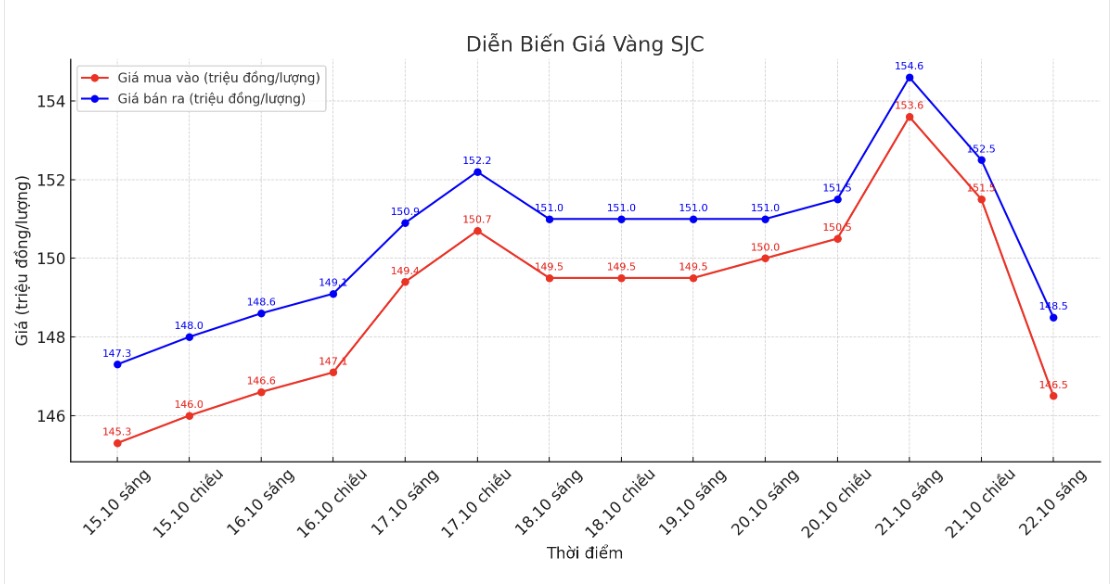

Updated SJC gold price

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at 146.5-148.5 million VND/tael (buy - sell), down 7.1 million VND/tael for buying and down 6.1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147-148.5 million VND/tael (buy - sell), down 7.1 million VND/tael for buying and down 6.1 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146-148.5 million VND/tael (buy - sell), down 7 million VND/tael for buying and down 6.1 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

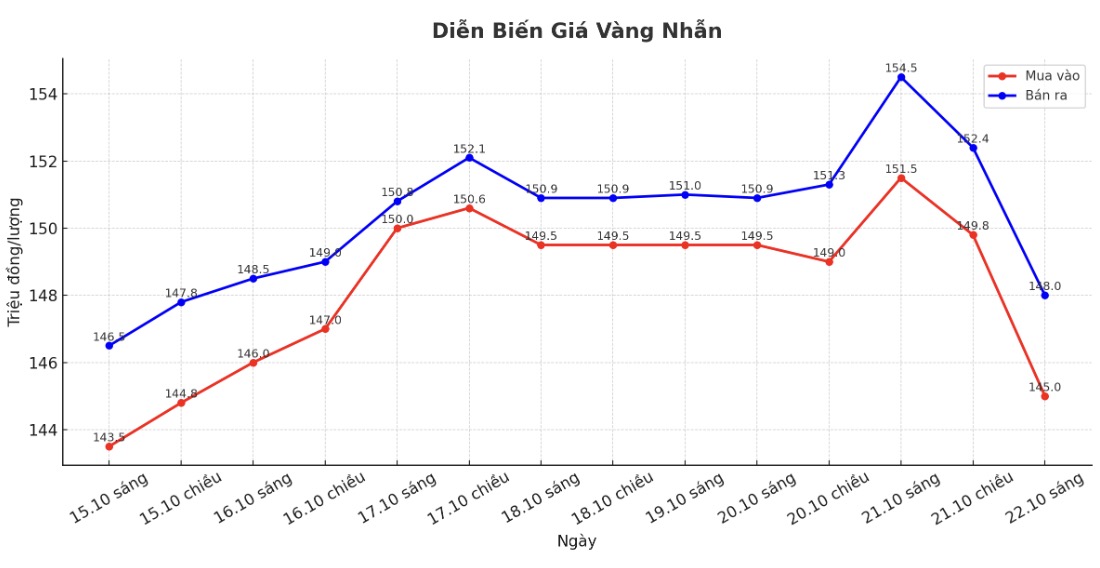

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 145-148 million VND/tael (buy - sell), down 6.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 152.5-155.5 million VND/tael (buy - sell), down 5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), down 6.1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

