According to Kitco, although gold prices have recently seen strong fluctuations, the breakout increase to $3,500/ounce has strengthened confidence in the long-term prospects of this precious metal.

According to Mr. Ryan McIntyre - Management partner at Sprott Inc., investors should take advantage of the corrections to accumulate gold, aiming for a ratio of about 10% in the portfolio.

In an interview with Kitco News, Mr. McIntyre emphasized that, compared to the US stock market that is overvalued, gold still has a lot of room for growth.

This expert predicts that gold prices will stabilize at over $3,000/ounce and affirmed that this is not a price that investors need to worry about.

I will be more concerned about the US stock market than about gold. It is clear that US stocks are over Valued, he said.

Sprott experts said that in the context of persistent inflation and the US Federal Reserve's neutral monetary policy, the stock market may continue to face many obstacles. Businesses will be forced to adjust their profit expectations due to pressure from high interest rates.

I clearly see many risks for the stock market, from high interest rates to worries about recession. It is understandable that investors are shifting to gold. Gold's yields in the next 10 years may not be lower than those of stocks, but the risk level is clearly much lower, Mr. McIntyre commented.

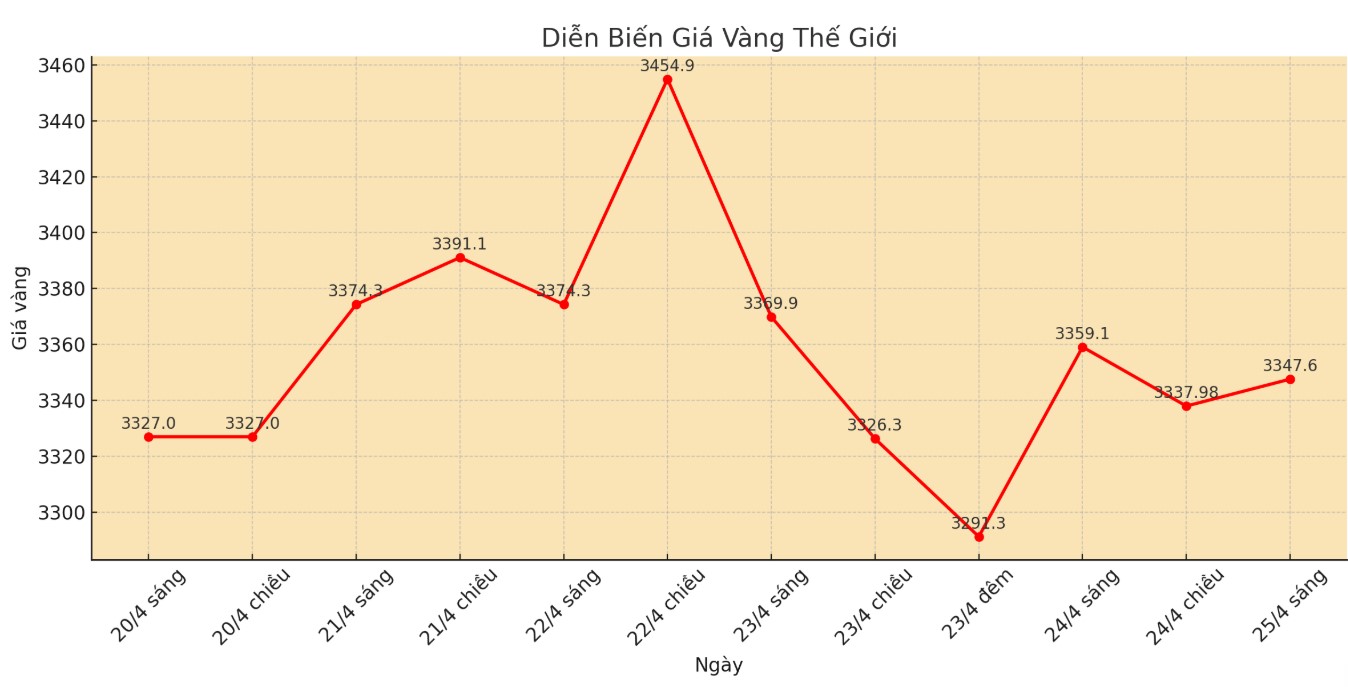

As of now, gold prices have risen nearly 27% since the beginning of the year. After peaking at $3,500/ounce, prices adjusted slightly. At the time of writing (8:45 a.m. on April 25 - Vietnam time), the world gold price listed on Kitco was at $3,347.6/ounce.

According to Mr. McIntyre, gold prices will be strongly supported until the end of 2025, when risks in the global financial market have spread to the national level.

"We have been used to handling business problems for decades. However, national risks are currently increasing and have a broader impact. Therefore, holding physical gold is a safe choice in this context, he said.

Gold's impressive rally this month reached 11% - its strongest increase since November 2011. The main reason was due to escalating trade tensions when former US President Donald Trump imposed a 145% tariff on Chinese goods, and publicly criticized FED Chairman Jerome Powell. Although Trump later lowered his tone, market confidence was severely damaged.

The demand for the dismissal of the Fed Chairman raises concerns about the rule of law in the US. This has undermined confidence in the US dollar and government bonds, McIntyre said.

Although the USD has not lost its global reserve position, he said that the trend of gradually reducing the role of the greenback is becoming apparent. Countries are increasing their holdings of domestic currencies and independent assets such as gold.

In addition, demand from global central banks is forecast to continue to support gold prices, turning it into an attractive safe-haven asset despite the current high prices.

Although the market has shown signs of optimism, Mr. McIntyre said that the gold fever has not yet reached the "crazy" level of 2011 - when gold prices peaked at 1,900 USD/ounce and the market was flooded with "exchange gold for cash" campaigns.

"Currently, there is still no extreme excitement like before. When investors start thinking that gold cannot be discounted and rush into mining stocks, that is the signal that the market is reaching its peak, he concluded.