Many experts predict prices to decrease

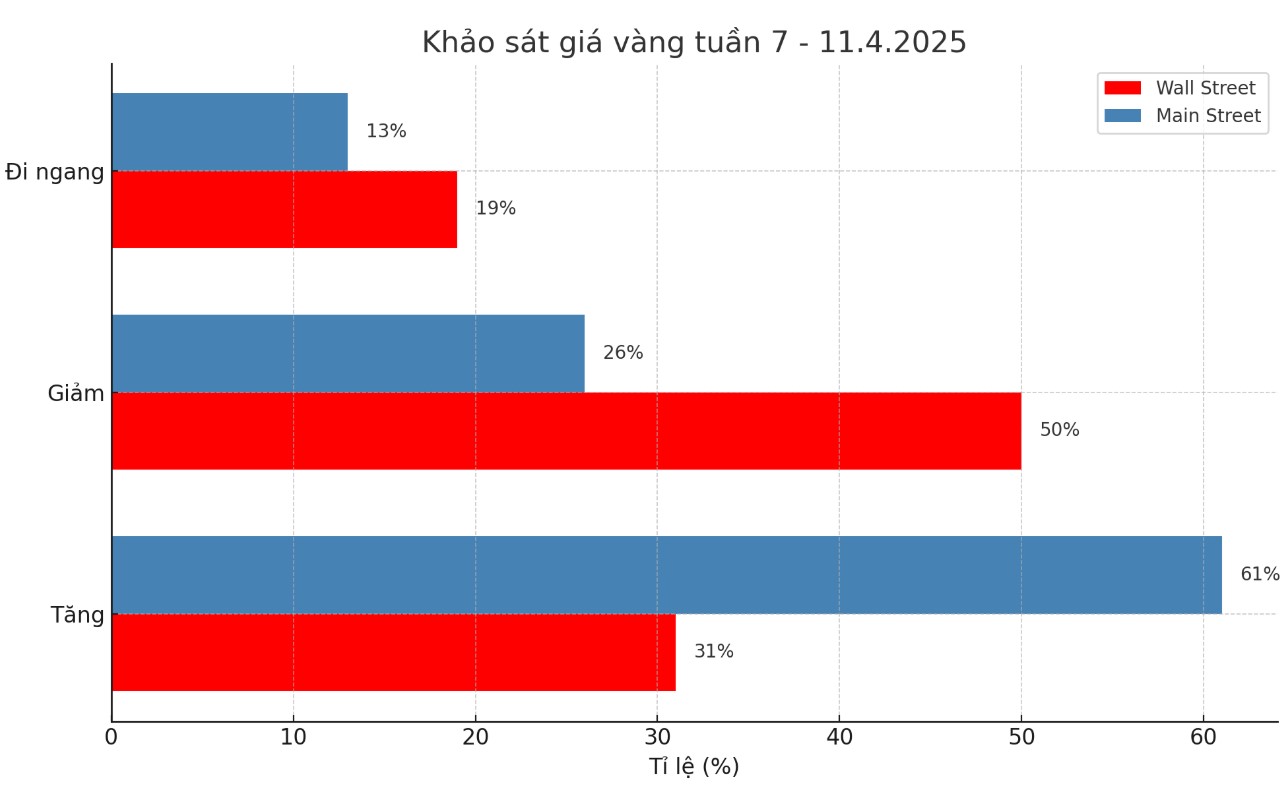

Kitco News' survey results show that out of 16 Wall Street experts, 5 (31%) predict gold prices will increase, 8 (50%) predict a decrease, and 3 (19%) think prices will go sideways.

Adrian Day - Chairman of Adrian Day Asset Management said that gold prices may continue to decline in the next few days, pushing the precious metal down to the $3,000/ounce area or lower. However, this expert also emphasized that this is only a short and slight correction, the factors supporting gold over the past two years have not only not been lost but are also clearer.

Although prices have increased sharply this year, gold is still not a popular holding, especially in North America. Therefore, he predicted that gold prices will decrease next week but will increase sharply in the rest of the year.

Kevin Grady - Chairman of Phoenix Futures and Options said the market is currently very chaotic, including with gold. He said many investors are selling profitable investments, such as gold, to collect cash to add funds for investments in stocks. When gold increases sharply, speculators rush to buy, but this is a group of investors who are impatient or have little capital, and now they also have to sell.

He stressed that algorithms are controlling the market and many major banks have withdrawn from gold positions ahead of the tax announcement on April 2.

According to Grady, there will be a strong increase in gold next week because the market is still unstable. Investors are prioritizing cash because they do not know where to invest. At the same time, he also noted that the commodity market has increased well at the beginning of the year and is now being sold to support the stock portfolio.