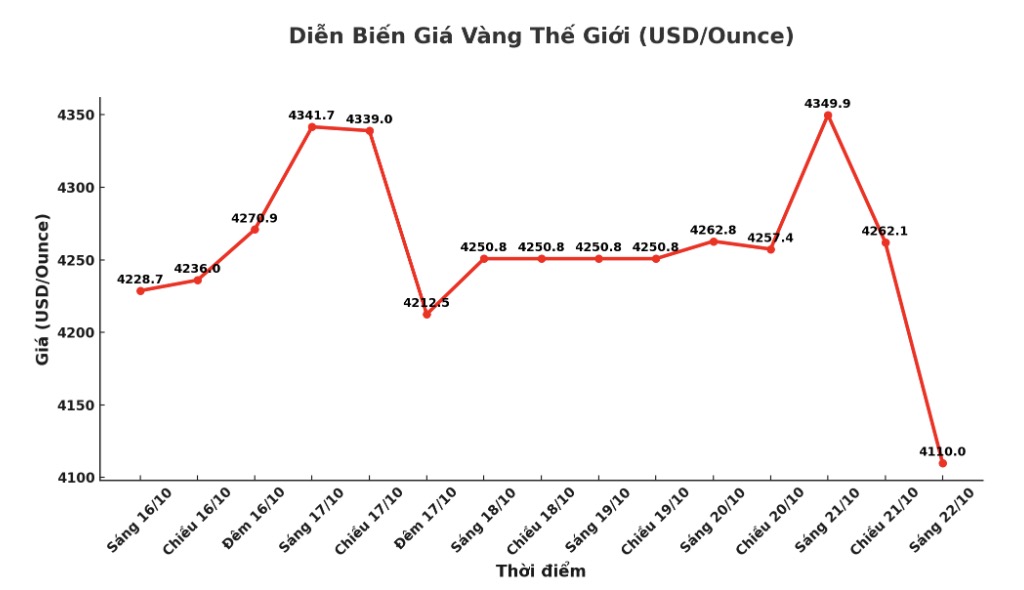

World gold price

At 9:15 a.m., the world gold price was listed around 4,110 USD/ounce, down 239.9 USD.

Gold price forecast

World gold prices plummeted last night. After losing the important psychological mark of 4,200 USD/ounce, this precious metal fell close to 4,100 USD/ounce.

Jim Wyckoff - senior analyst at Kitco - commented that gold and silver prices are under intense selling pressure, the market recorded a panic of selling to cut losses and meet deposit calls from short-term speculators on the futures exchange.

According to this expert, the more positive risk-taking sentiment this week also causes disadvantages for safe-haven metals. US stock indexes recovered strongly, approaching the recent record peak.

Selling pressure began when the London market opened and continued throughout the trading session in North America. Some experts say that the more optimistic sentiment surrounding US-China trade tensions and Japan's Nikkei 225 index reaching a record level have triggered a sell-off of gold and silver.

Others said that this is mainly technical sales after the market's "parabol" hot spike.

This adjustment is simply a profit-taking, said TD Securities commodity analysts. In our opinion, the positions are currently at extreme levels: algorithms have stopped buying, risk balance funds and volatility control funds have all reached their limits, macro funds have almost fully disbursed, central bank purchasing power has decreased significantly quarter-on-quarter, individual investors have participated at the highest level in a decade, while China has temporarily stopped buying. The profit-taking process will continue.

Technically, December gold contracts are weakening rapidly and strongly. The next upside target for buyers is to close above the solid resistance level at the peak of the contract - also a record - 4,398 USD/ounce. Meanwhile, the sellers aim to pull the price below the important support level of 4,000 USD/ounce.

The nearest resistance zone is at 4,200 USD/ounce and 4,250 USD/ounce; supported at 4,093 USD/ounce and 4,000 USD/ounce respectively.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...