels after each breakthrough.

Although it could not hold above 4,360 USD/ounce in October and was under significant profit-taking pressure, selling pressure was only limited, with the support zone remaining above 4,000 USD/ounce.

After a short sideways period, gold still maintained its position, building support around $4,200/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...