Grady said the market needs time to stabilize, and the important thing is to wait and see how gold recovers after the news of not being taxed has been confirmed.

Marc Chandler - CEO at Bannockburn Global Forex commented that gold is gradually losing its role as a safe haven asset in the eyes of individual investors when it is sold off in parallel with stocks, although the USD and bond yields are decreasing.

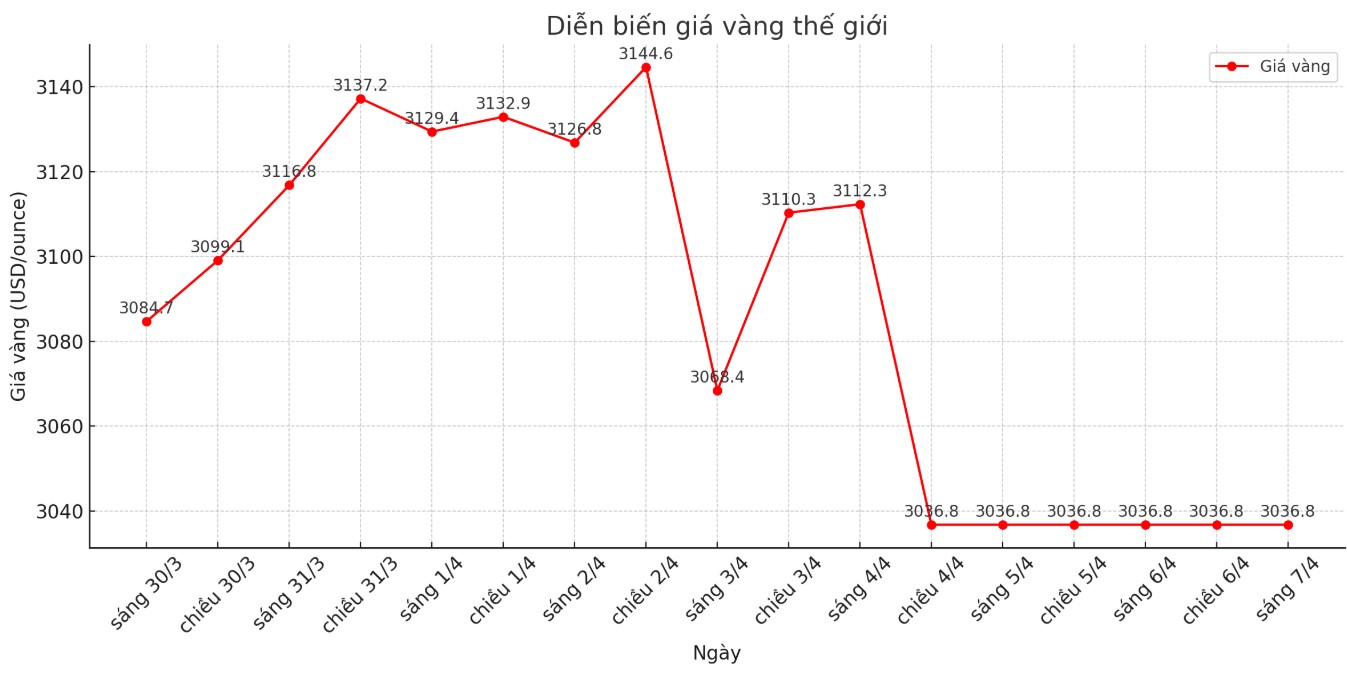

He said the 1.5% reduction this week was just to regain the previous increase. After breaking below $3,054 an ounce, he said gold could continue to fall to $3,030 and then $3,000 an ounce. According to him, technical indicators are signaling a decrease.

Difficulty determining the support level for gold

Everett Millman - Analyst at Gainesville Coins believes that the main reason for the decline in gold is that investors sell to make up for losses from the stock market. He said that although gold is a safe haven, it is still dominated by the general trend of goods.

When commodities fall in prices en masse, gold and silver are also affected. Millman also said that in the early stages of the crisis, safe-haven assets such as gold were often sold in advance for money.

This expert commented that it is difficult to determine a clear support level for gold at this time, because prices have increased too quickly in the first quarter. If there is no stability in the stock market or no clear policy response from the US Federal Reserve (FED), gold prices may continue to fall to $2,900/ounce or lower.

Michael Moor - Founder of Moor Analytics said gold has been in a long-term uptrend since 2015, but may be in the final stages.

He said that the previous bullish targets have been achieved, but in the short term, if gold breaks technical support levels, prices could continue to fall by another 85 - 125 USD. However, if gold bounces back, there could be a strong buyback.

See more news related to gold prices HERE...